Avalo Therapeutics, Inc. (Nasdaq: AVTX), today announced business

updates and financial results for the second quarter of 2024.

“The team has made outstanding progress in a

short amount of time toward initiating the Phase 2 LOTUS Trial, as

highlighted by the activation of the IND in July,” said Dr. Garry

Neil, Chief Executive Officer and Chairman of the Board.

“Furthermore, the Company is immediately benefiting from the

addition of Mittie and Paul to the leadership team as CMO and CLO,

respectively. Their deep expertise and leadership experience will

guide us as we focus on initiating the LOTUS Trial, as well as the

evaluation and announcement of a second indication, both of which

we believe are on track for the second half of the year.”

Program Updates and

Milestones:

- AVTX-009: Anti-IL-1β

monoclonal antibody (mAb) targeting inflammatory diseases.

- Avalo is pursuing the development

of AVTX-009 in hidradenitis suppurativa (HS).

- In July 2024, Avalo announced that

the Investigational New Drug Application (IND) for the treatment of

HS is active, permitting Avalo to commence its Phase 2 LOTUS Trial

in patients with HS.

- Avalo expects to enroll the first

patient in its global Phase 2 LOTUS Trial in the second half of

2024.

- In addition to hidradenitis

suppurativa, Avalo plans to develop AVTX-009 in at least one other

chronic inflammatory indication.

Second Quarter 2024 Financial

Update:

As of June 30, 2024, Avalo had $93.4 million in

cash and cash equivalents. Net cash used in operating activities

was $22.5 million for the six months ended June 30, 2024, which

includes a $7.5 million milestone payment to AlmataBio, Inc.

pursuant to the acquisition in the first quarter. The Company’s

current cash on hand is expected to fund operations into 2027.

For the six months ended June 30, 2024, Avalo

generated a net loss of $22.8 million, representing a $4.7 million

increase in net loss as compared to the same period in 2023. Total

operating expenses increased by $25.3 million and was primarily

driven by the recognition of $27.6 million of acquired in-process

research and development (“IPR&D”) expense from the acquisition

of AlmataBio, Inc. in the first quarter of 2024. The increase in

operating expenses was partially offset by a $21.7 million increase

in other income, net which largely related to the loss associated

with warrant liability from the private placement in the first

quarter being more than offset by the warrant liability change in

fair value in the second quarter. Net loss per share of common

stock decreased as a result of the increase in the shares

outstanding from the second quarter of 2023, partially offset by

the increase in net loss.

|

Consolidated Balance Sheets(In thousands, except

share and per share data) |

| |

| |

|

June 30, 2024 |

|

December 31, 2023 |

| |

|

(unaudited) |

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

93,426 |

|

|

$ |

7,415 |

|

|

Other receivables |

|

|

33 |

|

|

|

136 |

|

|

Prepaid expenses and other current assets |

|

|

2,435 |

|

|

|

843 |

|

|

Restricted cash, current portion |

|

|

— |

|

|

|

1 |

|

| Total current assets |

|

|

95,894 |

|

|

|

8,395 |

|

| Property and equipment,

net |

|

|

1,780 |

|

|

|

1,965 |

|

| Goodwill |

|

|

10,502 |

|

|

|

10,502 |

|

| Restricted cash, net of

current portion |

|

|

131 |

|

|

|

131 |

|

| Total assets |

|

$ |

108,307 |

|

|

$ |

20,993 |

|

| Liabilities, mezzanine

equity and stockholders’ (deficit) equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

654 |

|

|

$ |

446 |

|

|

Accrued expenses and other current liabilities |

|

|

7,888 |

|

|

|

4,172 |

|

|

Warrant liability |

|

|

82,855 |

|

|

|

— |

|

|

Contingent consideration |

|

|

5,000 |

|

|

|

— |

|

| Total current liabilities |

|

|

96,397 |

|

|

|

4,618 |

|

| Royalty obligation |

|

|

2,000 |

|

|

|

2,000 |

|

| Deferred tax liability,

net |

|

|

168 |

|

|

|

155 |

|

| Derivative liability |

|

|

10,710 |

|

|

|

5,550 |

|

| Other long-term

liabilities |

|

|

1,183 |

|

|

|

1,366 |

|

| Total liabilities |

|

|

110,458 |

|

|

|

13,689 |

|

| Mezzanine equity: |

|

|

|

|

|

Series C Preferred Stock—$0.001 par value; 34,326 and 0 shares of

Series C Preferred Stock authorized at June 30, 2024 and December

31, 2023, respectively; 22,358 and 0 shares of Series C Preferred

Stock issued and outstanding at June 30, 2024 and December 31,

2023, respectively |

|

|

11,457 |

|

|

|

— |

|

|

Series D Preferred Stock—$0.001 par value; 1 and 0 shares of Series

D Preferred Stock authorized at June 30, 2024 and December 31,

2023, respectively; 1 and 0 shares of Series D Preferred Stock

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively |

|

|

— |

|

|

|

— |

|

|

Series E Preferred Stock—$0.001 par value; 1 and 0 shares of Series

E Preferred Stock authorized at June 30, 2024 and December 31,

2023, respectively; 1 and 0 shares of Series E Preferred Stock

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively |

|

|

— |

|

|

|

— |

|

| Stockholders’ (deficit)

