Gilat Satellite Networks Ltd. (NASDAQ: GILT, TASE: GILT), a

worldwide leader in satellite networking technology, solutions and

services, today reported its results for the second quarter, ended

June 30, 2024.

Second

Quarter 2024

Financial Highlights

- Revenue of $76.6 million, up 13% compared with

$67.6 million in Q2 2023;

- GAAP operating income of $2.8

million, compared with $5.4 million in Q2 2023;

- The decline is mainly attributable to the acquisition-related

expenses, amortization of purchased intangibles, and earnout-based

expenses related to DataPath acquisition;

- Non-GAAP operating income of $7.3 million, up

21% compared with $6.1 million in Q2 2023;

- GAAP net income of $1.3

million, or $0.02 per diluted share, compared with $4.3 million, or

$0.08 per diluted share, in Q2 2023;

- Non-GAAP net income of $5.6 million, or $0.10

per diluted share, up 13% compared with $4.9 million, or $0.09 per

diluted share, in Q2 2023;

- Adjusted EBITDA of $10.1 million, up 10%

compared with $9.2 million in Q2 2023.

Forward-Looking Expectations

The Company today reiterated its formerly issued

guidance expectations for 2024.

Expectations are for revenue between $305 and

$325 million, representing year-over-year growth of 18% at the

midpoint. GAAP operating income is expected to be between $15 and

$19 million, and Adjusted EBITDA is expected to be between $40 and

$44 million, representing year-over-year growth of 15% at the

mid-point.

This Guidance does not include any contribution

expected from the acquisition of Stellar Blu. However given Stellar

Blu has already begun delivering its antennas, and assuming closing

will happen during the beginning of Q4, we estimate SBS revenues

will add between $25 to $35 million in Q4.

Management Commentary

Adi Sfadia, Gilat’s CEO,

commented: “We are pleased with our results for the second

quarter. Our business continues to perform well and we are on track

with our expectations for 2024. The pipeline of potential orders

throughout our business continues to broaden, supported by our

next-generation platform and growth engines. In particular, we are

pleased with the solid traction we are experiencing in the growing

defense satellite communications segment, a strategic growth vector

for us. This is strongly supported by our DataPath subsidiary

acquired at the end of last year, which has already proven itself

as a successful acquisition and key contributor to our success this

quarter.”

Mr. Sfadia

added, “We recently took a

major strategic step and announced our intention to acquire Stellar

Blu, a leader and first-to-market in delivering Electronically

Steerable Antenna for the In-Flight-Connectivity market. Given

Stellar Blu has already begun delivering its antennas we now expect

Stellar Blu to add between $120-$150 million in revenue in 2025 and

be accretive to our Non-GAAP results. Furthermore, we estimate that

once Stellar Blu reaches its target manufacturing capacity during

the second half of 2025, its EBITDA margin will be above 10%.”

Mr. Sfadia concluded, “With

Stellar Blu on board, we will become the leader in the ESA IFC

market, which we believe is set to explode in popularity and become

widely adopted in the coming years. I believe that this acquisition

will transform Gilat into a high-growth company for many years to

come, providing us with a highly attractive portfolio of ESA

products and technologies. We are very excited about the

significant potential this acquisition holds for Gilat.”

Key Recent Announcements

-

Gilat Awarded Over $9M for its GEO and NGSO Satellite

Communications Solutions

-

Gilat Awarded Over $5M by a National Defense Organization for the

Upgrade of Transportable SATCOM Network Hubs

-

Gilat Receives Over $10M Contract Extension for Cellular Backhaul

Services

-

Gilat Awarded Over $9M to Support Critical Connectivity

Requirements for the US Department of Defense

-

Gilat Receives over $14M in Orders Expanding Further into the IFC

Market

-

Gilat to Acquire Stellar Blu, an IFC Market Leader with a

First-to-Market ESA-Based Solution for Commercial Aviation

-

Nicole Robinson Appointed President of DataPath Inc.

