AFC Gamma, Inc. (NASDAQ:AFCG) (“Advanced Flower Capital”, “AFC” or

the “Company”) today announced its results for the second quarter

ended June 30, 2024.

AFC reported generally accepted accounting

principles (“GAAP”) net income of $16.4 million or $0.80 per basic

weighted average common share and Distributable Earnings of

$11.4 million or $0.56 per basic weighted average common share for

the second quarter of 2024.

“We are excited to announce that AFC is now a

pure-play cannabis lender after the spin-off of our commercial real

estate portfolio on July 9, 2024. This transition positions us to

well to capitalize on cannabis market opportunities, and we are on

track to meet or exceed our $100 million origination goal for this

year. This quarter has been marked by strong performance. Our

active portfolio management is showing positive momentum, with

reduced reserves and increased book value, highlighting the

effectiveness of our strategic initiatives,” said Daniel Neville,

the Company’s Chief Executive Officer.

Common Stock Dividend

On July 15, 2024, the Company paid a regular

cash dividend of $0.48 per common share for the second quarter of

2024. AFC distributed $9.9 million in dividends, or $0.48 per

common share, compared to Distributable Earnings of $0.56 per basic

weighted average common share for such period.

Additional Information

Advanced Flower Capital issued a presentation of

its second quarter 2024 results, titled “Second Quarter 2024

Earnings Presentation,” which can be viewed at

advancedflowercapital.com under the Investor Relations section. The

Company also filed its Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024, with the Securities and Exchange

Commission on August 7, 2024.

AFC routinely posts important information for

investors on its website, advancedflowercapital.com. The Company

intends to use this webpage as a means of disclosing material

information, for complying with our disclosure obligations under

Regulation FD and to post and update investor presentations and

similar materials on a regular basis. AFC encourages investors,

analysts, the media and others interested in AFC to monitor the

Investors section of its website, in addition to following its

press releases, SEC filings, public conference calls,

presentations, webcasts and other information posted from time to

time on the website. To sign-up for email-notifications, please

visit the “Email Alerts” section of the website under the “IR

Resources” section.

Conference Call & Discussion of

Financial Results

Advanced Flower Capital will host a conference

call at 10:00 am (Eastern Time) on Wednesday, August 7, 2024, to

discuss its quarterly financial results. All interested parties are

welcome to participate. The call will be available through a live

audio webcast at the Investor Relations section of AFC’s website

found here: AFC -- Investor Relations. To participate via

telephone, please register in advance at this link. Upon

registration, all telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number along with a unique passcode and

registrant ID that can be used to access the call. The complete

webcast will be archived for 90 days on the Investor Relations

section of AFC’s website.

About AFC Gamma, Inc.

AFC Gamma, Inc. (Nasdaq: AFCG) is a leading

commercial mortgage REIT that provides institutional loans to state

law compliant cannabis operators in the U.S. Through the management

team’s deep network and significant credit and cannabis expertise,

AFC originates, structures, underwrites and manages loans ranging

from $10 million to over $100 million, typically secured by quality

real estate assets, license value and cash flows. It is based in

West Palm Beach, Florida.

Non-GAAP Metrics

In addition to using certain financial metrics

prepared in accordance with GAAP to evaluate our performance, we

also use Distributable Earnings to evaluate our performance

excluding the effects of certain transactions and GAAP adjustments

we believe are not necessarily indicative of our current loan

activity and operations. Distributable Earnings is a measure that

is not prepared in accordance with GAAP. Distributable Earnings and

the other capitalized terms not defined in this section have the

meanings ascribed to such terms in our most-recently filed

quarterly report. We use this non-GAAP financial measure both to

explain our results to shareholders and the investment community

and in the internal evaluation and management of our businesses.

Our management believes that this non-GAAP financial measure and

the information they provide are useful to investors since these

measures permit investors and shareholders to assess the overall

performance of our business using the same tools that our

management uses to evaluate our past performance and prospects for

future performance.

The determination of Distributable Earnings is

substantially similar to the determination of Core Earnings under

our Management Agreement, provided that Core Earnings is a

component of the calculation of any Incentive Compensation earned

under the Management Agreement for the applicable time period, and

thus Core Earnings is calculated without giving effect to Incentive

Compensation expense, while the calculation of Distributable

Earnings account for any Incentive Compensation earned for such

time period. We define Distributable Earnings as, for a specified

period, the net income (loss) computed in accordance with GAAP,

excluding (i) stock-based compensation expense, (ii) depreciation

and amortization, (iii) any unrealized gains, losses or other

non-cash items recorded in net income (loss) for the period,

regardless of whether such items are included in other

comprehensive income or loss, or in net income (loss); provided

that Distributable Earnings does not exclude, in the case of

investments with a deferred interest feature (such as original

issue discount, debt instruments with PIK interest and zero coupon

securities), accrued income that we have not yet received in cash,

(iv) (decrease) increase in provision for current expected credit

losses (“CECL”), (v) taxable REIT (as defined below) subsidiary

(“TRS”) (income) loss, net of any dividends received from TRS and

(vi) one-time events pursuant to changes in GAAP and certain

non-cash charges, in each case after discussions between our

Manager and our independent directors and after approval by a

majority of such independent directors.