equity: |

|

|

|

|

|

Common stock—$0.001 par value; 200,000,000 shares authorized at

June 30, 2024 and December 31, 2023; 1,034,130 and 801,746 shares

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively |

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

344,352 |

|

|

|

342,437 |

|

|

Accumulated deficit |

|

|

(357,961 |

) |

|

|

(335,134 |

) |

| Total stockholders’ (deficit)

equity |

|

|

(13,608 |

) |

|

|

7,304 |

|

| Total liabilities, mezzanine

equity and stockholders’ (deficit) equity |

|

$ |

108,307 |

|

|

$ |

20,993 |

|

| |

The consolidated balance sheets as of June 30,

2024 and December 31, 2023 have been derived from the reviewed and

audited financial statements, respectively, but do not include all

of the information and footnotes required by accounting principles

accepted in the United States for complete financial

statements.

|

Consolidated Statements of Operations(In

thousands, except per share data) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

Product revenue, net |

|

$ |

— |

|

|

$ |

643 |

|

|

$ |

— |

|

|

$ |

1,117 |

|

|

Total revenues, net |

|

|

— |

|

|

|

643 |

|

|

|

— |

|

|

|

1,117 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

|

343 |

|

|

|

708 |

|

|

|

263 |

|

|

|

1,259 |

|

|

Research and development |

|

|

4,601 |

|

|

|

4,658 |

|

|

|

6,716 |

|

|

|

10,667 |

|

|

Acquired in-process research and development |

|

|

103 |

|

|

|

— |

|

|

|

27,641 |

|

|

|

— |

|

|

General and administrative |

|

|

4,528 |

|

|

|

2,427 |

|

|

|

7,721 |

|

|

|

5,134 |

|

|

Total operating expenses |

|

|

9,575 |

|

|

|

7,793 |

|

|

|

42,341 |

|

|

|

17,060 |

|

| |

|

|

(9,575 |

) |

|

|

(7,150 |

) |

|

|

(42,341 |

) |

|

|

(15,943 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Excess of initial warrant fair value over private placement

proceeds |

|

|

— |

|

|

|

— |

|

|

|

(79,276 |

) |

|

|

— |

|

|

Change in fair value of warrant liability |

|

|

112,046 |

|

|

|

— |

|

|

|

112,046 |

|

|

|

— |

|

|

Private placement transaction costs |

|

|

— |

|

|

|

— |

|

|

|

(9,220 |

) |

|

|

— |

|

|

Change in fair value of derivative liability |

|

|

(5,040 |

) |

|

|

(40 |

) |

|

|

(5,160 |

) |

|

|

(220 |

) |

|

Interest income (expense), net |

|

|

1,039 |

|

|

|

(996 |

) |

|

|

1,138 |

|

|

|

(1,945 |

) |

|

Other expense, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(25 |

) |

| Total other income (expense),

net |

|

|

108,045 |

|

|

|

(1,036 |

) |

|

|

19,528 |

|

|

|

(2,190 |

) |

| Income (loss) before

taxes |

|

|

98,470 |

|

|

|

(8,186 |

) |

|

|

(22,813 |

) |

|

|

(18,133 |

) |

| Income tax expense |

|

|

7 |

|

|

|

7 |

|

|

|

14 |

|

|

|

15 |

|

| Net income (loss) |

|

$ |

98,463 |

|

|

$ |

(8,193 |

) |

|

$ |

(22,827 |

) |

|

$ |

(18,148 |

) |

| Net income (loss) per share of

common stock1: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

4.21 |

|

|

$ |

(140.73 |

) |

|

$ |

(24.11 |

) |

|

$ |

(338.85 |

) |

|

Diluted |

|

$ |

(14.07 |

) |

|

$ |

(140.73 |

) |

|

$ |

(30.63 |

) |

|

$ |

(338.85 |

) |

|

|

1 Amounts for prior periods presented have been

retroactively adjusted to reflect the 1-for-240 reverse stock split

effected on December 28, 2023.

The unaudited consolidated statements of

operations for the three and six months ended June 30, 2024 and

2023 have been derived from the reviewed financial statements, but

do not include all of the information and footnotes required by

accounting principles generally accepted in the United States for

complete financial statements.

