Third Quarter Results from Nokia Decline, Cutting Up to 14,000 Jobs; Stock Falls

19 Outubro 2023 - 7:36AM

IH Market News

Nokia Corp’s (NYSE:NOK) shares were losing about 4 percent in

morning trading in Helsinki, as well as approximately 3 percent in

pre-market activity on the NYSE, after the leading Finnish

telecommunications company reported a sharp drop in its

third-quarter profit and revenue on Thursday amid ongoing

macroeconomic challenges.

Additionally, the company maintained its financial outlook for

2023 but at the lower end of the net sales range. The company also

reaffirmed its long-term comparable operating margin target of at

least 14%, to be achieved by 2026.

Separately, Nokia announced a cost-reduction program, planning

to cut up to 14,000 jobs to navigate the current market

uncertainty. The company is streamlining its operational model by

integrating sales teams into business groups.

The new cost-reduction program is designed to reduce the cost

base by 800 million euros, to 1.20 billion euros on a gross basis

over a three-year period. This represents a reduction of 10% to 15%

in personnel expenses. Cost savings are expected to be primarily

achieved in mobile networks, cloud services, and network, as well

as corporate functions at Nokia.

Nokia anticipates savings of at least 400 million euros in 2024

and an additional 300 million euros in 2025. The program is

expected to result in an organization with 72,000 to 77,000

employees, compared to Nokia’s current 86,000 employees.

The company emphasized that the exact scale of the program will

depend on market demand evolution and that cost savings are

expected to be achieved on a net basis, but the magnitude will

depend on inflation rates.

Looking ahead, for the full year 2023, the telecommunications

company continues to expect net sales in the range of 23.2 billion

euros to 24.6 billion euros, reflecting a variation of 4% lower to

2% higher year-over-year in constant currency terms.

Comparable operating margin is expected to remain in the range

of 11.5% to 13%, assuming the closing of pending deals in Nokia

Technologies.

Regarding Nokia Technologies, the company remains confident that

the business group will return to an annual net sales rate of 1.4

billion euros to 1.5 billion euros.

Additionally, the Board decided to distribute a dividend of 0.03

euros per share. The dividend record date is October 24, and the

dividend will be paid on November 2.

Pekka Lundmark, President and CEO, commented: “Looking ahead,

while our third-quarter net sales were impacted by ongoing

uncertainty, we expect a more typical seasonal improvement in our

network business in the fourth quarter. Based on this and assuming

we resolve the pending renewals affecting Nokia Technologies, we

are approaching the lower end of our net sales guidance for 2023

and the midpoint of our comparable operating margin guidance.”

In the third quarter, Nokia’s profit dropped by 69% to 133

million euros, compared to 428 million euros in the previous year.

Earnings per share decreased by 75% to 0.02 euros, down from 0.08

euros in the previous year.

On a comparable basis, profit was 299 million euros or 0.05

euros per share, down from 551 million euros or 0.10 euros per

share in the previous year.

Operating profit decreased by 53% to 241 million euros, and

comparable operating profit declined by 36% to 424 million euros.

Comparable operating margin decreased by 350 basis points compared

to the previous year, to 4.8%.

In the quarter, net sales decreased by 20% to 4.98 billion

euros, down from 6.24 billion euros in the previous year. Net sales

decreased by 15% in constant currency, as macroeconomic uncertainty

and higher interest rates continued to pressure operator

spending.

Network infrastructure declined by 14% in constant currency, due

to weaker spending impacting IP Networks. In Mobile Networks, net

sales decreased by 19%. In Helsinki, Nokia’s shares are currently

trading at 3.118 euros, a drop of 4.36%. In pre-market activity on

the NYSE, shares were trading at $3.28, a decrease of 3.24%.

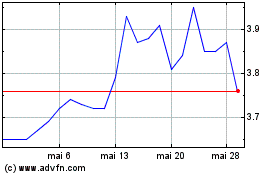

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024