Conference Call Details

Gilat’s management will discuss its second

quarter 2024 results and business achievements and participate in a

question-and-answer session:

|

Date:Start:Dial-in: |

Wednesday,

August 7, 202409:30 AM EDT / 16:30 IDTUS:

1-888-407-2553International: +972-3-918-0609 |

| |

|

A simultaneous webcast of the conference call

will be available on the Gilat website at www.gilat.com and

through this link: https://veidan.activetrail.biz/gilatq2-2024

The webcast will also be archived for a period

of 30 days on the Company’s website and through the link above.

Non-GAAP Measures

The attached summary unaudited financial

statements were prepared in accordance with U.S. Generally Accepted

Accounting Principles (GAAP). To supplement the consolidated

financial statements presented in accordance with GAAP, the Company

presents non-GAAP presentations of gross profit, operating

expenses, operating income, income before taxes on income, net

income, Adjusted EBITDA, and earnings per share. The adjustments to

the Company’s GAAP results are made with the intent of providing

both management and investors with a more complete understanding of

the Company’s underlying operational results, trends, and

performance. Non-GAAP financial measures mainly exclude, if and

when applicable, the effect of stock-based compensation expenses,

amortization of purchased intangibles, lease incentive

amortization, other non-recurring expenses, other integration

expenses, other operating expenses (income), net, one-time changes

of deferred tax assets and income tax effect on the relevant

adjustments.

Adjusted EBITDA is presented to compare the

Company’s performance to that of prior periods and evaluate the

Company’s financial and operating results on a consistent basis

from period to period. The Company also believes this measure, when

viewed in combination with the Company’s financial results prepared

in accordance with GAAP, provides useful information to investors

to evaluate ongoing operating results and trends. Adjusted EBITDA,

however, should not be considered as an alternative to operating

income or net income for the period and may not be indicative of

the historic operating results of the Company; nor is it meant to

be predictive of potential future results. Adjusted EBITDA is not a

measure of financial performance under GAAP and may not be

comparable to other similarly titled measures for other companies.

Reconciliation between the Company’s net income and adjusted EBITDA

is presented in the attached summary financial statements.

Non-GAAP presentations of gross profit,

operating expenses, operating income, income before taxes on

income, net income, adjusted EBITDA and earnings per share should

not be considered in isolation or as a substitute for any of the

consolidated statements of operations prepared in accordance with

GAAP, or as an indication of Gilat’s operating performance or

liquidity.

About Gilat

Gilat Satellite Networks Ltd. (NASDAQ: GILT,

TASE: GILT) is a leading global provider of satellite-based

broadband communications. With over 35 years of experience, we

create and deliver deep technology solutions for satellite, ground

and new space connectivity and provide comprehensive, secure

end-to-end solutions and services for mission-critical operations,

powered by our innovative technology. We believe in the right of

all people to be connected and are united in our resolution to

provide communication solutions to all reaches of the world.

Our portfolio includes a diverse offering to

deliver high value solutions for multiple orbit constellations with

very high throughput satellites (VHTS) and software defined

satellites (SDS). Our offering is comprised of a cloud-based

platform and high-performance satellite terminals; high performance

Satellite On-the-Move (SOTM) antennas; highly efficient, high-power

Solid State Power Amplifiers (SSPA) and Block Upconverters (BUC)

and includes integrated ground systems for commercial and defense,

field services, network management software, and cybersecurity

services.

