Ascot Resources Ltd. (TSX: AOT; OTCQX: AOTVF)

(“

Ascot” or the “

Company”)

As previously disclosed, the Company’s brokered

private placement was upsized to C$42 million instead of the

originally announced range of C$25-C$35 million. As a result of the

upsize, the Company was able to reduce the size of the proposed

senior debt financing to US$7.5 million instead of the original

US$11.25 million previously disclosed.

Ascot is pleased to announce that it has entered

into a non-binding indicative term sheet with Sprott Private

Resource Streaming and Royalty (B) Corp,

(“Sprott”), the Company‘s largest secured

creditor, to provide US$7.5 million of financing by way of an

amendment to the terms of one of its existing stream agreements

between Sprott, Ascot and certain of Ascot’s subsidiaries. In

addition, the Company and Nebari (as defined below) have made

certain amendments to the non-binding indicative term sheet that

was described in the Prior Announcements (as defined below).

The Company previously announced a funding

package comprised of a brokered private placement and amendments to

existing agreements with its secured creditors to provide funding

to advance the development of the Premier Northern Lights mine

(“PNL”), restart the mill and restart the Big

Missouri mine (“BM”) from the current state of

temporary care & maintenance. Please refer to the press release

titled “Ascot Provides an Update on Funding for Future Mine

Development & Restart of Operations” dated October 21, 2024 and

the press release titled “Ascot Announces Upsize Of Previously

Announced Equity Financing” dated October 22, 2024 (together, the

“Prior Announcements”). Capitalized terms used in

this press release but not otherwise defined have the meaning set

out in the Prior Announcements.

During negotiations with the Secured Creditors

in respect of the Debt Financing described in the Prior

Announcements, the Company determined that certain conditions would

be costly and difficult to achieve. The Company has proposed

amendments to the terms of the Debt Financing (the “Amended

Debt Financing”) in order to increase Ascot’s likelihood

of satisfying certain conditions precedent. As previously disclosed

in the Prior Announcements, as part of the Amended Debt Financing,

the Secured Creditors would extend their existing waiver and

forbearance conditions until May 31, 2025.

The Amended Debt Financing remains subject to

receipt of necessary regulatory approvals and exemptions, which may

not be received. The Company has not yet received any funding from

the Amended Debt Financing and the Amended Debt Financing remains

subject to several conditions which may not be satisfied or waived.

There is no certainty that Ascot will be able to complete the

Amended Debt Financing and accomplish the objectives described in

the Prior Announcements.

The Amended Debt Financing is conditional on

certain conditions precedent required by the Secured Creditors,

including the completion of the Equity Financing for a minimum

amount of approximately C$30 million, successful negotiation and

execution of definitive agreements and the receipt of the necessary

TSX approvals and exemptions.

The execution of definitive agreements in

respect of the Amended Debt Financing and the closing of the Equity

Financing are still expected to occur on or about November 18,

2024.

The Amended Debt Financing is expected to have

the following terms and conditions, among others, with the final

terms and conditions to be contained in the definitive agreements

for the Amended Debt Financing:

In respect of Sprott:

- The existing

stream agreement between Sprott and the Company referred to as

“Purchase and Sale Agreement #1” for an initial deposit amount of

US$110 million, will be amended to, among other things: (i) provide

an additional US$7.5 million to advance to Ascot (the

“Additional Stream Amount”); and (ii) grant an

additional gold and silver stream percentage to Sprott of 0.50% of

all payable gold and 6.80% of all payable silver (or silver

equivalent) until the Premier (as defined below) and Red Mountain

Projects has delivered 8,600 ounces of gold to Sprott, at which

time such additional stream percentages shall each be reduced by

50%.

- On or before

December 31, 2026, Ascot has the right to repurchase (and

eliminate) the Additional Stream Amount for US$9.7 million on or

before December 31, 2026.

- If Ascot does

not exercise its repurchase right, Sprott has a right to require

Ascot to repurchase (and eliminate) the Additional Stream Amount

for a 12 month period commencing on January 1, 2027.

- The Amended Debt

Financing shall be pari passu with the current stream

security.

- The proceeds

from the Amended Debt Financing will be deposited into an escrow

account and released in stages following the satisfaction of

certain key performance indicators and receipt of any regulatory

approvals or non-appealable court orders, to the extent required,

to establish the seniority of stream.

- Subject to TSX

approval, an alignment fee equal to US$112,500 to be paid in Common

Shares upon draw down of funds from escrow with an issue price

equal to the market price.

In respect of Nebari Gold Fund 1, LP, Nebari

Natural Resources Credit Fund II, LP and Nebari Collateral Agent

LLC (collectively, “Nebari”), in consideration for

the waiver and forbearance by Nebari of the COF and the CD:

- The terms of the

COF will be amended as follows:

- Interest shall

be increased from 10.0% to 10.5% above SOFR.

- All interest and

amortisation payments due under the COF from September 2024 until

May 31, 2025 shall be deferred and capitalized as part of the

outstanding principal of (the “Deferred

Payments”).

- Commencing on

May 31, 2025, the Deferred Payments shall be payable in 10 monthly

instalments ending in Feb 2026, which payments shall be in addition

to any regular interest payments being met.

- Subject to TSX

approval, an alignment fee equal to US$1 million to be paid in

Common Shares on execution of definitive agreements at the Offer

Price.

