Daktronics Comments on Presentation and Public Statements from Alta Fox

11 Dezembro 2024 - 10:40AM

Daktronics, Inc. (“Daktronics” or the “Company”) (NASDAQ-DAKT), the

leading U.S.-based designer and manufacturer of best-in-class

dynamic video communication displays and control systems for

customers worldwide, today issued the following statement regarding

the recent press release and public comments from Alta Fox Capital

Management, LLC (together with its affiliates, “Alta Fox”):

In May 2023, after a competitive

process with several potential financing providers, we sold $25

million of convertible debt to Alta Fox. At that time, Alta Fox

stated on social media that Daktronics’ stock “could triple” to

approximately $16.23 per share.1

Since then, we have engaged

extensively and in good faith with Alta Fox, including recently

regarding Alta Fox’s desire to accelerate the Company’s repayment

of this twenty-month-old convertible debt. In its most recent

proposal, Alta Fox demanded that the Company retire the convertible

debt at a price more than three times its face value and nearly 50%

above its fair value.2 On behalf of our shareholders and following

consultation with its investment bankers, the Board rejected Alta

Fox’s proposal as too costly to common shareholders, and it stands

by that decision.

Alta Fox then tried to intimidate the

Board by threatening to initiate specious litigation on three

separate matters, call a special meeting of shareholders, and

nominate candidates to replace directors at the Company’s 2025

annual meeting of shareholders if the Board did not accept Alta

Fox’s buyout terms on the convertible note.

Recognizing that those threats would

not convince the Board to repurchase Alta Fox’s debt at an

unreasonable price, Alta Fox has now issued a press release and

presentation rife with innuendo and misleading statements. Alta

Fox’s public communications yesterday are also concerning because

they fail to disclose that Alta Fox has been seeking to secure an

economic windfall for itself as a creditor of Daktronics at the

expense of our common shareholders.

The Board recognizes and embraces its

role as fiduciaries and will not be pressured into a transaction

that is not in the best interests of the Company and its

shareholders. The Company has made a counterproposal to Alta Fox

that reflects the market value for Alta Fox’s convertible note and

remains willing to assist Alta Fox in gaining the liquidity it

desires at a price that is fair to both Alta Fox and our

shareholders. At the same time, the Company will remain focused on

its business transformation plan.

Notably, after significant

transformation efforts and record financial performance in Fiscal

Year 2024, Daktronics’ stock closed yesterday at a price of $19.24

per share, well above the price target Alta Fox itself set for the

stock in May 2023.

About Daktronics

Daktronics has strong leadership positions in, and is the

world's largest supplier of, large-screen video displays,

electronic scoreboards, LED text and graphics displays, and related

control systems. The Company excels in the control of display

systems, including those that require integration of multiple

complex displays showing real-time information, graphics,

animation, and video. Daktronics designs, manufactures, markets and

services display systems for customers around the world in four

domestic business units: Live Events, Commercial, High School Park

and Recreation, and Transportation, and one International business

unit. For more information, visit the company's website at:

www.daktronics.com.

Safe Harbor Statement

Cautionary Notice: In addition to statements of historical fact,

this news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 and

is intended to enjoy the protection of that Act. These

forward-looking statements reflect the Company's expectations or

beliefs concerning future events. The Company cautions that these

and similar statements involve risk and uncertainties which could

cause actual results to differ materially from our expectations,

including, but not limited to, changes in economic and market

conditions, management of growth, timing and magnitude of future

contracts and orders, fluctuations in margins, the introduction of

new products and technology, the impact of adverse weather

conditions, increased regulation, and other risks described in the

company's SEC filings, including its Annual Report on Form 10-K for

its 2024 fiscal year. Forward-looking statements are made in the

context of information available as of the date stated. The Company

undertakes no obligation to update or revise such statements to

reflect new circumstances or unanticipated events as they

occur.

For more information contact:

INVESTOR RELATIONS:Sheila M. Anderson, Chief Financial

OfficerTel (605) 692-0200Investor@daktronics.com

Alliance Advisors IR Carolyn Capaccio / Jody Burfening

DAKTIRTeam@lhai.com

______________

1 Alta Fox May 12, 2023, post on X2 The convertible note is

carried on Daktronics’ balance sheet at a fair value of $52.8

million as of October 26, 2024. See Daktronics Form 10-Q for period

ended October 26, 2024, for additional details.

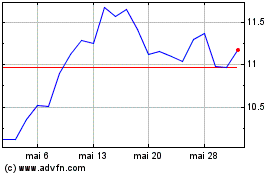

Daktronics (NASDAQ:DAKT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Daktronics (NASDAQ:DAKT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025