The board of trustees (the “Board”) of Advent Convertible and

Income Fund (NYSE: AVK) (the “Fund”) has approved the terms of the

issuance of transferable rights (“Rights”) to the holders of the

Fund’s common shares (the “Common Shareholders”) of beneficial

interest, par value $0.001 per share (“Common Shares”), as of the

record date, entitling the holders of those Rights to subscribe for

Common Shares (the “Offer”). The Board, based on the

recommendations and presentations of the Fund’s investment adviser,

Advent Capital Management, LLC (“Advent” or the “Adviser”), and

others, has determined that it is in the best interests of the Fund

and the Common Shareholders to conduct the Offer and thereby to

increase the assets of the Fund available for investment. In making

this determination, the Board considered a number of factors,

including potential benefits and costs. In particular, the Board

considered the Adviser’s belief that the Offer would enable the

Fund to take advantage of existing and future investment

opportunities for convertible securities and non-convertible income

producing securities that may be or may become available,

consistent with the Fund’s investment objective of providing total

return through a combination of capital appreciation and current

income. The Offer also seeks to provide an opportunity to existing

Common Shareholders to purchase Common Shares at a discount to

market price (subject to a sales load).

The record date for the Offer is currently expected to be

September 20, 2024 (the “Record Date”). The Fund will distribute to

Common Shareholders on the Record Date (“Record Date Common

Shareholders”) one Right for each Common Share held on the Record

Date. Common Shareholders will be entitled to purchase one new

Common Share for every three Rights held (1 for 3); however, any

Record Date Common Shareholder who owns fewer than three Common

Shares as of the Record Date will be entitled to subscribe for one

Common Share. Fractional Common Shares will not be issued.

The proposed subscription period will commence on the Record

Date and is currently anticipated to expire on October 17, 2024,

unless extended by the Fund (the “Expiration Date”). Rights may be

exercised at any time during the subscription period. The Rights

are transferable and are expected to be admitted for trading on the

New York Stock Exchange LLC (the “NYSE”) under the symbol “AVK RT”

during the course of the Offer.

The subscription price per Common Share (the “Subscription

Price”) will be determined on the Expiration Date, and will be

equal to 92.5% of the average of the last reported sales price of a

Common Share of the Fund on the NYSE on the Expiration Date and

each of the four (4) immediately preceding trading days (the

“Formula Price”). If, however, the Formula Price is less than 90%

of the Fund’s net asset value per Common Share at the close of

trading on the NYSE on the Expiration Date, the Subscription Price

will be 90% of the Fund’s net asset value per Common Share at the

close of trading on the NYSE on that day. The estimated

Subscription Price has not yet been determined by the Fund.

Record Date Common Shareholders who exercise all of their

primary subscription Rights will be eligible for an

over-subscription privilege entitling Record Date Common

Shareholders to subscribe, subject to certain limitations and

allotment, for any additional Common Shares not purchased pursuant

to the primary subscription.

The Fund has previously declared a regular September monthly

distribution to Common Shareholders payable on September 30, 2024

with a record date of September 13, 2024, which will not be payable

with respect to Common Shares issued pursuant to the Offer.

The Offer will be made only by means of a prospectus supplement

and accompanying prospectus. The Fund expects to mail subscription

certificates evidencing the Rights and a copy of the prospectus

supplement and accompanying prospectus for the Offer to Record Date

Common Shareholders within the United States shortly following the

Record Date. To exercise their Rights, Common Shareholders who hold

their Common Shares through a broker, custodian or trust company

should contact such entity to forward their instructions to either

exercise or sell their Rights on their behalf. Common Shareholders

who do not hold Common Shares through a broker, custodian, or trust

company should forward their instructions to either exercise or

sell their Rights by completing the subscription certificate and

delivering it to the subscription agent for the Offer, together

with their payment, at one of the locations indicated on the

subscription certificate or in the prospectus supplement.

The Fund will pay expenses associated with the Offer which will

be borne indirectly by the Fund’s Common Shareholders.

The Fund reserves the right to modify, postpone or cancel the

rights offering.

Declaration of October Distribution

The Fund announced today that the Fund had declared its regular

monthly distribution for October in an amount of $0.1172 per

share.

