US index futures were higher in premarket trading on Wednesday,

moving to recover from recent losses as investors digested the tax

cut on banks in Italy and data in China.

By 6:42 AM, Dow Jones futures (DOWI:DJI) were up 62 points, or

0.18%. S&P 500 futures and Nasdaq-100 futures were up

0.25% each. The 10-year Treasury yield is at 4.032%.

On Wednesday’s economic agenda, investors will follow, at 10:30

am, the release of EIA’s weekly oil inventory, with the market

projecting a reduction of 233 thousand barrels. Yesterday, API

data showed an inventory build of 4.06 million barrels of oil for

the week. At 1 pm, the government holds the ten-year Treasury

auction. Yesterday, the US Treasury placed US$42 billion in

the three-year event, with a cut rate of 4.398%.

In Europe, markets are digesting the recovery of bank shares in

Italy, as they fell sharply yesterday after the local government

announced a tax on income that could represent around

19%. Today, however, the government backtracked and said the

tax will be capped at 0.1%, according to agencies.

In Asia, markets closed with no clear direction, with investors

analyzing the inflation data in China, as measured by the consumer

price index, which rose 0.20% in July month-on-month – above the

consensus of -0.10% – and by the producer price index, which had a

retraction of 0.30% on the same basis of comparison – also above

the consensus of -0.40%.

In commodities markets, West Texas Intermediate crude for

September was up 0.83% to trade at $83.61 a barrel. Brent

crude for October was up 0.77% near $86.83 a barrel. Iron ore

futures traded in Dalian, China rose 0.07% to $100.19 a tonne,

showing some recovery from losses in recent days.

At Tuesday’s close, world markets faced declines due to economic

uncertainties and instabilities in the financial

system. Financial stocks in the US took the brunt especially

after Moody’s downgraded US banks. The Dow Jones dropped 0.45%

at 35,314.49 points. The S&P 500 fell 0.42% to 4,499.38

points. The Nasdaq Composite ended down 110.07 points or 0.79%

at 13,884.32 points.

Contributing to the decline, Italy announced a tax on bank

earnings. In the commodities sector, unfavorable Chinese trade

data influenced negatively, marking the worst drop in exports since

February 2020. The value of oil reestablished itself amid Ukrainian

tensions. Federal Reserve remarks were also analyzed in light

of an impending inflation report. Patrick Harker, president of

the Fed Bank of Philadelphia, mentioned the chance of pausing rate

hikes, while Thomas Barkin of Richmond thought it was premature to

discuss a possible hike in September.

Ahead of Wednesday’s corporate results, traders are awaiting

reports from Roblox (NYSE:RBLX), Sony , Wendy’s (NASDAQ:WEN), Nuvei

(NASDAQ:NVEI), ahead of market opening. After the market

closes, reports are expected from Walt Disney (NYSE:DIS),

TheTradeDesk (NASDAQ:TTD), Wynn Resorts (NASDAQ:WYNN), Sonos

(NASDAQ:SONO), among others.

Wall Street Corporate Highlights for Today

Amazon (NASDAQ:AMZN) – Reuters reported

that Amazon is in talks as a key investor in SoftBank

Group’s Arm Ltd (USOTC:SFTBY) ahead of the IPO,

underlining Arm’s importance in cloud computing. AWS

manufactures its own processing chip called Graviton, using Arm’s

design. Arm is seeking to raise between $8 billion to $10

billion and is in talks

with Intel, Alphabet (NASDAQ:GOOGL, Nvidia (NASDAQ:NVDA), Apple (NASDAQ:AAPL)

and Samsung Electronics (USOTC:SSNHZ). The IPO will strengthen

Arm and help SoftBank recover its Vision Fund. After the

failed sale to Nvidia, Arm prospered, focusing on higher royalty

servers and PCs.

Alphabet (NASDAQ:GOOGL) – A US judge has

rejected Google’s attempt to dismiss a lawsuit for invasion of

privacy by secretly tracking the internet usage of

millions. Judge Yvonne Gonzalez Rogers stated that there was

no explicit consent. $5 billion class action continues in

defense of privacy.

Zoom Video Communications (NASDAQ:ZM) –

Zoom Video, a former work-from-home favorite, is now taking a

hybrid approach, calling employees back to the office twice a

week. While many companies opt for more in-person presence,

Zoom believes this balance is most effective in driving innovation

and global support. After success during the pandemic, the

company is looking to expand its software toolset, while facing

post-pandemic challenges and changing work trends.

Taiwan Semiconductor

Manufacturing (NYSE:TSM) – TSMC’s $3.83 billion

investment in Germany promotes a closer relationship between Taiwan

and Europe, offering political advantages. Faced with pressure

from China, the investment signals Taiwan’s goodwill towards

Europe. The investment will also strengthen bilateral

relations as TSMC expands globally with factories in the US and

Japan. Taiwan seeks continued cooperation in semiconductors,

awaiting progress on a bilateral investment agreement with the

European Union.

