Rise of bitcoin and prospects

Bloomberg suggests that Bitcoin’s recent surpassing of the

$42,000 mark signals the beginning of a possible “super cycle” that

could push its value beyond $500,000. This phenomenon is

interpreted as a harbinger of significant transformations in the

global financial system. The expectation surrounding the approval

of a Bitcoin investment fund (ETF) in the United States is one of

the factors fueling this rise. Eric Balchunas from Bloomberg

believes there is a 90% chance of this ETF being approved by

January 2024. Regarding the recent market behavior, Fernando

Pereira, an analyst at Bitget, observed that after a period of

trading accumulation in November in the $37,000 range, there was

intensive Bitcoin (COIN:BTCUSD) buying by purchasers, depleting the

available supply at this level. “After accumulating trades

throughout November in the $37,000 range, Bitcoin buyers purchased

all the available supply in this region and are accumulating until

a new resistance zone appears and the number of bitcoins offered

increases. In my analysis, I understand that the region between

$43k and $45.5k will have a supply strong enough to stop the rise

for some time. I believe that should be the peak of 2023,” said

Pereira.

BlackRock receives $100,000 from investor for Bitcoin fund

BlackRock (NYSE:BLK) obtained an initial capital investment of

$100,000 for its proposed Bitcoin exchange-traded fund (ETF), as

revealed in a filing with the U.S. Securities and Exchange

Commission (SEC). The investor committed to purchasing $100,000 in

shares on October 27, 2023, receiving 4,000 shares at a unit price

of $25.00 on the same day. This initial capital is essential for

funding the underlying creation units of the ETF, enabling the

trading of the shares on the open market.

Phoenix Group shares soar in Abu Dhabi Stock Exchange debut

On its first trading day on the Abu Dhabi Securities Exchange,

shares of Phoenix Group, specializing in cryptocurrency mining, saw

a significant increase of 35%, reaching approximately $0.55 (2.03

dirhams). Initially offered at 1.50 dirhams in the November IPO,

which raised 1.36 billion dirhams (about $368 million), the shares

of the United Arab Emirates-based company surged 50%, reaching 2.25

dirhams. The IPO attracted demand 33 times greater than the supply.

Phoenix Group offers cryptocurrency mining and hosting services and

operates the M2 exchange, supported by its Ethereum token, MMX.

Recently, the International Holding Company acquired 10% of Phoenix

Group.

Robinhood registers a 75% increase in cryptocurrency trading volume

in November

Robinhood (NASDAQ:HOOD) reported a remarkable 75% increase in

cryptocurrency trading volume in November compared to October,

according to a recent document submitted to the U.S. Securities and

Exchange Commission (SEC). This significant increase in trading

activity marks a notable shift in the platform’s recent

performance, indicating renewed interest from Robinhood users in

cryptocurrency trading.

Ark Invest sells more Coinbase shares and increases stake in

Robinhood

Ark Invest, led by Cathie Wood, sold more than $1.4 million in

Coinbase (NASDAQ:COIN) shares on Monday, transferring 10,218 COIN

from two of its funds. This sale follows last week’s movement, when

Ark sold $15 million in Coinbase shares during the period when COIN

was on the rise. Coinbase’s shares are currently at $138.05, up

about 70% over the past month and 286% year-to-date. Additionally,

Ark Invest acquired more Robinhood (NASDAQ:HOOD) shares, adding to

the $3 million bought the previous week, coinciding with the launch

of the stock trading app in the United Kingdom.

Large Ether holder inactive for five years transfers $90 million to

Kraken exchange

A large Ether (COIN:ETHUSD) holder, who had been inactive for

five years, transferred nearly $90 million in tokens to the

cryptocurrency exchange Kraken. The “whale” deposited 39,260 Ether

in Kraken after receiving 47,260 Ether from a transaction in 2017.

This movement may indicate an intention to sell or convert the

tokens, increasing sell pressure in the market. Kraken has a market

depth available of over $5 million, meaning a transaction of this

size could significantly impact the market.

U.S. cryptocurrency industry spends record on lobbying in 2023

The U.S. cryptocurrency industry spent a staggering $18.96

million on federal lobbying in the first three quarters of 2023,

surpassing the $16.1 million spent in the same period of 2022.

Coinbase (NASDAQ:COIN) led the spending with $2.16 million,

followed by prominent companies like Foris DAX, operator of

Crypto.com, the Blockchain Association, and Binance Holdings.

