US index futures are appreciating in this Friday’s pre-market,

awaiting the release of activity data in the country. However, the

market is poised to conclude the week with notable declines,

reacting to signals from central banks that interest rates will

persistently stay elevated to curb inflation.

At 7:00 am, Dow Jones futures (DOWI:DJI) increased by 30 points,

or 0.08%. S&P 500 futures ascended 0.21%, and Nasdaq-100

futures went up 0.42%. The yield on the 10-year Treasury note was

at 4.486%.

In commodities, West Texas Intermediate crude for November

advanced 1.14% to $90.65 per barrel. Brent oil for November

elevated 0.92%, nearing US$94.13 per barrel. The iron ore with a

62% concentration grade rose 0.87%, quoted at US$119.36 per

ton.

On Friday’s U.S. economic schedule, investors are anticipating

September’s composite, industrial, and services PMIs from S&P

Global at 9:45 am, likely indicating a contracting economy due to

sustained inflation, deterring investments in these sectors. At 1

pm, Baker Hughes will publish the weekly oil rig count.

In Europe, investors are assessing a series of data from the

United Kingdom and Germany, validating the Bank of England’s (BoE)

stance to maintain interest rates at 5.25%, against market

anticipations of a 25 basis point rise.

In the UK, retail sales in August rose 0.40% monthly, below the

0.50% consensus. S&P Global’s composite, industrial, and

services PMIs for the last month recorded 46.8, 44.2, and 47.2

points respectively, all beneath the projections and the 50-point

threshold distinguishing between activity expansion and

contraction.

In Germany, the PMIs, measured by the Hamburg Commercial Bank

(HCOB), demonstrated mixed outcomes relative to projections,

registering 46.2, 39.8, and 49.8 points in September,

respectively.

A statement from the European Central Bank’s (ECB) vice

president, Luis de Guindos, is anticipated.

In Asia, markets concluded mixed, affected by Chinese incentives

for foreigners and the Bank of Japan’s (BoJ) resolution to maintain

negative interest rates at 0.1% and the local 10-year government

bond yield target at zero. The BoJ stressed that amid significant

global economic uncertainties, it will continue its prudent policy,

adapting responsively to alterations in prices and financial

circumstances.

In China, the markets ended a three-day losing streak after

Shanghai permitted foreign investors to transfer resources

unrestrictedly and swiftly. The Chinese government also vowed to

ease the capital flows from foreign firms.

At Thursday’s close, stock values have receded, while,

concurrently, there has been an increase in the yields of

Treasuries and in the valuation of the dollar. Dow Jones fell

370.46 points or 1.08% to 34,070.42 points. S&P 500 fell 72.20

points or 1.64% to 4,330.00. Nasdaq fell 245.14 points or 1.82% to

13,223.98 points.

This scenario occurred in response to a labor market report that

supported the Federal Reserve’s stance to maintain high-interest

rates. The long-term yields in the United States, particularly the

10-year rates, reached levels not seen since 2007, demonstrating

renewed confidence in the economy.

Economically speaking, applications for unemployment benefits in

the US have reduced, reaching their lowest level since January,

signaling a robust job market. However, the real estate sector has

shown signs of weakness, with a decline in the numbers of property

sales due to scarce supply and rising mortgage rates.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – At the launch of the

iPhone 15 in Shanghai, more than a hundred consumers were waiting

at Apple’s main store. Despite concerns about government

restrictions and competition from Huawei, demand was robust, with

premium models selling out quickly online. Some consumers,

however, lamented the lack of significant innovations in the new

model.

Alphabet (NASDAQ:GOOGL), Broadcom (NASDAQ:AVGO)

– Google has denied plans to abandon Broadcom as a supplier of

artificial intelligence chips, contrary to media

reports. Despite rumors of replacing Broadcom

with Marvell Technology (NASDAQ:MRVL)

due to price disputes, Google said it values the collaboration

with Broadcom, which remains a significant partner. Meanwhile,

it continues to expand investments in AI to compete with

Microsoft.

Microsoft (NASDAQ:MSFT) – Microsoft

announced a “unified” AI, Copilot, for Windows 11 and four new

Surface devices. Copilot will be available on November 1,

integrating with numerous apps and services, including Bing and

Microsoft 365, intensifying AI competition with giants like

Alphabet and Apple.

Activision Blizzard (NASDAQ:ATVI) –

The restructuring of Microsoft’s (NASDAQ:MSFT) $69 billion

acquisition of Activision Blizzard has received preliminary

approval from the British regulator, which previously blocked the

deal due to antitrust concerns. The sale of Activision’s

streaming rights to Ubisoft has assuaged concerns, although

additional solutions have been proposed to address residual

issues. Final approval is still pending following subsequent

consultation.

Cisco

Systems (NASDAQ:CSCO), Splunk (NASDAQ:SPLK)

– Cisco Systems acquired cybersecurity company Splunk for

approximately $28 billion, aiming to strengthen its software sector

and capitalize on artificial intelligence. This is Cisco’s

largest deal, marking a strategy to reduce dependence on networking

equipment and focus more on services and software, exploiting

Splunk’s capabilities in data security and observability. The

deal is expected to be completed in the third quarter of 2024.