Nvidia (NASDAQ:NVDA) – Nvidia has released

the enhanced version of the Grace Hopper Superchip AI chip,

providing increased high-bandwidth memory to power generative AI

applications such as ChatGPT. This will allow larger AI models

to work without interconnecting multiple systems, improving GPU

performance. The new configuration will be available in the

second quarter of next year.

WeWork (NYSE:WE) – WeWork faces doubts

about its operational continuity, with three board members stepping

down and its shares falling more than 16% in Wednesday’s

premarket. The company warned of the need for additional

capital in the next 12 months. Despite past efforts to

restructure debt, the departure of top executives and the search

for a new CEO persist.

Dell Technologies (NYSE:DELL) – Dell

Technologies stock got a boost amid a challenging day for

technology stocks following a positive review from Morgan

Stanley. Analyst Erik Woodring pointed out that the company is

gaining prominence in the server market for generative artificial

intelligence applications. While there are constraints on

Nvidia’s supply of GPUs, Woodring sees potential for Dell to add up

to $7 billion in revenue and improve its bottom line by 4-5%,

driven by AI servers.

Walt Disney (NYSE:DIS) – Disney has

created a team to explore artificial intelligence in its

entertainment empire, despite resistance from Hollywood

professionals. The group, formed before the writers’ strike,

aims to develop AI applications internally and seek partnerships

with startups. The company currently has 11 openings that

require AI experience. Technology is seen as a way to control

production costs and improve park experiences. Disney has a

long history of technological innovation, including advances in

mixed reality and animation. AI is also a hot topic in

Hollywood.

Penn Entertainment (NASDAQ:PENN)

– Disney-owned ESPN and casino owner Penn Entertainment

will join forces to create ESPN Bet, a sports betting

business. Penn will pay ESPN $1.5 billion in cash and about

$500 million in stock for rights and promotion. The ESPN Bet

brand will be adopted in legalized states where Penn operates.

Piedmont Lithium (NASDAQ:PLL) – Piedmont

Lithium faced resistance in a meeting with North Carolina officials

over its proposed lithium mine for

Tesla (NASDAQ:TSLA). The project, more

than two years on hold, has divided the community, addressing the

tension between local resistance and the US quest for independence

from Chinese minerals. While the company has expressed

openness to helping affected neighbors, the lack of details shared

has raised concerns in the community.

Boeing (NYSE:BA) – In July, Boeing

delivered fewer aircraft than Airbus due to logistical challenges

and supply chain disruptions, particularly affecting the 737 MAX

jet. 737 MAX deliveries have dropped to 32 due to support and

supply issues. Boeing plans to increase production, but

foresees continued challenges. Boeing’s 2023 gross orders

total 579. In other news, Boeing said that Brazil, already a world

leader in biofuels, can play an important role in supplying

sustainable aviation fuel (SAF). With vast agricultural

capacity, the country is well positioned to help decarbonize

aviation as the industry aims to achieve net zero emissions by

2050. IATA estimates that SAFs could encompass 65% of efforts to

meet the target. Gol (NYSE:GOL), a

Brazilian airline, sees the provision of SAF as an urgent challenge

to achieve this goal.

Ferrari (NYSE:RACE) – Chinese women make

up 26% of Ferrari sales in China over the past five years,

outpacing other nations. The trend is driven by training

events and social media as Ferrari capitalizes on rising demand in

the post-pandemic Chinese luxury market.

Stellantis (NYSE:STLA) – United Auto Workers

(UAW) union leader Shawn Fain has rejected Stellantis’ proposals,

criticizing excessive concessions. The suggestions involve

cuts in health care, vacations for new hires and 401(k)

contributions. Stellantis’ quest for cutbacks is driven by the

electric transition. Current contracts expire in

September. In other news, US auto safety regulators are

investigating whether 1.1 million older Ram 1500 pickup trucks need

to be recalled due to power steering issues. In addition, the

Italian government plans to agree a broad plan for the automotive

industry until 2030, with Stellantis and other groups by the end of

2023. The proposal seeks to increase vehicle production to one

million per year, involving discussions on production, R&D,

labor costs, energy and sustainability.

Ford (NYSE:F), BYD (USOTC:BYDDY)

– Ford’s factory in Brazil, closed two years ago, could be revived

by Chinese electric vehicle maker BYD. BYD’s proposed

reactivation of Camaçari illustrates Brazilian President Lula’s

strategy of attracting Chinese investment to boost industry and

jobs, differing from the US approach.

