Keep An Eye Out: Pre-Market Movers And Recommendations

11 Outubro 2023 - 9:43AM

IH Market News

Here are some of the biggest premarket U.S. stock movers

today:

Don’t Trade Without Seeing

The Orderbook

Pioneer Natural Resources (NYSE:PXD) stock rose

1.9% after oil major Exxon Mobil (NYSE:XOM), down 2.4%, confirmed

plans to acquire its rival in an all-stock deal with just under $60

billion, in what would be the most significant corporate deal of

the year.

Walgreens Boots Alliance (NASDAQ:WBA) stock

rose 1.8% after the pharmacy chain operator appointed Tim Wentworth

as its CEO, pinning hopes on the healthcare industry veteran to

reverse a recent drop in profits.

Amazon (NASDAQ:AMZN) stock rose 0.7% as the

online retail giant launched its Prime Big Deal Days, seeking to

tempt shoppers with deals on limited-quantity items.

Morgan Stanley (NYSE:MS) stock fell 0.5% after

UBS downgraded its stance on the banking giant to ‘neutral’ from

‘buy’, seeing little upside from current levels given the

challenging environment.

LVMH Moet Hennessy Louis Vuitton (USOTC:LVMUY)

ADRs are seen sharply lower after the French luxury goods retailer

reported a slowdown in sales in the third quarter, with organic

revenue growth of 9% during the quarter, down from 17% in the prior

three-month period.

Arista Networks (NYSE:ANET) stock fell 1.5%

after Piper Sandler downgraded its stance on the cloud networking

solutions provider to ‘neutral’ from ‘overweight’, citing a lack of

immediate catalysts.

Plug Power (NASDAQ:PLUG) stock rose 6.4% after

the alternative energy company projected a big jump in revenue, up

to $6 billion in revenue by 2027 and $20 billion by 2030, compared

with about $1.2 billion in 2023.

Humana (NYSE:HUM) stock fell 2.8% after the

health insurer announced that CEO Bruce Broussard is set to step

down next year after 11 years in the role.

Polestar (NASDAQ:PSNY) stock fell 8.6% after

the EV manufacturer announced plans to raise as much as $1 billion

as it struggles with continued cash burn.

US Options Trader

Live Realtime Streaming: US Options (OPRA), NYSE, NASDAQ, AMEX

prices + Dow Jones and S&P indices – and our innovative Options

Tools, featuring Live Options Flow.

ANALYST RECOMMENDATIONS:

Arch Capital: Morgan Stanley maintains its

overweight/attractive recommendation with a price target raised

from $98 to $100.

Arista Networks: Piper Sandler & Co

downgrades to neutral from overweight with a target price of

$190.

Ball Corp: Barclays upgrades to overweight from

equalweight with a price target reduced from $61 to $59.

Chubb: Morgan Stanley maintains its

equalwt/attractive recommendation with a price target raised from

$209 to $224.

Cme Group Inc: Morgan Stanley maintains its

equalwt/in-line recommendation with a target price raised from $211

to $215.

Csx Corp: JPMorgan upgrades to overweight from

neutral with a price target raised from $37 to $40.

Dow Inc: Piper Sandler & Co maintains its

overweight rating and reduces the target price from $66 to $60.

Hershey: RBC Capital maintains its outperform

rating and reduces the target price from $275 to $246.

Hubspot: Raymond James upgrades to outperform

from strong buy with a price target reduced from $600 to $520.

Nasdaq: Morgan Stanley maintains its equalwt/in-line recommendation

with a target price reduced from $55 to $54.

Netflix: Morgan Stanley maintains its equal

weight/in-line recommendation with a price target reduced from $450

to $430.

Palo Alto: William O’Neil & Co Incorporated

initiates coverage with a buy rating.

Pepsico: Morningstar upgrades to buy from sell

with a target price of $176.

PPG Industries: Barclays upgrades to overweight

from equalweight with a target price of $160.

Procter & Gamble: RBC Capital maintains its

sector perform rating with a price target reduced from $167 to

$154.

Take Two Interactive Software: Raymond James

upgrades to outperform from market perform with a target price of

$170.

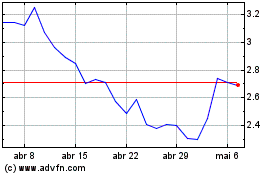

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024