Intel (NASDAQ:INTC) – Intel was fined

US$400 million (€376.36 million) by the European Union for abusing

its dominant position in the x86 chip market, following the

annulment of a previous penalty of €1.06 billion. The European

Commission reimposed the fine alleging anti-competitive practices

by Intel, aimed at excluding competitors. Even with errors

highlighted in previous decisions, the court confirmed Intel’s

abusive conduct under EU competition rules.

AXT Inc (NASDAQ:AXTI) – Semiconductor

wafer maker AXT Inc said subsidiary Beijing Tongmei has obtained

initial licenses to export gallium arsenide and germanium

substrates from China, essential for chips. This development

comes amid rising tensions and tight controls between the US and

China on the microchip trade.

Oracle (NYSE:ORCL) – On Thursday, in a

meeting with analysts in Las Vegas, Oracle reaffirmed its revenue

target of US$65 billion for 2026, even after forecasts below Wall

Street’s consensus for the current quarter.

News

Corp (NASDAQ:NWSA), Fox

Corp (NASDAQ:FOX) – Lachlan Murdoch has been named

chairman of News Corp and will maintain his role as president and

chief executive at Fox Corp. The son of Rupert Murdoch, he now

leads important media brands, temporarily resolving succession

issues in the media empire. Lachlan has a deep background in

family media companies and represents a significant figure in the

global media landscape.

Warner Bros Discovery (NASDAQ:WBD) –

Warner Bros Discovery plans to expand its Leavesden studios by 50%,

adding 10 sound stages, creating around 4,000 jobs. The

investment of US$301 million will increase annual production to

US$737.6 million. The works, starting in 2024, will conclude

in 2027.

Scholastic (NASDAQ:SCHL) – Scholastic

shares are down 19.8% in pre-market trading Friday after reporting

a larger-than-expected second-quarter loss and maintaining its

full-year outlook. The company reported a net loss of US$74.2

million and a drop in revenue to US$228.5 million. The

administration attributed the results to summer vacations and the

temporality of revenue from state programs.

United Parcel Service (NYSE:UPS) – UPS is

in talks with Mexican authorities following the mandatory change of

cargo flights to Felipe Angeles International Airport (AIFA),

seeking to speed up imports and align operations with military

standards. Francisco Ricaurte, head of UPS for Mexico and

Latin America, expressed the need for understanding to adapt

processes and mitigate the impacts of the hasty transfer.

Ford Motor (NYSE:F), General

Motors (NYSE:GM), Stellantis (NYSE:STLA)

– Detroit automakers UAW face growing tensions with hourly workers

union, entering final hours Friday for new labor agreements, trying

to avoid an expansion of the strike. This impasse raises

concerns about possible disruptive impacts on US production and the

economy.

Ford Motor (NYSE:F) – U.S. automotive

safety regulators are investigating approximately 240,000 Ford

EcoSport (2018-2021) vehicles due to complaints of oil pump

failures. The National Highway Traffic Safety Administration

has received 95 complaints about loss of vehicle propulsion.

Toyota Motor (NYSE:TM) – Toyota plans to

accelerate production of electric vehicles, aspiring to produce

more than 600,000 units annually by 2025, Nikkei revealed. The

company aims to sell 1.5 million electric vehicles per year by

2026, and 3.5 million by 2030.

Tesla (NASDAQ:TSLA) – Tesla has proposed

manufacturing and selling battery storage systems in India, and is

in dialogue about incentives to build a factory. The focus is

on the “Powerwall”, to store solar or grid energy. While there

are challenges, the proposal reflects Elon Musk’s continued

interest in expanding Tesla’s presence in India, encompassing

electric vehicles and energy storage solutions. Additionally,

more car manufacturers are seeking access to Tesla’s charging

network in the US, bringing Elon Musk’s superchargers closer to

becoming an industrial standard. Texas now requires

compatibility with Tesla plugs to access federal funds, solidifying

Tesla’s superior reliability over rival networks like CCS.

VinFast (NASDAQ:VFS) – VinFast Auto

reported a second-quarter loss of $500 million on sales of $315

million. The company has delivered more than 9,000 electric

vehicles globally. Despite a strong stock market debut in

August, shares are down 71.29% so far this month. VinFast,

majority-owned by Vingroup, has substantial plans to invest in a

manufacturing facility in North Carolina.

American Airlines (NASDAQ:AAL) – American

Airlines, after internal audits and collaboration with suppliers,

identified and removed uncertified components on some

aircraft. This issue, also reported by other airlines, comes

after the discovery that AOG Technics sold unapproved parts for GE

engines. The FAA and the European Union Aviation Safety Agency

are investigating, and legal action is underway against AOG for

unauthorized practices and falsifying airworthiness approvals.