Gilat’s comprehensive offering supports multiple

applications with a full portfolio of products and tailored

solutions to address key applications including broadband access,

mobility, cellular backhaul, enterprise, defense, aerospace,

broadcast, government, and critical infrastructure clients all

while meeting the most stringent service level requirements. For

more information, please visit: www.gilat.com

Certain statements made herein that are not

historical are forward-looking within the meaning of the Private

Securities Litigation Reform Act of 1995. The words “estimate”,

“project”, “intend”, “expect”, “believe” and similar expressions

are intended to identify forward-looking statements. These

forward-looking statements involve known and unknown risks and

uncertainties. Many factors could cause the actual results,

performance or achievements of Gilat to be materially different

from any future results, performance or achievements that may be

expressed or implied by such forward-looking statements, including,

among others, changes in general economic and business conditions,

inability to maintain market acceptance to Gilat’s products,

inability to timely develop and introduce new technologies,

products and applications, rapid changes in the market for Gilat’s

products, loss of market share and pressure on prices resulting

from competition, introduction of competing products by other

companies, inability to manage growth and expansion, loss of key

OEM partners, inability to attract and retain qualified personnel,

inability to protect the Company’s proprietary technology and risks

associated with Gilat’s international operations and its location

in Israel, including those related to the current terrorist attacks

by Hamas, and the war and hostilities between Israel and Hamas and

Israel and Hezbollah. For additional information regarding these

and other risks and uncertainties associated with Gilat’s business,

reference is made to Gilat’s reports filed from time to time with

the Securities and Exchange Commission. We undertake no obligation

to update or revise any forward-looking statements for any

reason.

Contact:

Gilat Satellite NetworksHagay Katz, Chief Products and Marketing

Officerhagayk@gilat.com

Gilat Satellite NetworksMayrav Sher, Head of Finance and

Investor Relationsmayravs@gilat.com

EK Global IREhud Helft, Managing Partnerehud@ekgir.com

|

GILAT SATELLITE NETWORKS LTD. |

|

CONSOLIDATED STATEMENTS OF INCOME |

|

U.S. dollars in thousands (except share and per share

data) |

|

|

|

|

|

|

Six months ended |

|

Three months ended |

|

|

June 30, |

|

June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Unaudited |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

152,709 |

|

|

$ |

126,551 |

|

|

$ |

76,631 |

|

|

$ |

67,589 |

|

|

Cost of revenues |

|

98,082 |

|

|

|

76,330 |

|

|

|

50,058 |

|

|

|

42,053 |

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

54,627 |

|

|

|

50,221 |

|

|

|

26,573 |

|

|

|

25,536 |

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses, net |

|

18,547 |

|

|

|

19,003 |

|

|

|

9,228 |

|

|

|

9,384 |

|

|

Selling and marketing expenses |

|

14,109 |

|

|

|

11,941 |

|

|

|

7,032 |

|

|

|

5,932 |

|

|

General and administrative expenses |

|

14,514 |

|

|

|

9,155 |

|

|

|

6,437 |

|

|

|

4,724 |

|

|

Other operating expenses (income), net |

|

(725 |

) |

|

|

(2,340 |

) |

|

|

1,085 |

|

|

|

47 |

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

46,445 |

|

|

|

37,759 |

|

|

|

23,782 |

|

|

|

20,087 |

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

8,182 |

|

|

|

12,462 |

|

|

|

2,791 |

|

|

|

5,449 |

|

|

|

|

|

|

|

|

|

|

|

Financial income (expenses), net |

|

779 |

|

|

|

(735 |

) |

|

|

266 |

|

|

|

(586 |

) |

|

|

|

|

|

|

|

|

|

|

Income before taxes on income |

|

8,961 |

|

|

|

11,727 |

|

|

|

3,057 |

|

|

|

4,863 |

|

|

|

|

|

|

|

|

|

|

|

Taxes on income |

|

(2,695 |

) |

|

|

(1,822 |

) |

|

|

(1,755 |

) |

|

|

(538 |

) |

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

6,266 |

|

|

$ |

9,905 |

|

|

$ |

1,302 |

|

|

$ |

4,325 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per share (basic and diluted) |