Yellow Corp (NASDAQ:YELL) – The sale of

Yellow’s assets is attracting significant bidders, possibly

surpassing the $1.4 billion secured debt. Shareholders can get

paid if no significant unsecured debt creditors arise, according to

Fox Business. The trucking company filed for Chapter 11

bankruptcy on Monday. The International Brotherhood of

Teamsters union called for reforms to US bankruptcy laws after

Yellow’s bankruptcy, seeking to protect workers. The union

argues that 22,000 members have been left unemployed despite

concessions. The proposed legislation would prioritize work

and retirement arrangements.

Novo Nordisk (NYSE:NVO) – Novo Nordisk,

maker of Wegovy, revealed that an extensive study highlighted the

cardiovascular benefits of the highly effective obesity

treatment. This gave the Danish company a boost, reinforcing

its image beyond just a lifestyle drug. The popular Wegovy has

raised Novo Nordisk’s hopes for greater coverage and

acceptance. Test results could influence insurers and health

authorities to roll out the cost of Wegovy to a wider audience.

Emergent BioSolutions (NYSE:EBS) – Shares

of Emergent BioSolutions are down more than 4% in premarket

Wednesday after the company opted to eliminate 400 jobs and reduce

activity at some facilities, focusing on core products such as

Narcan nasal spray and anthrax vaccines. The restructuring

aims to move out of contract drug development and save more than

$100 million annually.

Carlyle Group (NASDAQ:CG) – The Carlyle

Group will acquire a minority stake in Quest Global Services,

valuing it at $2 billion. The transaction involves the

departure of investors Bain

Capital (NYSE:BCSF) and Advent International, with

the repurchase of shares by Quest Global. Carlyle will use its

own and bank financing.

KKR (NYSE:KKR), Synovus

Financial (NYSE:SNV) – KKR acquired a premium

automotive loan portfolio from Synovus Bank worth $373

million. The investment aligns with KKR’s asset

strategy. Regional banks are selling loan portfolios to reduce

risk and improve liquidity, following the sectoral

crisis. Ares Management (NYSE:ARES)

also closed a similar deal in June.

Earnings

Rivian (NASDAQ:RIVN) – Rivian Automotive has

raised its annual production projections and said it has sufficient

funding through 2025, underlining its cost control. Demand for

its electric pickup trucks and SUVs holds, setting it apart from

smaller competitors that have faced recent bankruptcies. In

the second quarter, the company generated revenue of $1.12 billion,

beating Wall Street estimates of $1 billion according to Refinitiv

data. Rivian posted a smaller quarterly loss. In

addition, it delivered 12,640 vehicles between April and June,

exceeding analysts’ estimates of 11,000 units. CEO RJ Scaringe

indicated a solid financial position, despite the reduction of the

cash balance to $9.26 billion. The company seeks to reduce

dependence on suppliers, while keeping an eye on supply chain

challenges.

Hond Motor (NYSE:HMC) – Honda Motor

announced a quarterly profit increase of 78%, driven by US sales

and the weaker yen. Operating profit reached $2.76 billion in

the three months through June, beating expectations.

Sony (NYSE:SONY) – Sony reported a drop in

first-quarter profit due to weaker performances in its financials

and film divisions. Operating profit fell 31% to $1.8 billion,

in line with estimates. The film division suffered a

two-thirds decline due to lower sales of television content and

higher marketing costs for additional film releases. Sony has

been focusing on entertainment and is also a leader in image

sensors, seeking a partial spin-off in the financial unit and

predicting record sales of PlayStation 5 consoles.

Bumble (NASDAQ:BMBL) – Bumble forecast

weak quarterly revenue due to competition from Match

Group (NASDAQ:MTCH), which owns Tinder. Bumble’s

operating costs increased by more than 7%, reflecting investments

in development and marketing. Second-quarter revenue grew

23.4% to $208 million. Third-quarter revenue was projected

between $274 million and $280 million. Total paying users

increased to 3.6 million.

Lyft (NASDAQ:LYFT) – Lyft indicated a

competitive price doubling to

rival Uber (NYSE:UBER), negatively

impacting equities. The competitive pricing strategy reduced

Lyft’s revenue per active user by 5%. CEO David Risher

envisions profitability through the end of 2023. Second-quarter

revenue was $1.02 billion, with adjusted EBITDA of $41

million. On an adjusted basis, it earned 16 cents per share,

compared to an estimated loss of 1 cent. The company plans to

eliminate primetime pricing for a more consistent structure.

Upstart Holdings (NASDAQ:UPST) – Upstart

suffered an 18.1% drop in pre-market trading due to a

lower-than-expectation earnings and revenue forecast for the third

quarter. The $140 million revenue forecast is below

expectations of $155.3 million, and adjusted pre-tax earnings came

in at $5 million, below the $9.6 million expected by analysts.