About Avalo Therapeutics

Avalo Therapeutics is a clinical stage

biotechnology company focused on the treatment of immune

dysregulation. Avalo’s lead asset is AVTX-009, an anti-IL-1β mAb,

targeting inflammatory diseases. Avalo also has two additional drug

candidates, which include quisovalimab (anti-LIGHT mAb) and

AVTX-008 (BTLA agonist fusion protein). For more information about

Avalo, please visit www.avalotx.com.

About AVTX-009

AVTX-009 is a humanized monoclonal antibody

(IgG4) that binds to interleukin-1β (IL-1β) with high affinity and

neutralizes its activity. IL-1β is a central driver in the

inflammatory process. Overproduction or dysregulation of IL-1β is

implicated in many autoimmune and inflammatory diseases.

IL-1β is a major, validated target for therapeutic intervention.

There is evidence that inhibition of IL-1β could be effective in

hidradenitis suppurativa and a variety of

inflammatory diseases in dermatology, gastroenterology, and

rheumatology.

About the LOTUS Trial

The LOTUS Trial is a randomized, double-blind,

placebo-controlled, parallel-group Phase 2 trial with two

AVTX-009 dose regimens to evaluate the efficacy and safety of

AVTX-009 in approximately 180 adults with moderate to severe

hidradenitis suppurativa. The primary efficacy endpoint is the

proportion of subjects achieving Hidradenitis Suppurativa Clinical

Response (HiSCR75) at Week 16. Subjects will be randomized

(1:1:1) to receive either one of two doses of AVTX-009 or

placebo.

About Hidradenitis

Suppurativa

Hidradenitis suppurativa (HS) is a chronic

inflammatory skin condition characterized by painful nodules,

abscesses, and tunnels that form in areas of the body such as the

armpits, groin, and buttocks, severely impacting the quality of

life of affected individuals.1 HS is often underdiagnosed or

misdiagnosed and therefore estimates of HS vary between 0.2-1.7% of

the population worldwide.2-5 The exact cause of HS is not fully

understood but is believed to involve a combination of genetic,

hormonal, and environmental factors. While advances in treatment

have been made, limited treatment options are available. IL-1β

plays a crucial role in the inflammatory cascade underlying HS,

contributing to tissue damage, inflammation, and disease

progression. Given the involvement of IL-1β in the inflammatory

process of HS, we believe therapies that target IL-1β offer a

potential treatment option for HS.

Forward-Looking Statements

This press release may include forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are statements that

are not historical facts. Such forward-looking statements are

subject to significant risks and uncertainties that are subject to

change based on various factors (many of which are beyond Avalo’s

control), which could cause actual results to differ from the

forward-looking statements. Such statements may include, without

limitation, statements with respect to Avalo’s plans, objectives,

projections, expectations and intentions and other statements

identified by words such as “projects,” “may,” “might,” “will,”

“could,” “would,” “should,” “continue,” “seeks,” “aims,”

“predicts,” “believes,” “expects,” “anticipates,” “estimates,”

“intends,” “plans,” “potential,” or similar expressions (including

their use in the negative), or by discussions of future matters

such as: drug development costs, timing of trials and trial results

and other risks, including reliance on investigators and enrollment

of patients in clinical trials; reliance on key personnel;

regulatory risks; integration of AVTX-009 into our operations;

general economic and market risks and uncertainties, including

those caused by the war in Ukraine and the Middle East; and those

other risks detailed in Avalo’s filings with the Securities and

Exchange Commission, available at www.sec.gov. Actual results may

differ from those set forth in the forward-looking statements.

Except as required by applicable law, Avalo expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in Avalo’s expectations with respect thereto or

any change in events, conditions or circumstances on which any

statement is based.

References1Patel ZS et al. Curr

Pain Headache Rep. 2017;21(12):49.2Egeberg A, et al. JAMA Dermatol

2016;152:429–343Phan K, et al Biomed Dermatol 2020; 4: 2-64Jfri, A,

et al. JAMA Dermatol. 2021;157(8):924-315Nguyen TV, et al. J Eur

Acad Dermatol Venereol. 2021;35(1):50-61

For media and investor inquiries

Christopher Sullivan, CFO Avalo Therapeutics,

Inc. ir@avalotx.com 410-803-6793

or

Chris BrinzeyICR

WestwickeChris.brinzey@westwicke.com 339-970-2843

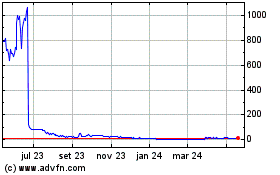

Avalo Therapeutics (NASDAQ:AVTX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

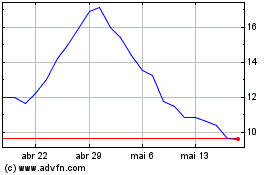

Avalo Therapeutics (NASDAQ:AVTX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025