$ |

0.11 |

|

|

$ |

0.17 |

|

|

$ |

0.02 |

|

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares used in |

|

|

|

|

|

|

|

|

computing earnings per share |

|

|

|

|

|

|

|

|

Basic |

|

57,016,808 |

|

|

|

56,615,714 |

|

|

|

57,017,032 |

|

|

|

56,617,943 |

|

|

Diluted |

|

57,016,808 |

|

|

|

56,622,204 |

|

|

|

57,017,032 |

|

|

|

56,620,977 |

|

| |

|

|

|

|

|

|

|

|

GILAT SATELLITE NETWORKS LTD. |

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP CONSOLIDATED

STATEMENTS OF INCOME |

|

FOR COMPARATIVE PURPOSES |

|

U.S. dollars in thousands (except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Three months ended |

| |

June 30, 2024 |

|

June 30, 2023 |

| |

GAAP |

|

Adjustments (*) |

|

Non-GAAP |

|

GAAP |

|

Adjustments (*) |

|

Non-GAAP |

|

|

Unaudited |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

$ |

26,573 |

|

$ |

1,617 |

|

|

$ |

28,190 |

|

$ |

25,536 |

|

$ |

95 |

|

|

$ |

25,631 |

|

Operating expenses |

|

23,782 |

|

|

(2,914 |

) |

|

|

20,868 |

|

|

20,087 |

|

|

(513 |

) |

|

|

19,574 |

|

Operating income |

|

2,791 |

|

|

4,531 |

|

|

|

7,322 |

|

|

5,449 |

|

|

608 |

|

|

|

6,057 |

|

Income before taxes on income |

|

3,057 |

|

|

4,531 |

|

|

|

7,588 |

|

|

4,863 |

|

|

608 |

|

|

|

5,471 |

|

Net income |

$ |

1,302 |

|

$ |

4,253 |

|

|

$ |

5,555 |

|

$ |

4,325 |

|

$ |

608 |

|

|

$ |

4,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share (basic and diluted) |

$ |

0.02 |

|

$ |

0.08 |

|

|

$ |

0.10 |

|

$ |

0.08 |

|

$ |

0.01 |

|

|

$ |

0.09 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

|

|

|

|

used in computing earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

57,017,032 |

|

|

|

|

57,017,032 |

|

|

56,617,943 |

|

|

|

|

56,617,943 |

|

Diluted |

|

57,017,032 |

|

|

|

|

57,017,032 |

|

|

56,620,977 |

|

|

|

|

56,620,977 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(*) Adjustments reflect the effect of stock-based compensation

expenses as per ASC 718, amortization of purchased

intangibles, other operating expenses, net, |

|

other non-recurring expenses, other integration expenses and

income tax effect on such adjustments which is calculated using the

relevant effective tax rate. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

Three months ended |

| |

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

Unaudited |

|

|

|

|

|

Unaudited |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income |

|

|

$ |

1,302 |

|

|

|

|

|

|

$ |

4,325 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expenses |

|

|

|

150 |

|

|

|

|

|

|

|

95 |

|

|

|

|

Amortization of purchased intangibles |

|

|

|

920 |

|

|

|

|

|

|

|

- |

|

|

|

|

Other non-recurring expenses |

|

|

|

466 |

|

|

|

|

|

|

|

- |

|

|

|

|

Other integration expenses |

|

|

|

81 |

|

|

|

|

|

|

|

- |

|

|

|

| |

|

|

|

1,617 |

|

|

|

|

|

|

|

95 |

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expenses |

|

|

|

705 |

|

|

|

|

|

|

|

417 |

|

|

|

|

Stock-based compensation expenses related to business

combination |

|

|

|

842 |

|

|

|

|

|

|

|

- |

|

|

|

|

Amortization of purchased intangibles |

|

|

|

267 |

|

|

|

|

|

|

|

49 |

|

|

|

|

Other operating expenses, net |

|

|

|

1,085 |

|

|

|

|

|

|

|

47 |

|

|

|

|

Other integration expenses |

|

|

|

15 |

|

|

|

|

|

|

|

- |

|

|

|

| |

|

|

|

2,914 |

|

|

|

|

|

|

|

513 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Taxes on income |

|

|

|

(278 |

) |

|

|

|

|

|

|

- |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income |

|

|

$ |

5,555 |

|

|

|

|

|

|

$ |

4,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GILAT SATELLITE NETWORKS LTD. |

