US index futures advanced in pre-market trading on Tuesday,

extending the positive momentum from the previous day. This came in

response to optimistic comments about interest rates in the U.S.,

contributing to improved investor sentiment.

At 06:53 AM, Dow Jones (DOWI:DJI) futures rose by 79 points, or

0.23%. S&P 500 futures increased by 0.22%, and Nasdaq-100

futures rose by 31%. The yield on 10-year Treasury bonds was at

4.682%.

In the commodities market, West Texas Intermediate crude oil for

November fell by 0.57% to $85.89 per barrel. Brent crude oil for

December declined by 0.48% to near $87.75 per barrel. Iron ore with

a 62% concentration, traded on the Dalian exchange, fell by 1.74%

to $112.31 per ton.

The conflict between the terrorist group Hamas and Israel raises

concerns, creating uncertainty in the markets. There are fears of a

potential geopolitical escalation and impacts on the commodities

market, especially in the price of Brent crude oil. Investors are

concerned about a destabilization in the oil supply if Iran becomes

involved and closes the Strait of Hormuz, through which a

significant portion of global oil production passes. Additionally,

the conflict has led to a search for safe-haven assets, such as

gold and the U.S. dollar, which could harm developing

economies.

On the agenda, the IMF and World Bank meetings in Morocco stand

out, featuring speeches by central bank presidents, including

Christine Lagarde of the European Central Bank (ECB). The IMF has

also released a report warning of persistent inflation and the need

for more restrictive monetary policies, as well as weaker global

growth in 2024.

In Asia, markets closed with mixed directions. In Japan, the

current account balance in August fell below projections due to

reduced global demand for the country’s products, impacted by

inflation. In China, despite expectations of new stimuli, the

market did not sustain positive territory. The country is

considering issuing additional sovereign debt to finance

infrastructure spending. Furthermore, real estate developer Country

Garden indicated the possibility of default and hired consultants

due to declining sales. In the corporate sphere, another executive,

He Jinbi, founder of Maike Metals, was detained by police due to

creditor actions, following the case of Hui Ka Yan, founder of

Evergrande.

On Tuesday’s U.S. economic agenda, investors are awaiting a

speech by Atlanta Fed President Raphael Bostic at 9:30 AM, followed

by Fed Governor Christopher Waller at 1:30 PM. Neel Kashkari,

President of the Minneapolis Fed, will speak at 3:00 PM, and San

Francisco Fed President Mary Daly will address the audience at 6:00

PM.

At Monday’s close, the Dow Jones gained 197.07 points or 0.59%

at 33,604.65. The S&P 500 finished up 27.16 points or

0.63% to 4,335.66, while the Nasdaq Composite ended with a gain of

52.90 points or 0.39% to 13,484.24. It was a day of ups and

downs, and US markets headed towards a positive close, thanks to

more conciliatory statements from Federal Reserve leaders. Fed

Vice Chairman Philip Jefferson recommended a cautious approach to

monetary policy. On the other hand, L. Logan, leader of the

Dallas Fed, opined that an increase in long-term interest rates

could reduce the need for future rate hikes by the

FOMC. Notably, the price of Brent registered an increase of

over 4% on the day.

On Tuesday’s corporate earnings front, investors will be

watching reports from Pepsico (NASDAQ:PEP), Neogen (NASDAQ:NEOG),

AZZ (NYSE:AZZ) and E2Open (NYSE:ETWO).

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL)

– The EU is investigating whether Microsoft’s Bing, Edge and

Microsoft Advertising as well as Apple’s iMessage must follow the

new Digital Markets Act (DMA) technology rules. The European

Commission questioned users and competitors about the importance of

these services in relation to competitors and their

ecosystems. The investigation is expected to be completed

within five months.

Nvidia (NASDAQ:NVDA) – Nvidia shares have

faced pressure due to news about OpenAI exploring manufacturing its

own AI chips, threatening Nvidia as a supplier. However,

Nvidia remains optimistic, expecting to maintain its leadership in

the AI GPU market.

Arm Holdings (NASDAQ:ARM) – Arm Holdings

has received positive reviews from Wall Street analysts,

highlighting its leadership in smartphone chips and potential in

data centers. This followed the post-IPO quiet period when

banks underwrote Arm’s initial public offering. Analysts

expressed confidence in increased revenue through royalties and

expansion in markets such as cloud and automotive. While some

brokerages were cautious due to uncertainty in the smartphone

market, most analysis was bullish, with target prices in the range

of $57 to $85. SoftBank Group, owner of Arm, expects to maintain

its majority stake in company.

Unity Software (NYSE:U) – Video game

software maker Unity has announced the immediate retirement of John

Riccitiello as CEO. James Whitehurst has been named interim

CEO, joining from IBM (NYSE:IBM)

following its acquisition of Red Hat, where he served as president

and CEO from 2008 to 2020. Roelof Botha has been named

president.