Ryanair (NASDAQ:RYAAY) – Ryanair will

reduce 17 routes in Dublin, relocating 19 Boeing 737 MAX planes to

airports with green flight incentives. The decision, prompted

by fee increases and a lack of environmental incentives in Dublin,

will see planes flown to Spain, Italy and Luton, UK.

Chevron (NYSE:CVX) – Australian union

alliance and Chevron have reached an agreement, suspending strikes

on liquefied natural gas projects, which threatened 7% of global

supply. The agreement, which follows proposals from an

arbitrator over pay and conditions, ends disputes that have driven

up gas prices by 35%. The final terms are being drafted,

aiming to improve salaries and working conditions.

TotalEnergies (NYSE:TTE) – TotalEnergies

SE plans to sell its remaining stake in North Sea gas fields in the

Greater Laggan region, following the trend of oil majors leaving

the area. The decision comes after selling 20% of its stake

to Kistos Plc for US$125 million last year. The sale signals

continued interest from smaller, newer companies in assets in the

region.

Magellan Midstream

Partners (NYSE:MMP), Oneok (NYSE:OKE)

– Shareholders of Magellan Midstream Partners approved the $18.8

billion sale to ONEOK despite concerns about executive

compensation. Approximately 96% of votes were in favor of the

transaction, but opposed the directors’ remuneration associated

with the deal.

NextEra Energy (NYSE:NEE) – NextEra

Energy’s $5.4 billion retirement plan suffered significant losses,

exposing 401(k) policy risks with a high concentration in

proprietary shares. Nearly 50% of this plan’s investments are

in company stock, contrasting with the standard practice of

diversification, and placing employees at considerable financial

risk, as evidenced by recent declines in the company’s stock value,

substantially affecting employee retirement balances.

Constellation Energy (NASDAQ:CEG) – Joe

Dominguez, CEO of Constellation Energy, emphasized in an interview

with CNBC the reliability of nuclear energy. He highlighted

its importance for decarbonization and its ability to fill gaps in

solar and wind energy. Constellation claims to be a leader in

clean energy, aiming to surpass renewable energy certificates,

ensuring a continuous supply of renewable energy to companies.

US Steel (NYSE:X) – Canadian

steelmaker Stelco Holdings (USOTC:STZHF)

seeks to make an offer for US Steel Corp to expand its portfolio

and participation in the automotive market, increasing the number

of interested parties in the American company.

Faraday Future Intelligent

Electric (NASDAQ:FFIE) – On Thursday, Faraday Future

Intelligent Electric named Matthias Aydt as its new global CEO

effective September 29. Aydt, a company veteran, will focus on

increasing production and generating revenue as the company faces

liquidity and governance crises, as well as delivery delays and

shareholding disputes.

AstraZeneca (NASDAQ:AZN) – AstraZeneca

shares rose 2.8% in pre-market trading on Friday after the company,

in collaboration with Daiichi Sankyo, announced that it had

achieved extremely positive results in trials of its drug Dato

-DXd, intended for the treatment of breast cancer. In other

news, Bloomberg reported on Thursday that Elmarie Bodes, a former

director at AstraZeneca, has sued the company, alleging it refused

to pay her $125,000 in bonuses because she worked

remotely. Bodes asserts that retroactively modifying bonus

criteria, without prior notice, constitutes a breach of contract

and transgression of local law.

Alibaba (NYSE:BABA), JD.com (NASDAQ:JD)

– In Friday’s pre-market, Alibaba’s American depositary receipts

were up 4.7%, while JD.com posted a gain of 4.7%. A Bloomberg

report says that China is considering easing rules that restrict

foreign ownership of local listed companies. In addition,

Cainiao Network Technology, Alibaba’s logistics sector, plans to

hold its initial public offering in Hong Kong, potentially raising

at least US$1 billion, according to sources. The initiative is

part of Alibaba’s strategy of listing its units separately.

Wayfair (NYSE:W) – Wayfair was up 2.7% in

Friday pre-market trading to $62.19 after the online furniture

merchant’s stock was upgraded from Underperform to Market Perform

by Bernstein, with the price target being adjusted from $60 to

$65.

HSBC (NYSE:HSBC) – HSBC raised its

forecast for 10-year U.S. Treasury yields to 3.5%, anticipating

that the Federal Reserve will raise interest rates to combat

inflation as the economy continues to expand. Despite the

Fed’s aggressive stance, some predict rate cuts by global central

banks next year.

JPMorgan Chase (NYSE:JPM) – A judge upheld

a $1.4 million arbitration award against JPMorgan in favor of

Dustin Luckett, a former consultant, for alleged

defamation. Luckett, who was fired in 2017, claimed that the

reason given by the bank for his dismissal harmed his future

employment opportunities. The decision comes after the bank

tried to annul the arbitration award, alleging excessive authority

by the arbitration panel.

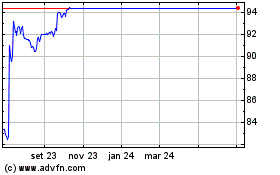

Activision Blizzard (NASDAQ:ATVI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Activision Blizzard (NASDAQ:ATVI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024