Navios Maritime Partners L.P. Announces Cash Distribution of $0.05 per Unit

25 Julho 2024 - 5:10PM

Navios Maritime Partners L.P. ("Navios Partners") (NYSE:NMM),

announced today that its Board of Directors has declared a cash

distribution of $0.05 per unit for the quarter ended June 30, 2024.

This distribution represents an annualized distribution of $0.20

per unit.

The cash distribution will be payable on August

14, 2024 to unit holders of record as of August 9, 2024.

About Navios Maritime Partners

L.P.Navios Partners (NYSE: NMM) is an international owner

and operator of dry cargo and tanker vessels. For more information,

please visit our website at www.navios-mlp.com.

Forward-Looking StatementsThis

press release contains and will contain forward-looking statements

(as defined in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended) concerning future events, TCE rates and Navios Partners’

expected cash flow generation, future contracted revenues, future

distributions and its ability to make distributions going forward,

opportunities to reinvest cash accretively in a fleet renewal

program or otherwise, potential capital gains, its ability to take

advantage of dislocation in the market and Navios Partners’ growth

strategy and measures to implement such strategy, including

expected vessel acquisitions and entering into further time

charters and Navios Partners’ ability to refinance its debt on

attractive terms, or at all. Words such as “may,” “expects,”

“intends,” “plans,” “believes,” “anticipates,” “hopes,”

“estimates,” and variations of such words and similar expressions

are intended to identify forward-looking statements.

These forward-looking statements are based on

the information available to, and the expectations and assumptions

deemed reasonable by Navios Partners at the time these statements

were made. Although Navios Partners believes that the expectations

reflected in such forward-looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct. These statements involve risks and are based upon a

number of assumptions and estimates that are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Partners. Actual results may differ

materially from those expressed or implied by such forward-looking

statements.

Factors that could cause actual results to

differ materially include, but are not limited to, risks relating

to: global and regional economic and political conditions including

global economic activity, demand for seaborne transportation of the

products we ship, the ability and willingness of charterers to

fulfill their obligations to us and prevailing charter rates, the

economic condition of the markets in which we operate, shipyards

performing scrubber installations, construction of newbuilding

vessels, drydocking and repairs, changing vessel crews and

availability of financing; potential disruption of shipping routes

due to accidents, wars, sanctions, diseases, pandemics, political

events, piracy or acts by terrorists; uncertainty relating to

global trade, including prices of seaborne commodities and

continuing issues related to seaborne volume and ton miles, our

continued ability to enter into long-term time charters, our

ability to maximize the use of our vessels, expected demand in the

dry and liquid cargo shipping sectors in general and the demand for

our dry bulk, containerships and tanker vessels in particular,

fluctuations in charter rates for dry bulk, containerships and

tanker vessels, the aging of our fleet and resultant increases in

operations costs, the loss of any customer or charter or vessel,

the financial condition of our customers, changes in the

availability and costs of funding due to conditions in the bank

market, capital markets and other factors, fluctuation in interest

rates and foreign exchange rates, increases in costs and expenses,

including but not limited to: crew, insurance, provisions, port

expenses, lube oil, bunkers, repairs, maintenance and general and

administrative expenses, the expected cost of, and our ability to

comply with, governmental regulations and maritime self-regulatory

organization standards, as well as standard regulations imposed by

our charterers applicable to our business, general domestic and

international political conditions, competitive factors in the

market in which Navios Partners operates; risks associated with

operations outside the United States; and other factors listed from

time to time in Navios Partners’ filings with the Securities and

Exchange Commission, including its Form 20-Fs and Form 6-Ks. Navios

Partners expressly disclaims any obligations or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in Navios

Partners’ expectations with respect thereto or any change in

events, conditions or circumstances on which any statement is

based. Navios Partners makes no prediction or statement about the

performance of its common units.

ContactsPublic & Investor Relations

Contact:Navios Maritime Partners

L.P.+1.212.906.8645Investors@navios-mlp.com

Nicolas BornozisCapital Link,

Inc.+1.212.661.7566naviospartners@capitallink.com

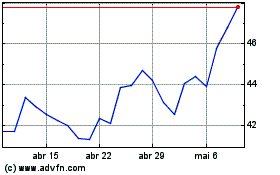

Navios Maritime Partners (NYSE:NMM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

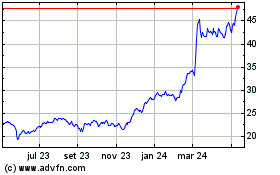

Navios Maritime Partners (NYSE:NMM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025