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP CONSOLIDATED

STATEMENTS OF INCOME |

|

FOR COMPARATIVE PURPOSES |

|

U.S. dollars in thousands (except share and per share

data) |

|

|

|

|

|

|

Six months ended |

|

Six months ended |

| |

June 30, 2024 |

|

June 30, 2023 |

| |

GAAP |

|

Adjustments (*) |

Non-GAAP |

|

GAAP |

|

Adjustments (*) |

Non-GAAP |

| |

Unaudited |

|

Unaudited |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

$ |

54,627 |

|

$ |

2,343 |

|

|

$ |

56,970 |

|

$ |

50,221 |

|

$ |

170 |

|

|

$ |

50,391 |

|

Operating expenses |

|

46,445 |

|

|

(3,413 |

) |

|

|

43,032 |

|

|

37,759 |

|

|

1,296 |

|

|

|

39,055 |

|

Operating income |

|

8,182 |

|

|

5,756 |

|

|

|

13,938 |

|

|

12,462 |

|

|

(1,126 |

) |

|

|

11,336 |

|

Income before taxes on income |

|

8,961 |

|

|

5,756 |

|

|

|

14,717 |

|

|

11,727 |

|

|

(1,126 |

) |

|

|

10,601 |

|

Net income |

$ |

6,266 |

|

$ |

5,303 |

|

|

$ |

11,569 |

|

$ |

9,905 |

|

$ |

(1,126 |

) |

|

$ |

8,779 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share (basic and diluted) |

$ |

0.11 |

|

$ |

0.09 |

|

|

$ |

0.20 |

|

$ |

0.17 |

|

$ |

(0.01 |

) |

|

$ |

0.16 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

|

|

|

|

used in computing earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

57,016,808 |

|

|

|

|

57,016,808 |

|

|

56,615,714 |

|

|

|

|

56,615,714 |

|

Diluted |

|

57,016,808 |

|

|

|

|

57,062,883 |

|

|

56,622,204 |

|

|

|

|

56,622,204 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(*) Adjustments reflect the effect of stock-based compensation

expenses as per ASC 718, amortization of purchased

intangibles, other operating income, net, |

|

other non-recurring expenses, other integration expenses and

income tax effect on such adjustments which is calculated using the

relevant effective tax rate. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Six months ended |

|

Six months ended |

| |

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

Unaudited |

|

|

|

|

|

Unaudited |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income |

|

|

$ |

6,266 |

|

|

|

|

|

|

$ |

9,905 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expenses |

|

|

|

300 |

|

|

|

|

|

|

|

170 |

|

|

|

|

Amortization of purchased intangibles |

|

|

|

1,427 |

|

|

|

|

|

|

|

- |

|

|

|

|

Other non-recurring expenses |

|

|

|

466 |

|

|

|

|

|

|

|

- |

|

|

|

|

Other integration expenses |

|

|

|

150 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

2,343 |

|

|

|

|

|

|

|

170 |

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expenses |

|

|

|

1,422 |

|

|

|

|

|

|

|

944 |

|

|

|

|

Stock-based compensation expenses related to business

combination |

|

|

|

2,166 |

|

|

|

|

|

|

|

- |

|

|

|

|

Amortization of purchased intangibles |

|

|

|

524 |

|

|

|

|

|

|

|

100 |

|

|

|

|

Other operating income, net |

|

|

|

(725 |

) |

|

|

|

|

|

|

(2,340 |

) |

|

|

|

Other integration expenses |

|

|

|

26 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

3,413 |

|

|

|

|

|

|

|

(1,296 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Taxes on income |

|

|

|

(453 |

) |

|

|

|

|

|

|

- |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income |

|

|

$ |

11,569 |

|

|

|

|

|

|

$ |

8,779 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

GILAT SATELLITE NETWORKS LTD. |

|

SUPPLEMENTAL INFORMATION |

|

U.S. dollars in thousands |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Six months ended |

