Rezolute Announces Closing of Public Offering with Approximately $60M in Gross Proceeds

24 Junho 2024 - 9:00AM

Rezolute, Inc. (Nasdaq: RZLT) (“Rezolute” or the “Company”), a

late-stage biopharmaceutical company committed to developing

novel, transformative therapies for serious rare diseases,

today announced the closing of its underwritten public offering of

11,250,000 shares of its common stock at a price to the public of

$4.00 per share and, to certain investors in lieu of common stock,

pre-funded warrants to purchase 3,750,000 shares of its common

stock at a price to the public of $3.999 per pre-funded warrant, in

each case, before underwriting discounts and commissions. All of

the shares and warrants in the public offering were sold by the

Company.

The Company received net proceeds of

approximately $56.4 million from the public offering, after

deducting underwriting discounts and commissions and estimated

offering expenses. In addition to general corporate activities and

post-Phase 3 planning for its RZ358 program in congenital

hyperinsulinism (cHI), Rezolute intends to use the net proceeds

from the offering to fund activities towards initiation and conduct

of a potential late-stage, registrational, clinical study of RZ358

in patients with tumor hyperinsulinism (tHI) resulting from islet

cell (insulinomas) and non-islet cell tumors (NICTs).

Jefferies and Cantor served as the joint

book-running managers for the offering. BTIG, Craig-Hallum, H.C.

Wainwright & Co., Jones and Maxim Group LLC are acting as

co-managers for the offering.

The public offering was made only by means of a

prospectus supplement and accompanying prospectus that form a part

of an effective registration statement. A final prospectus

supplement related to the public offering was filed with

the Securities and Exchange Commission (the “SEC”) and is

available on the SEC’s website at www.sec.gov. Copies of the

final prospectus supplement and the accompanying prospectus

relating to the public offering may also be obtained by contacting:

Jefferies LLC, Attention: Equity Syndicate Prospectus Department,

520 Madison Avenue, New York, New York 10022, by telephone at

877-821-7388, or by email at prospectus_department@jefferies.com or

Cantor Fitzgerald & Co., Attention: Capital Markets, 110 East

59th Street, 6th Floor, New York, New York 10022, or by email at

prospectus@cantor.com

This press release does not constitute an offer

to sell, or a solicitation of an offer to buy these securities, nor

shall there be any sale of, these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

Rezolute, Inc.

Rezolute is a late-stage rare disease company

focused on significantly improving outcomes for individuals with

hypoglycemia caused by hyperinsulinism (HI). The Company’s

antibody therapy, RZ358, is designed to treat all forms of HI and

has shown substantial benefit in clinical trials and real-world use

for the treatment of congenital hyperinsulinism (cHI) and tumor

hyperinsulinism (tHI).

Forward-Looking Statements

Any statements in this press release about the

Company’s future expectations, plans and prospects, including

statements regarding the public offering, constitute

forward-looking statements for purposes of the safe harbor

provisions under the Private Securities Litigation Reform Act of

1995. Forward-looking statements include any statements about the

Company’s strategy, future operations and future expectations and

plans and prospects for the Company, and any other statements

containing the words “anticipate,” “believe,” “estimate,” “expect,”

“intend”, “goal,” “may”, “might,” “plan,” “predict,” “project,”

“target,” “potential,” “will,” “would,” “could,” “should,”

“continue,” and similar expressions. Such forward-looking

statements involve substantial risks and uncertainties that could

cause the Company’s development programs, future results,

performance or achievements to differ significantly from those

expressed or implied by the forward-looking statements. Such risks

and uncertainties include, among others, those related to market

and other financial conditions, the potential completion of the

public offering, satisfaction of customary closing conditions

related to the public offering and other factors discussed in the

“Risk Factors” section contained in the preliminary prospectus

supplement and the reports that the Company files with the SEC. Any

forward-looking statements represent the Company’s views only as of

the date of this press release. The Company anticipates that

subsequent events and developments will cause its views to change.

While the Company may elect to update these forward-looking

statements at some point in the future, the Company specifically

disclaims any obligation to do so except as required by law.

Contacts:

Rezolute, Inc.Christen

Baglaneascbaglaneas@rezolutebio.com508-272-6717

LHA Investor RelationsTirth T.

Pateltpatel@lhai.com212-201-6614

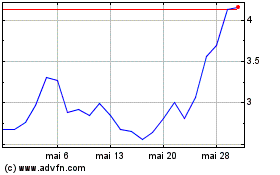

Rezolute (NASDAQ:RZLT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Rezolute (NASDAQ:RZLT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024