We believe providing Distributable Earnings on a

supplemental basis to our net income as determined in accordance

with GAAP is helpful to shareholders in assessing the overall

performance of our business. As a real estate investment trust

(“REIT”), we are required to distribute at least 90% of our annual

REIT taxable income, subject to certain adjustments, and to pay tax

at regular corporate rates to the extent that we annually

distribute less than 100% of such taxable income. Given these

requirements and our belief that dividends are generally one of the

principal reasons that shareholders invest in our common stock, we

generally intend to attempt to pay dividends to our shareholders in

an amount at least equal to such REIT taxable income, if and to the

extent authorized by our Board of Directors. Distributable Earnings

is one of many factors considered by our Board of Directors in

authorizing dividends and, while not a direct measure of net

taxable income, over time, the measure can be considered a useful

indicator of our dividends.

Distributable Earnings is a non-GAAP financial

measure and should not be considered as a substitute for GAAP net

income. We caution readers that our methodology for calculating

Distributable Earnings may differ from the methodologies employed

by other REITs to calculate the same or similar supplemental

performance measures, and as a result, our reported Distributable

Earnings may not be comparable to similar measures presented by

other REITs.

The following table provides a

reconciliation of GAAP Net income to Distributable

Earnings:

| |

Three months endedJune 30, |

|

Six months endedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

income |

$ |

16,446,121 |

|

|

$ |

12,135,333 |

|

|

$ |

16,392,005 |

|

|

$ |

22,160,607 |

|

| Adjustments to net

income: |

|

|

|

|

|

|

|

| Stock-based compensation

expense |

|

369,343 |

|

|

|

130,769 |

|

|

|

912,565 |

|

|

|

411,347 |

|

| Depreciation and

amortization |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Unrealized (gains) losses, or

other non-cash items |

|

1,420,001 |

|

|

|

462,918 |

|

|

|

5,033,694 |

|

|

|

1,940,609 |

|

| (Decrease) increase in

provision for current expected credit losses |

|

(6,190,240 |

) |

|

|

(1,606,187 |

) |

|

|

(1,258,566 |

) |

|

|

(903,761 |

) |

| TRS (income) loss, net of

dividends |

|

(624,235 |

) |

|

|

(1,250,400 |

) |

|

|

306,998 |

|

|

|

(2,116,604 |

) |

| One-time events pursuant to

changes in GAAP and certain non-cash charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Distributable

earnings |

$ |

11,420,990 |

|

|

$ |

9,872,433 |

|

|

$ |

21,386,696 |

|

|

$ |

21,492,198 |

|

| Basic weighted average shares

of common stock outstanding (in shares) |

|

20,400,004 |

|

|

|

20,317,341 |

|

|

|

20,396,940 |

|

|

|

20,310,606 |

|

| Distributable earnings

per basic weighted average share |

$ |

0.56 |

|

|

$ |

0.49 |

|

|

$ |

1.05 |

|

|

$ |

1.06 |

|

|

|

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 that reflect our current views and projections with respect

to, among other things, future events and financial performance.

Words such as “believes,” “expects,” “will,” “intends,” “plans,”

“guidance,” “estimates,” “projects,” “anticipates,” and “future” or

similar expressions are intended to identify forward-looking

statements. These forward-looking statements, including statements

about our future growth and strategies for such growth, are subject

to the inherent uncertainties in predicting future results and

conditions and are not guarantees of future performance, conditions

or results. Certain factors, including the ability of our manager

to locate suitable loan opportunities for us, monitor and actively

manage our loan portfolio and implement our investment strategy;

the demand for commercial real estate investment and cannabis

cultivation and processing facilities; management’s current

estimate of expected credit losses and current expected credit loss

reserve and other factors could cause actual results and

performance to differ materially from those projected in these

forward-looking statements. More information on these risks and

other potential factors that could affect our business and

financial results is included in AFC’s filings with the SEC,

including in the “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” sections

of AFC’s most recently filed periodic reports on Form 10-K, Form

10-Q and subsequent filings. New risks and uncertainties arise over

time, and it is not possible to predict those events or how they

may affect AFC. We do not undertake any obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

Investor Relations

AFC GAMMA, INC. INVESTOR CONTACT:Robyn

Tannenbaum(561) 510-2293ir@advancedflowercapital.com

AFC GAMMA, INC. MEDIA CONTACT:Profile

AdvisorsRich Myers(347) 774-1125rmyers@profileadvisors.com

1 Distributable Earnings is a non-GAAP financial measure. See

the “Non-GAAP Metrics” section of this release for a reconciliation

of GAAP Net Income to Distributable Earnings.

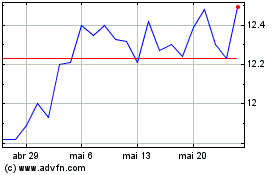

Advanced Flower Capital (NASDAQ:AFCG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Advanced Flower Capital (NASDAQ:AFCG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025