|

Three months ended |

| |

June 30, |

|

June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

Unaudited |

|

Unaudited |

| |

|

|

|

|

|

|

|

|

GAAP net income |

$ |

6,266 |

|

|

$ |

9,905 |

|

|

$ |

1,302 |

|

|

$ |

4,325 |

|

Adjustments: |

|

|

|

|

|

|

|

|

Financial expenses (income), net |

|

(779 |

) |

|

|

735 |

|

|

|

(266 |

) |

|

|

586 |

|

Taxes on income |

|

2,695 |

|

|

|

1,822 |

|

|

|

1,755 |

|

|

|

538 |

|

Stock-based compensation expenses |

|

1,722 |

|

|

|

1,114 |

|

|

|

855 |

|

|

|

512 |

|

Stock-based compensation expenses related to business

combination |

|

2,166 |

|

|

|

- |

|

|

|

842 |

|

|

|

- |

|

Depreciation and amortization (*) |

|

7,443 |

|

|

|

6,335 |

|

|

|

3,963 |

|

|

|

3,172 |

|

Other operating expenses (income), net |

|

(725 |

) |

|

|

(2,340 |

) |

|

|

1,085 |

|

|

|

47 |

|

Other non-recurring expenses |

|

466 |

|

|

|

- |

|

|

|

466 |

|

|

|

- |

|

Other integration expenses |

|

176 |

|

|

|

- |

|

|

|

96 |

|

|

|

- |

| |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

19,430 |

|

|

$ |

17,571 |

|

|

$ |

10,098 |

|

|

$ |

9,180 |

|

|

|

|

|

|

|

|

|

|

(*) Including amortization of lease incentive |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended |

|

Three months ended |

|

|

June 30, |

|

June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Unaudited |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