The following dates apply to the distribution:

|

|

|

| Record Date: |

October 1, 2024 |

| |

|

| Ex-Dividend Date: |

October 1, 2024 |

| |

|

| Payable Date: |

October 31, 2024 |

| |

|

A portion of this distribution is estimated to be a return of

capital rather than income. Final determination of the character of

distributions will be made at year-end. The Section 19(a) notice

referenced below provides more information and can be found at

www.guggenheiminvestments.com.

You should not draw any conclusions about the Fund’s investment

performance from the amount of this distribution or from the terms

of the Fund’s Distribution Policy.

Past performance is not indicative of future performance. As of

this announcement, the sources of each fund distribution are

estimates. Distributions may be paid from sources of income other

than ordinary income, such as short-term capital gains, long-term

capital gains or return of capital. Unless otherwise noted, the

distributions above are not anticipated to include a return of

capital. If a distribution consists of something other than

ordinary income, a Section 19(a) notice detailing the anticipated

source(s) of the distribution will be made available. The Section

19(a) notice will be posted to a Fund’s website and to the

Depository Trust & Clearing Corporation so that brokers can

distribute such notices to Shareholders of the Fund. Section 19(a)

notices are provided for informational purposes only and not for

tax reporting purposes. The final determination of the source and

tax characteristics of all distributions will be made after the end

of the year. This information is not legal or tax advice. Consult a

professional regarding your specific legal or tax matters.

The October distribution will not be payable with respect to

Common Shares issued pursuant to the Offer after the record date

for the October distribution.

The information herein is not complete and is subject to

change. A registration statement relating to these securities has

been filed with the SEC but has not yet become effective. The

securities may not be sold nor may offers to buy be accepted prior

to the time the registration statement becomes

effective.

This document is not an offer to sell any securities and

is not soliciting an offer to buy any securities in any

jurisdiction where the offer or sale is not permitted. This

document is not an offering, which can only be made by a prospectus

supplement and accompanying prospectus, once the registration

statement has become effective. Investors should consider the

Fund’s investment objectives, risks, charges and expenses carefully

before investing. The Fund’s prospectus supplement and accompanying

prospectus, when available, will contain this and additional

information about the Fund and additional information about the

Offer, and should be read carefully before investing. For further

information regarding the Offer, or to obtain a prospectus

supplement and the accompanying prospectus, when available, please

contact the Fund’s information agent:

EQ Fund Solutions, LLC55 Challenger

Road, Suite 201Ridgefield Park, New Jersey

07660(866) 342-1635

Additional Information About the Fund

The Fund is a diversified, closed-end management investment

company with an investment objective of providing total return

through a combination of capital appreciation and current income.

The Fund seeks to achieve its investment objective by investing,

under normal market conditions, at least 80% of its net assets,

plus any borrowings for investment purposes, in a diversified

portfolio of convertible securities and non-convertible income

producing securities. The Fund’s shares are traded on the New York

Stock Exchange under the symbol “AVK.”

About Advent Capital Management, LLC

Advent is an SEC-registered investment adviser headquartered in

New York, NY. Advent’s investment discipline emphasizes capital

structure research, encompassing equity fundamentals as well as

credit research, with a focus on cash flow and asset values while

seeking to maximize total return.

About Guggenheim Investments

Guggenheim Investments includes Guggenheim Funds Distributors,

LLC (the servicing agent for the Fund). Advent Capital Management,

LLC serves as Adviser for the Fund and is not affiliated with

Guggenheim.

IMPORTANT INFORMATION

This press release contains certain statements that may include

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical fact, included herein are “forward-looking statements.”

Although the Fund and the Adviser believe that the expectations

reflected in these forward-looking statements are reasonable, they

do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. Actual results could differ

materially from those anticipated in these forward-looking

statements as a result of a variety of factors, including those

discussed in the company's reports that are filed with the

Securities and Exchange Commission. You should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. Other than as required by law,

the Fund and the Adviser do not assume a duty to update this

forward-looking statement.

Contact:

William T. Korver

cefs@guggenheiminvestments.com

|

|

|

|

|

NOT FDIC INSURED |

NO BANK GUARANTEE |

MAY LOSE VALUE |

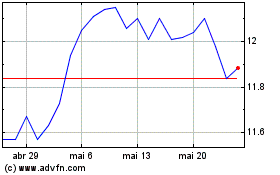

Advent Convertible and I... (NYSE:AVK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Advent Convertible and I... (NYSE:AVK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025