PagerDuty (NYSE:PD) – PagerDuty, a company

specializing in incident management software, announced its

intention to issue $350 million in convertible senior notes.

ParaZero Technologies (NASDAQ:PRZO) –

ParaZero Technologies shares rose in Tuesday’s pre-market trading,

following a 133% gain on Monday, after its drone manufacturing

partner received approval in Australia to operate drones in densely

populated areas.

Walt Disney (NYSE:DIS) – Activist investor

Nelson Peltz plans a new challenge to Walt Disney’s board less than

10 months after plans to respond to his criticism. With Disney

shares falling 30% since then, Peltz, an 82-year-old billionaire,

could seek multiple board seats, including one for

himself. Peltz’s Trian Fund Management is one of Disney’s

biggest investors, owning about $2.5 billion in the company’s

shares. If Disney rejects the request, Trian could nominate

director candidates, paving the way for shareholders to vote.

Best Buy (NYSE:BBY) – Best Buy is

expanding its presence in healthcare by selling the Dexcom G7

prescription medical device, which monitors glucose

levels. The company plans to expand its glucose monitoring

product offering and enter other areas of healthcare. The

initiative is part of Best Buy’s efforts to increase its long-term

profitability.

Ventyx Biosciences (NASDAQ:VTYX) – Pivotal

results from Ventyx Biosciences’ VTX002 clinical trial in patients

with moderately to severely active ulcerative colitis were at the

low end of the company’s guidance.

General

Motors (NYSE:GM), Stellantis (NYSE:STLA), Ford

Motor (NYSE:F) – Canada’s Unifor union announced

strikes at three General Motors facilities after negotiations to

improve wages and pensions failed before the deadline. The

strike affects locations in Oshawa, St. Catharines and Woodstock,

increasing unrest in the U.S. and Canadian auto industry. GM

expressed disappointment and will continue

negotiations. Stellantis said Monday it laid off 570 workers,

and General Motors cut nearly 200 employees due to the United Auto

Workers strike. Ford also laid off another 70 workers in

Michigan, bringing the total to 1,865 layoffs since the strike

began.

Tesla (NASDAQ:TSLA) – Employees at Tesla’s

factory in Brandenburg, Germany, are joining the IG Metall union

over health, safety and overwork concerns. The union alleges

understaffing and inadequate safety measures, leading to frequent

accidents and a high rate of illness among workers. IG Metall

reported a sharp increase in Tesla membership.

Rivian Automotive (NASDAQ:RIVN) – Rivian

Automotive saw a 3.3% increase in Tuesday pre-market trading to

$19.40 after receiving an upgrade to “Buy” from “Neutral” along

with a target price of $24 per share. The electric truck

maker’s shares fell significantly last week due to the announcement

of a $1.5 billion convertible note offering to raise additional

funds.

Northrop

Grumman (NYSE:NOC), Lockheed

Martin (NYSE:LMT) – In the wake of Hamas’ attack on

Israel, defense stocks performed remarkably well on

Monday. Northrop Grumman posted an 11% increase in regular

trading on Monday, with an additional 0.99% in pre-market trading

on Tuesday, while Lockheed Martin, which gained 8.9% on the same

day , had an increase of 0.88% in pre-market negotiations.

Chevron (NYSE:CVX) – For security reasons

amid the conflict with Hamas, Israel requested that Chevron close a

natural gas platform in the Eastern Mediterranean Sea. Chevron

operates two platforms in the Tamar and Leviathan gas fields in

Israel. Shares rose 3.1% on Monday, leading the Dow Jones

Industrial Average.

Pioneer Natural

Resources (NYSE:PXD), Exxon

Mobil (NYSE:XOM) – Exxon Mobil’s possible acquisition

of Pioneer Natural Resources could further restrict production

growth in the Permian oil field, affecting companies and pipeline

suppliers. This could also allow the company to negotiate

favorable pricing due to increased work volume. The White

House would have difficulty preventing such a takeover.

AO Smith (NYSE:AOS) – AO Smith

Corp. announced on Monday a 7% increase in its quarterly cash

dividend, bringing it to 32 cents per share. The company

justified the increase as a reflection of confidence in the

stability of replacement demand in its business and its commitment

to returning capital to shareholders.

Truist Financial (NYSE:TFC) – Truist

Financial Corp is in discussions to sell its insurance brokerage

unit to private equity firm Stone Point for approximately $10

billion, according to Semafor. The sale follows the sale of a

20% stake in Truist’s insurance business to Stone Point in

February. The deal is still in progress and may depend on

Stone Point’s ability to obtain adequate financing.

JPMorgan (NYSE:JPM), Apple (NASDAQ:AAPL)

– JP Morgan lowered its confidence in demand for Apple’s iPhone 15

Pro and 15 Pro Max, citing shorter delivery times suggest less

robust demand.