Satellite Networks |

$ |

97,378 |

|

|

$ |

74,273 |

|

|

$ |

50,605 |

|

|

$ |

40,727 |

|

Integrated Solutions |

|

24,619 |

|

|

|

25,619 |

|

|

|

12,969 |

|

|

|

12,700 |

|

Network Infrastructure and Services |

|

30,712 |

|

|

|

26,659 |

|

|

|

13,057 |

|

|

|

14,162 |

| |

|

|

|

|

|

|

|

|

Total revenues |

$ |

152,709 |

|

|

$ |

126,551 |

|

|

$ |

76,631 |

|

|

$ |

67,589 |

|

|

|

|

|

|

|

|

|

|

GILAT SATELLITE NETWORKS LTD. |

|

CONSOLIDATED BALANCE SHEETS |

|

U.S. dollars in thousands |

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

2024 |

|

2023 |

|

|

Unaudited |

|

Audited |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

93,667 |

|

|

$ |

103,961 |

|

|

Restricted cash |

|

1,030 |

|

|

|

736 |

|

|

Trade receivables, net |

|

62,217 |

|

|

|

44,725 |

|

|

Contract assets |

|

26,041 |

|

|

|

28,327 |

|

|

Inventories |

|

36,774 |

|

|

|

38,525 |

|

|

Other current assets |

|

20,016 |

|

|

|

24,299 |

|

|

|

|

|

|

|

Total current assets |

|

239,745 |

|

|

|

240,573 |

|

|

|

|

|

|

|

LONG-TERM ASSETS: |

|

|

|

|

Restricted cash |

|

54 |

|

|

|

54 |

|

|

Long-term contract assets |

|

8,587 |

|

|

|

9,283 |

|

|

Severance pay funds |

|

5,607 |

|

|

|

5,737 |

|

|

Deferred taxes |

|

9,760 |

|

|

|

11,484 |

|

|

Operating lease right-of-use assets |

|

4,910 |

|

|

|

5,105 |

|

|

Other long-term assets |

|

8,120 |

|

|

|

9,544 |

|

|

|

|

|

|

|

Total long-term assets |

|

37,038 |

|

|

|

41,207 |

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, NET |

|

71,168 |

|

|

|

74,315 |

|

|

|

|

|

|

|

INTANGIBLE ASSETS, NET |

|

14,238 |

|

|

|

16,051 |

|

|

|

|

|

|

|

GOODWILL |

|

54,740 |

|

|

|

54,740 |

|

|

|

|

|

|

|

TOTAL ASSETS |

$ |

416,929 |

|

|

$ |

426,886 |

|

|

|

|

|

|

|

|

|

|

|

|

GILAT SATELLITE NETWORKS LTD. |

|

CONSOLIDATED BALANCE SHEETS (Cont.) |

|

U.S. dollars in thousands |

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

2024 |

|

2023 |

|

|

Unaudited |

|

Audited |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Short-term debt |

$ |

129 |

|

|

$ |

7,453 |

|

|

Trade payables |

|

17,585 |

|

|

|

13,873 |

|

|

Accrued expenses |

|

48,621 |

|

|

|

51,906 |

|

|

Advances from customers and deferred revenues |

|

25,188 |

|

|

|

34,495 |

|

|

Operating lease liabilities |

|

2,622 |

|

|

|

2,426 |

|

|

Other current liabilities |

|

18,079 |

|

|

|

16,431 |

|

|

|

|

|

|

|

Total current liabilities |

|

112,224 |

|

|

|

126,584 |

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

Long-term loan |

|

2,000 |

|

|

|

2,000 |

|

|

Accrued severance pay |

|

6,467 |

|

|

|

6,537 |

|

|

Long-term advances from customers and deferred revenues |

|

912 |

|

|

|

1,139 |

|

|

Operating lease liabilities |

|

2,430 |

|

|

|

3,022 |

|

|

Other long-term liabilities |

|

10,141 |

|

|

|

12,916 |

|

|

|

|

|

|

|

Total long-term liabilities |

|

21,950 |

|

|

|

25,614 |

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

Share capital - ordinary shares of NIS 0.2 par value |

|

2,733 |

|

|

|

2,733 |

|

|

Additional paid-in capital |

|

940,520 |

|

|

|

937,591 |

|

|

Accumulated other comprehensive loss |

|

(6,443 |

) |

|

|

(5,315 |

) |

|

Accumulated deficit |

|

(654,055 |

) |

|

|

(660,321 |

) |

|

|

|

|

|

|

Total shareholders' equity |

|

282,755 |

|

|

|

274,688 |

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

416,929 |

|

|

$ |

426,886 |

|

| |

|

|

|

|

GILAT SATELLITE NETWORKS LTD. |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