Doximity (NYSE:DOCS) – Doximity is down

25.9% premarket after announcing layoffs of 10% of its staff

(approximately 100 employees) and revising its 2024 revenue outlook

downwards to $452-468 million, compared to the previous estimate of

$500-506 million.

Akamai Technologies (NASDAQ:AKAM) – Akamai

Technologies beat estimates with second-quarter adjusted earnings,

driven by revenue of $936 million, up 4%. Adjusted earnings

were $1.49 per share, up 10% from a year ago and nine cents above

Wall Street estimates. Shares are flat premarket despite the

company expanding its focus into security software and cloud

computing.

Under Armor (NYSE:UAA) – Under Armor beat

first-quarter expectations with unexpected earnings and

better-than-expected sales due to discounting and lower cost

pressures. The discounting strategy helped maintain demand

despite lower gross margins. The company maintains its 2024

outlook. Quarterly revenue fell 2.4% to $1.32 billion, just above

analysts’ estimate of $1.30 billion. Earnings of 2 cents a

share for the quarter beat estimates of a loss of 2 cents a share,

according to Refinitiv data.

Marqeta (NASDAQ:MQ) – Marqeta reassured

investors by renewing its four-year contract with Block (SQ,

S2QU34), boosting its latest earnings. The deal extends the

partnership to power the Cash App debit card through June 2027,

sending Marqeta shares up 13.5% in Wednesday’s premarket. The

company also reported an increase in revenue, with a net loss of

$58.8 million and adjusted earnings before interest, taxes,

depreciation and amortization (EBITDA) of $824,000.

TakeTwo Interactive (NASDAQ:TTWO) –

Take-Two Interactive Software Inc revealed reduced results and

predictions, but highlighted the next iteration of “Grand Theft

Auto”. The company, known for franchises such as “Red Dead

Redemption” and “NBA2K”, predicts a quarterly loss of $1 to 90

cents a share, below estimates indicating the expectation for “GTA

VI”. Take-Two also posted a loss of $206 million in the first

fiscal quarter, but expects a tipping point in fiscal 2025.

Toast (NYSE:TOST) – Toast Inc. were

up 14.2% in premarket trading on Wednesday after the restaurant

tech company beat last-quarter revenue expectations and posted

positive free cash flow for the first time since its initial public

offering. Revenue increased to $978 million and the company

reported free cash flow of $39 million, driving sustainable

growth.

Super Micro Computer (NASDAQ:SMCI) –

Shares in Super Micro Computer were down 10.8% premarket due to the

lower-than-expected outlook. The AI-centric server company has

forecast increased spending to support artificial intelligence

technology. For the first quarter, it estimated adjusted

earnings of $2.75 to $3.50 on revenue of $1.9 billion to $2.2

billion. In the last quarter, Super Micro had beaten

expectations, buoyed by optimism in AI, with the stock rising 323%

in 2023.

Nextdoor Holdings (NYSE:KIND) – Local

social media-focused Nextdoor Holdings reported

better-than-expected financial results, reversing revenue declines

from the previous two quarters. With second-quarter revenue of

$57 million, up 4% from last year, and a net loss of $35.4 million,

the company beat analysts’ estimates. Nextdoor expects

positive revenue growth for the year, with improved adjusted EBITDA

margin and accelerated growth in the second half. Stocks are

stable in premarket trading.

IAC Inc (NASDAQ:IAC) – IAC reported

lower-than-expected financial results due to weak advertising sales

as it seeks recovery in its Dotdash Meredith and Angi segments of

the home repair services market. Second-quarter revenue was

$1.11 billion, down 18% year-over-year. Dotdash Meredith’s

revenue was down 15% and Angi was down 27%.

GlobalFoundries (NASDAQ:GFS) –

Second-quarter revenue reached $1.845 billion, near the top of the

company’s forecast range of $1.81 billion to $1.85 billion, but

down 7% year-over-year. Adjusted earnings of 53 cents a share

were also close to the forecast of 46 to 54 cents. Adjusted

Ebitda totaled $668 million, down 15% year-over-year. Silicon

wafer shipments were down 9% year-on-year. For the third

quarter, GlobalFoundries projects revenue of $1.825 billion to

$1.87 billion, on adjusted earnings of 46 to 54 cents a share,

below Wall Street expectations.

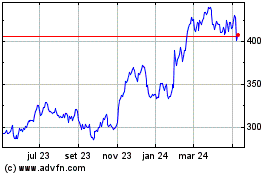

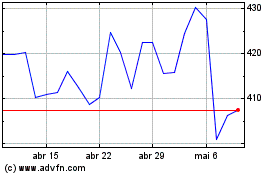

Ferrari NV (NYSE:RACE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Ferrari NV (NYSE:RACE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024