U.S. Stocks May Lack Direction Following Yesterday’s Modest Pullback

27 Fevereiro 2024 - 11:14AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Tuesday, with stocks likely to show a lack of

direction following the modest pullback seen in the previous

session.

Uncertainty about the near-term outlook for the markets may lead

to choppy trading on Wall Street following last week’s advance by

the Dow and S&P 500 to new record highs.

Traders may also stick to the sidelines ahead of the release of

some key economic data later this week, including a closely watched

inflation reading.

The Commerce Department’s report on personal income and

spending, which is scheduled to be released on Thursday, includes a

reading on consumer price inflation said to be preferred by the

Federal Reserve.

The inflation data could have a notable impact on the outlook

for interest rates, as Fed officials have said they need greater

confidence inflation is slowing before cutting rates.

U.S. stocks ended on a negative note on Monday, and the major

averages turned weak after a slightly positive start, as investors

largely stayed cautious ahead of some key economic data.

Among the major averages, the Dow ended lower by 62.30 points or

0.2 percent at 39,069.23. The S&P 500 settled with a loss of

19.27 points or 0.4 percent at 5,069.53. The Nasdaq, which spent

much of the day’s session in positive territory despite a choppy

ride, ended down 20.57 points or 0.1 percent at 15,976.25.

In economic news, data released by the Commerce Department

showed new home sales climbed 1.5 percent to an annual rate of

661,000 in January after surging by 7.3 percent to a revised rate

of 651,000 in December.

With the increase, new home sales continued to regain ground

after hitting their lowest level in a year in November. Economists

had expected new home sales to jump by 2.4 percent to a rate of

680,000 in January from the 664,000 originally reported for the

previous month.

Palo Alto Networks (NASDAQ:PANW) shares climbed more than 7

percent. Dominos Pizza (LSE:DOM) surged nearly 6 percent after

reporting stronger than expected quarterly earnings.

Micron Technology (NASDAQ:MU), Tesla (NASDAQ:TSLA), Applied

Materials (NASDAQ:AMAT), Illumina (NASDAQ:ILMN), Salesforce.com

(NYSE:CRM) and Arista Networks (NYSE:ANET) gained 2 to 4

percent.

Walmart (NYSE:WMT), Marathon Petroleum (NYSE:MPC), Marathon Oil

(NYSE:MRO), Qualcomm (NASDAQ:QCOM) and Costco (NASDAQ:COST) also

posted strong gains.

Berkshire Hathaway (NYSE:BRK.A) lost nearly 2 percent, despite

the group posted an annual profit of $97 billion, its second

straight record annual profit.

Alphabet (NASDAQ:GOOG), Walgreens Boots Alliance (NASDAQ:WBA),

Whirlpool (NYSE:WHR), Moderna (NASDAQ:MRNA), Verizon (NYSE:VZ) and

Pfizer (NYSE:PFE) also ended sharply lower.

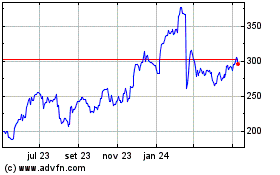

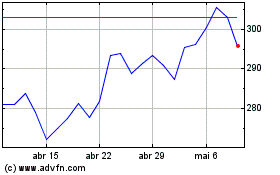

Palo Alto Networks (NASDAQ:PANW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Palo Alto Networks (NASDAQ:PANW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024