U.S. dollars in thousands |

|

|

|

|

|

|

|

|

|

| |

Six months ended |

|

Three months ended |

| |

June 30, |

|

June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

Unaudited |

|

Unaudited |

|

Cash flows from operating activities: |

|

Net income |

$ |

6,266 |

|

|

$ |

9,905 |

|

|

$ |

1,302 |

|

|

$ |

4,325 |

|

|

Adjustments required to reconcile net income to net cash

provided by operating activities: |

|

Depreciation and amortization |

|

7,333 |

|

|

|

6,222 |

|

|

|

3,908 |

|

|

|

3,115 |

|

|

Stock-based compensation (*) |

|

3,888 |

|

|

|

1,114 |

|

|

|

1,697 |

|

|

|

512 |

|

|

Accrued severance pay, net |

|

60 |

|

|

|

196 |

|

|

|

115 |

|

|

|

(101 |

) |

|

Deferred taxes, net |

|

1,724 |

|

|

|

1,820 |

|

|

|

1,273 |

|

|

|

694 |

|

|

Decrease (increase) in trade receivables, net |

|

(17,734 |

) |

|

|

9,398 |

|

|

|

(8,937 |

) |

|

|

2,907 |

|

|

Decrease (increase) in contract assets |

|

2,982 |

|

|

|

8,378 |

|

|

|

(3,266 |

) |

|

|

3,461 |

|

|

Decrease in other assets and other adjustments (including |

|

|

|

|

|

|

|

|

short-term, long-term and effect of exchange ratechanges on cash

and cash equivalents) |

|

5,512 |

|

|

|

243 |

|

|

|

2,005 |

|

|

|

3,010 |

|

|

Decrease (increase) in inventories, net |

|

974 |

|

|

|

(7,895 |

) |

|

|

4,167 |

|

|

|

(272 |

) |

|

Increase (decrease) in trade payables |

|

3,579 |

|

|

|

(4,240 |

) |

|

|

4,245 |

|

|

|

(6,229 |

) |

|

Decrease in accrued expenses |

|

(2,229 |

) |

|

|

(5,039 |

) |

|

|

(989 |

) |

|

|

(2,840 |

) |

|

Increase (decrease) in advances from customers and deferred

revenues |

|

(9,486 |

) |

|

|

3,124 |

|

|

|

(6,732 |

) |

|

|

7,593 |

|

|

Decrease in other liabilities |

|

(2,177 |

) |

|

|

(15,009 |

) |

|

|

(2,316 |

) |

|

|

(14,161 |

) |

|

Net cash provided by (used in) operating

activities |

|

692 |

|

|

|

8,217 |

|

|

|

(3,528 |

) |

|

|

2,014 |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

Purchase of property and equipment |

|

(2,650 |

) |

|

|

(6,556 |

) |

|

|

(1,857 |

) |

|

|

(3,524 |

) |

|

Net cash used in investing activities |

|

(2,650 |

) |

|

|

(6,556 |

) |

|

|

(1,857 |

) |

|

|

(3,524 |

) |

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

Repayment of credit facility, net |

|

(7,453 |

) |

|

|

- |

|

|

|

(4,709 |

) |

|

|

- |

|

|

Repayments of short-term debts |

|

(1,340 |

) |

|

|

- |

|

|

|

(1,340 |

) |

|

|

- |

|

|

Proceeds from short-term debts |

|

1,469 |

|

|

|

- |

|

|

|

1,469 |

|

|

|

- |

|

|

Net cash used in financing activities |

|

(7,324 |

) |

|

|

- |

|

|

|

(4,580 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash, cash equivalents

and restricted cash |

|

(718 |

) |

|

|

(1,010 |

) |

|

|

(450 |

) |

|

|

(433 |

) |

| |

|

|

|

|

|

|

|

|

Increase (decrease) in cash, cash equivalents and

restricted cash |

|

(10,000 |

) |

|

|

651 |

|

|

|

(10,415 |

) |

|

|

(1,943 |

) |

| |

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at the beginning

of the period |

|

104,751 |

|

|

|

87,145 |

|

|

|

105,166 |

|

|

|

89,739 |

|

| |

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at the end of

the period |

$ |

94,751 |

|

|

$ |

87,796 |

|

|

$ |

94,751 |

|

|

$ |

87,796 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) Stock-based compensation including expenses related to business

combination in the amounts of $2,166 and $842 for the six months

and three months ended June 30, 2024, respectively. |

| |

|

|

|

|

|

|

|

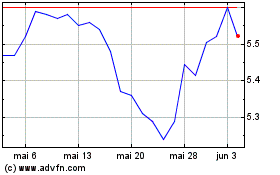

Gilat Satellite Networks (NASDAQ:GILT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Gilat Satellite Networks (NASDAQ:GILT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024