Neutron acquires 25% of Confio in strategy to boost CosmWasm

Neutron, a smart contract platform on Cosmos, bought 25% of

Confio, developer of CosmWasm. The investment, whose value was not

disclosed, aims to promote CosmWasm and improve its technology in

collaboration with Neutron, focusing on web3 areas such as

zero-knowledge proofs. The ultimate goal is to establish CosmWasm

as an alternative to the Ethereum Virtual Machine. This follows

Neutron’s $10 million fundraising in June 2023, raising its current

valuation to over $670 million since the mainnet launch, along with

the adoption of the Cosmos Hub’s replicated security.

Hedera Blockchain and UN launch solution for carbon market

The UN introduced the Guardian and Managed Guardian Service, a

solution for measurement, reporting, and verification in the carbon

market, powered by the Hedera blockchain and the HBAR token

(COIN:HBARUSD). This innovation aims to increase transparency and

accessibility to carbon market data, eliminating centralized

intermediaries. It’s a significant step in digitalizing and

streamlining climate change mitigation methodologies. The UN is

increasingly involved in blockchain-related collaborations,

including the Algorand Blockchain Academy in partnership with the

Algorand Foundation (COIN:ALGOUSD).

Societe Generale issues first digital green bond on Ethereum

Blockchain

Societe Generale (EU:GLE), one of France’s leading banks,

achieved a milestone by issuing its first digital green bond on the

Ethereum blockchain. Valued at 10 million euros and maturing in

three years, this bond symbolizes the bank’s commitment to

environmentally responsible financial practices. Facilitated by its

subsidiary Forge, the green bond aims to finance sustainable

projects and businesses. This pioneering move also highlights the

bank’s adoption of the Ethereum blockchain to increase transparency

and efficiency, especially in environmental, social, and governance

(ESG) matters, providing open data on the carbon footprint of

bonds.

Security vulnerability affects NFT platforms, including OpenSea and

Coinbase NFT

Thirdweb, a Web3 development platform, disclosed a critical

vulnerability in an open-source code library impacting several NFT

collections using its smart contracts. While the company did not

specify the affected collections, OpenSea and Coinbase NFT

confirmed that some of their collections were hit. They are working

to mitigate security issues and migrate to contracts without known

vulnerabilities, like DropERC20, ERC721, and ERC1155. The

vulnerability has not yet been exploited in projects using

Thirdweb’s contracts, but precautionary measures are being

taken.

Riot Blockchain makes largest purchase of Bitcoin miners in company

history

Riot Blockchain (NASDAQ:RIOT) announced the purchase of 66,560

Bitcoin miners from MicroBT, totaling $290.5 million. This purchase

is an expansion of Riot’s previous agreement with MicroBT and

includes miners with a hash rate of 250 TH/s. The deployment will

begin in the first quarter of 2024 and extend through the second

half of 2024, with a goal of reaching a hash rate capacity of 38

EH/s when all machines are operational. The CEO of Riot highlighted

that this is the largest hash rate order in the company’s

history.

PYTH governance tokens launched by Pyth with support from major

investors

Pyth, a low-latency Oracle service for blockchains, released

PYTH governance tokens to over 90,000 wallets. The initiative,

aiming to decentralize the platform’s governance, was driven by a

funding round with participation from key industry players, such as

Castle Island Ventures and Multicoin Capital. Pyth seeks to improve

the efficiency and accuracy of data in oracles, differentiating

itself from competitors like Chainlink (COIN:LINKUSD).

Curvance raises $3.6 million in initial funding with support from

major DeFi names

Curvance, an emerging platform in the DeFi sector, secured an

initial investment of $3.6 million, backed by over 20 organizations

and renowned developers, including Offchain Labs (Arbitrum),

Wormhole, and Sandeep Nailwal (co-founder of Polygon). Described as

an “everything app” for DeFi lending, the project aims to overcome

barriers between chains and protocols, supporting Ethereum and

various layer 2s. Curvance plans to use the funds to expand

operations, enhance security, and recruit talent, with the goal of

facilitating access to DeFi.

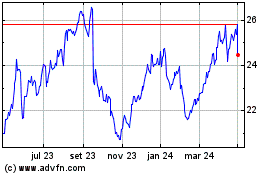

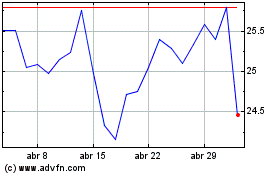

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024