Deutsche Bank expands its operations in digital assets in

partnership with Taurus

Deutsche Bank (NYSE:DB) announced the integration of digital

asset custody and tokenization services from Swiss company

Taurus. This move expands the bank’s efforts in digital

assets, considering its previous initiatives such as applying for a

cryptocurrency custody license in Germany. Deutsche Bank’s

Paul Maley emphasized the growing importance of digital

assets. Previously, Deutsche Bank invested in Taurus’

financing round, strengthening ties with the sector.

Lido expands liquidity on Cosmos with stETH

Leading Ether (COIN:ETHUSD) staking company Lido will join

forces with Neutron and Axelar, two Cosmos innovators, to

incorporate their stETH (COIN:STETHUSD) tokens into the Cosmos

network. This move will potentially transfer significant

liquidity between blockchains. With net staking growing in

popularity, reaching a combined value of $16 billion, platforms

like Lido have allowed users to maximize their digital

assets. Once migrated, Lido’s stETH token can be leveraged on

multiple blockchains supported by Cosmos’ IBC technology.

Circle and Grab converge to expand the Web3 era in Southeast Asia

Circle announced a strategic partnership with Grab, the renowned

Southeast Asian super platform, to integrate Web3 experiences for

users in Singapore. This collaboration aims to enrich Grab’s

service offering and promote greater adoption of the blockchain

universe. The Grab Web3 Wallet will allow users to interact

with NFT rewards and vouchers. This advance coincides with

Singapore’s Project Orchid initiative and demonstrates the

country’s ambition to consolidate itself as an epicenter of

innovation in digital assets.

Bull Bitcoin expansion in Latin America

Bull Bitcoin, a Canadian-based Bitcoin exchange, has teamed up

with Costa Rican payments system SINPE Movil and crypto wallet

solution Bitcoin Jungle. The partnership allows Costa Ricans

and foreigners to convert the local currency, Colones, into Bitcoin

and vice versa. Users can also make bank account transactions

in Colones and US Dollars. This step marks the beginning of

Bull Bitcoin’s international expansion, with plans to reach one

billion people globally in the next 12 months.

Ramp Network integrates Pix

Ramp Network, a payments infrastructure company, incorporated

the Central Bank of Brazil’s Pix system to connect cryptocurrencies

and conventional finance. This addition reflects Ramp’s recent

expansion in Brazil, part of its broader strategy for Latin

America. Pix, used by more than 70% of Brazilians, was

launched by the Central Bank in 2021. This integration provides

Brazilians with an agile method to buy cryptocurrencies, following

the country’s growing presence in the crypto market.

Sui Network launches access to DApps with social login

Sui Network blockchain introduced zkLogin, which allows users to

access decentralized applications (DApps) using social media

credentials such as Facebook, Google and Twitch. This step is

intended to ease the transition for users from Web2 to Web3,

especially those unfamiliar with the nuances of web3. Greg

Siourounis from the Sui Foundation highlighted that zkLogin removes

barriers, making DApps more accessible. This tool uses

zero-knowledge proof technology, ensuring privacy and security, and

there are plans to expand it to Apple (NASDAQ:AAPL), Microsoft

(NASDAQ:MSFT), Amazon (NASDAQ:AMZN) and WeChat in the future.

Coinbase CEO Challenges CFTC Stance on DeFi Protocols

Coinbase (NASDAQ:COIN) CEO Brian Armstrong has appealed to the

U.S. Commodity Futures Trading Commission (CFTC), arguing against

enforcement actions targeting DeFi protocols. In a post on X,

Armstrong claims that the Commodity Exchange Act is unlikely to

apply to such protocols. This statement comes after the CFTC

filed charges against three DeFi protocols. While some defend

the CFTC as the ideal regulatory body for crypto, others believe

that its approach could be even more restrictive than that of

SEC.

Vitalik Buterin questions stability of support for cryptocurrencies

in Hong Kong

Vitalik Buterin, co-founder of Ethereum, warned cryptocurrency

projects considering Hong Kong as a base to assess the consistency

of long-term government support. At the Web3 Transitions

Summit in Singapore, Buterin expressed his uncertainty about the

relationship between Hong Kong and mainland China and questioned

the durability of Hong Kong’s current favorable environment for

cryptocurrencies. Despite Hong Kong’s recent openness to

crypto companies, Buterin sees a challenge in ensuring “stability

in friendship.” Separately, he praised the growth of developer

communities in Asia.

Bybit looks for ways to stay in the UK despite new rules

Cryptocurrency exchange Bybit is determined to maintain its

operations in the UK despite looming financial promotions rules

that have affected other companies in the sector. CEO Ben Zhou

reaffirmed the company’s commitment in a statement on Telegram,

contradicting previous rumors of a possible withdrawal. From

October 8th, the rules will require the registration of crypto

companies by the Financial Conduct Authority. While some

companies have already halted operations, Bybit is in discussions

with regulators, seeking full compliance.

MobileCoin reinforces global strategy with new CEO

MobileCoin, notorious for its crypto payments partnership with

Signal, has promoted its CTO, Sara Drakeley, to CEO. This move

aligns with the company’s objectives of improving its portfolio and

expanding its market presence. Having worked at SpaceX and

Disney Animation Studios, Drakeley is an enthusiast of instant and

cross-border payments. Under her leadership, MobileCoin aims

to explore markets in Latin America and Africa, and address gaps in

payments infrastructure. The company, backed by BlockTower

Capital and Coinbase Ventures, recently launched the Moby wallet,

popular in countries like Mexico and the Philippines.

Genesis ceases all business operations

Cryptocurrency trading firm Genesis, which was impacted by the

decline of Three Arrows Capital and FTX over the last year, has

ended all trading activities. Initially, news about the

closure of its US office emerged, but it has now been confirmed

that all international operations, including spot and derivatives

trading, have also been closed. Although Genesis’ lending

division filed for bankruptcy protection months ago, the business

side has remained intact until now. Previously, Genesis was a

major reference in the sector, serving institutional clients.

Case of costly error in Bitcoin transaction fee was committed by

Paxos

Paxos, a North American cryptographic services provider,

recently paid an exorbitant fee of around $500,000 for a

transaction of just $200 in Bitcoin (COIN:BTCUSD). The

company, responsible for several stablecoins, was initially

mistaken for a veteran Bitcoin user. She recognized the error

as due to a bug and tried to recover the amount with F2Pool, which

mined the block. Chun Wang, co-founder of F2Pool, expressed

regret for agreeing to return the amount.

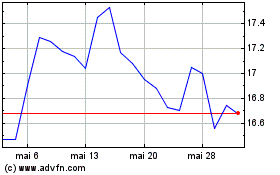

Deutsche Bank Aktiengese... (NYSE:DB)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Deutsche Bank Aktiengese... (NYSE:DB)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024