- Subject to TSX approval, the

exercise price of the existing warrants held by Nebari will be

amended to C$0.192 per Common Share (representing a 20% premium to

the Offer Price).

- The terms of the

CD be amended as follows:

- All interest

payments payable during the period from September 2024 to May 2025

to be deferred and capitalized as part of the outstanding

principal, consistent with the terms of the COF.

- All capitalised

interest from the period September 2024 until May 31, 2025 to be

payable quarterly over the following 4 quarters, from May 2025 to

February 2026 (in addition to regular interest payments owing)

- Subject to TSX

approval, the conversion price to be amended to C$0.192 per Common

Share (representing a 20% premium to the Offer Price), and the

forced conversion option for Ascot to be removed.

- The CD continues

to be promoted into the senior position upon repayment of the

COF.

Equity Financing

Except for the amendments described above as

they relate to the Amended Debt Financing, the terms and conditions

of the Equity Financing have not been amended and the Equity

Financing remains conditional on (i) the execution of all necessary

definitive agreements in respect of the Amended Debt Financing,

(ii) the deposit of the proceeds of the Amended Debt Financing into

an escrow account and (iii) receipt of all necessary TSX approvals

and exemptions (which for clarity have not yet been received). The

Equity Financing is also conditional upon the Company not being

required to obtain any shareholder approvals in respect of the

Equity Financing (whether by way of exemption by the TSX or

otherwise).

Use of Funding

The net proceeds from the Amended Debt Financing

and the Equity Financing are expected to be used for the

development of PNL, the mill and BM.

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.

“Derek C. White”

President & CEO, Director

For further information

contact:

Kristina Howe

VP, Communications khowe@ascotgold.com

778-725-1060 ext. 1019

About Ascot

Ascot is a Canadian mining company headquartered

in Vancouver, British Columbia and its shares trade on the TSX

under the ticker AOT and on the OTCQX under the ticker AOTVF. Ascot

is the 100% owner of the Premier Gold Mine

(“Premier”), which poured first gold in April 2024

and is located on Nisga’a Nation Treaty Lands, in the prolific

Golden Triangle of northwestern British Columbia.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements").

Forward-looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "believe", "plan",

"estimate", "expect", "targeted", "outlook", "on track" and

"intend" and statements that an event or result "may", "will",

"should", "could", “would” or "might" occur or be achieved and

other similar expressions. All statements, other than statements of

historical fact, included herein are forward-looking statements,

including statements in respect of the terms and conditions of the

Amended Debt Financing or the Equity Financing, the ability to

raise additional funds, the completion of the Amended Debt

Financing or the Equity Financing, the future performance, defaults

and obligations of Ascot under agreements with the Secured

Creditors; the anticipated use of proceeds from the funding package

and the ability of the Company to accomplish its business

objectives and the intentions described herein; and future plans,

development and operations of the Company. These statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in such forward-looking statements, including risks

related to whether the Equity Financing and/or Amended Debt

Financing will be completed on the terms described or at all; the

need for future waivers or forbearance agreements from the Secured

Creditors; business and economic conditions in the mining industry

generally; fluctuations in commodity prices and currency exchange

rates; uncertainty of estimates and projections relating to

development, production, costs and expenses, and health, safety and

environmental risks; uncertainties relating to interpretation of

drill results and the geology, continuity and grade of mineral

deposits; the need for cooperation of government agencies and

indigenous groups in the exploration and development of Ascot’s

properties and the issuance of required permits; the need to obtain

additional financing to finance operations and uncertainty as to

the availability and terms of future financing; the possibility of

delay in future plans and uncertainty of meeting anticipated

program milestones; uncertainty as to timely availability of

permits and other governmental approvals; the need for TSX

approval, including pursuant to financial hardship exemptions, and

other regulatory approvals and other risk factors as detailed from

time to time in Ascot's filings with Canadian securities

regulators, available on Ascot's profile on SEDAR+ at

www.sedarplus.ca including the Annual Information Form of the

Company dated March 25, 2024 in the section entitled "Risk

Factors". Forward-looking statements are based on assumptions made

with regard to: the estimated costs associated with the care and

maintenance plans; the ability to maintain throughput and

production levels at BM and PNL; the tax rate applicable to the

Company; future commodity prices; the grade of mineral resources

and mineral reserves; the ability of the Company to convert

inferred mineral resources to other categories; the ability of the

Company to reduce mining dilution; the ability to reduce capital

costs; the ability of the Company to raise additional financing;

compliance with the covenants in Ascot’s credit agreements; and

exploration plans. Forward-looking statements are based on

estimates and opinions of management at the date the statements are

made. Although Ascot believes that the expectations reflected in

such forward-looking statements and/or information are reasonable,

undue reliance should not be placed on forward-looking statements

since Ascot can give no assurance that such expectations will prove

to be correct. Ascot does not undertake any obligation to update

forward-looking statements, other than as required by applicable

laws. The forward-looking information contained in this news

release is expressly qualified by this cautionary statement.

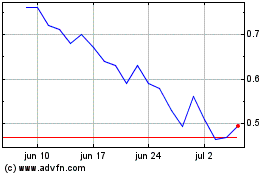

Ascot Resources (TSX:AOT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Ascot Resources (TSX:AOT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025