Morgan Stanley (NYSE:MS) – Morgan Stanley

has agreed to pay a $20 million option mentioned in the commodities

fraud case involving Neil Phillips, co-founder of Glen Point

Capital, who faces trial in New York. The bank was involved as

an options seller in the case, but was not directly

accused. The trial could question the legality of so-called

“barrier chases” in foreign exchange markets, as Phillips alleges

authorities are trying to criminalize normal trading

practices. The trial begins on October 16th.

Citigroup (NYSE:C) – Investors are

reducing their bets on the continued decline in U.S. stock futures

as the pace of flows slows, according to Citigroup

strategists. While positioning is still moderately bearish on

S&P 500 and Nasdaq 100 futures, it is unclear whether this

slowdown in momentum will mark the end of the sell-off. The

S&P 500 rebounded in October after two months of declines, but

10-year bond yields have fallen recently. The minutes of the

last Fed meeting and US inflation data are on investors’ radar.

Deutsche Bank (NYSE:DB) – Spanish securities

regulator CNMV is scrutinizing Deutsche Bank’s sales of currency

derivatives to small businesses in Spain, intensifying its

investigation into the matter. The analysis focuses on

compliance with rules that prohibit the marketing of complex

derivatives to inexperienced buyers. The European Central Bank

also expressed concern about Deutsche Bank’s sales in the

country. The bank has stopped selling these products and is

trying to reduce its existing portfolio, but this process is taking

longer than expected. Additionally, Deutsche Bank formed a

panel with internal executives and external organizations, such as

the United Nations and the World Wide Fund for Nature, to assess

nature-related risks and develop financial products linked to

biodiversity. The bank seeks to better understand these risks,

integrate them into its processes and offer sustainable products to

global clients, while global biodiversity faces

challenges. Deutsche Bank is also considering investing in

nature-related startups and participating in debt-for-natural

resource swaps, aiming for financial and environmental

sustainability.

Imax Corp (NYSE:IMAX) – Benchmark raised

its price target for Imax Corp. from US$23 to US$24, due to

better than expected box office performance. Global box office

in the third quarter surpassed estimates, reaching 141% of

pre-pandemic performance. China is seen as a market with

recovery potential by 2024, and national and international markets

are expected to equal or exceed pre-pandemic values. Imax had

success with the film “Oppenheimer” and had the best July at the

box office ever. Imax shares fell 1.9% on Monday.

Carnival (NYSE:CCL), Royal

Caribbean (NYSE:RCL), Norwegian

Cruise Line Holdings (NYSE:NCLH) – Of the three major

cruise operators, Carnival Corp. is the least exposed to

cruises in Israel, but its shares are taking the most significant

hit. Wells Fargo analyst Daniel Politzer notes that Hamas’

surprise attack on Israel over the weekend had the biggest impact

on the Royal Caribbean Group, followed by Norwegian Cruise Line

Holdings and then Carnival. He predicts pressure on prices in

the fourth and first quarter due to cancellations and modifications

of cruise itineraries to Israel.

Hyatt Hotels (NYSE:H) – Hyatt Hotels will

replace National Instruments Corp in the S&P MidCap 400 before

trading opens on Thursday, after Emerson Electric Co. agreed to

acquire National Instruments.

Gamer Pakistan (NASDAQ:GPAK) – Gamer

Pakistan, the first Pakistani esports company listed on the Nasdaq,

saw its shares debut higher before falling. The company raised

$6.8 million in its IPO and is looking to develop collegiate and

professional sporting events in Pakistan, with plans for global

expansion. The company sold 1.7 million shares at a price of

$4 each. With 25.6 million shares outstanding, the company was

valued at $102.4 million at the IPO. The shares opened at

US$4.20, exceeding the IPO price by 5%, reaching a valuation of

around US$107.4 million. After trading at $4.39, they fell

29%.

PepsiCo (NASDAQ:PEP) – PepsiCo exceeded

analysts’ expectations by reporting quarterly earnings and

revenue. Adjusted EPS was $2.25 compared to the $2.15

expected, and revenue came in at $23.45 billion compared to the

$23.39 billion forecast. Additionally, Pepsi raised its

full-year profit outlook, projecting 13% growth from its previous

forecast of 12%. However, the company’s sales volume continued

to fall due to price increases implemented to combat

inflation. The company’s shares rose 2.5% in pre-market

trading.

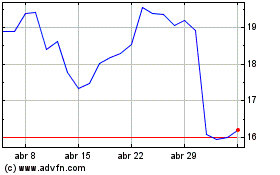

Norwegian Cruise Line (NYSE:NCLH)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

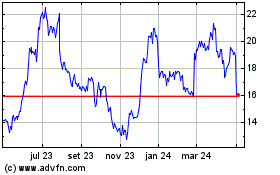

Norwegian Cruise Line (NYSE:NCLH)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024