U.S. Index Futures Trade Sideways Amid Anticipation of Fed’s Policy Update; Oil Prices Dip

20 Março 2024 - 8:17AM

IH Market News

In Wednesday’s pre-market trading, U.S. index futures were

trading sideways, reflecting investors’ caution after a positive

session, with focus turning to the upcoming Federal Reserve

monetary policy update.

As of 6:31 AM, Dow Jones futures (DOWI:DJI)

were down 31 points, or -0.08%. S&P 500

futures declined by -0.06%, and Nasdaq-100 futures

gained 0.03%. The yield on 10-year Treasury notes stood at

4.279%.

In the commodities market, West Texas Intermediate crude for

April fell 0.85% to $82.76 per barrel. Brent crude for May dropped

0.65%, to around $86.81 per barrel. Iron ore traded on the Dalian

exchange rose 1.23%, to $114.38 per metric ton.

On Wednesday’s economic agenda, investors await the release of

the weekly oil inventories by the EIA at 10:30 AM. Subsequently, at

2:00 PM, all eyes will turn to the FOMC, which will announce its

interest rate decision, with the consensus from LSEG anticipating

the range to be maintained between 5.25% and 5.5%. This moment is

crucial for the financial markets as it directly affects investment

strategies and economic expectations. Immediately after, at 2:30

PM, the press conference led by the Fed Chair will be meticulously

analyzed by investors and analysts, seeking insights into the

future directions of monetary policy and its influence on the

global economy.

In the Asia-Pacific stock markets, the majority closed higher,

driven by the decision of the Chinese Central Bank to keep its main

interest rates stable. The stability of Chinese rates follows a

previous cut in the longer-term rate, keeping the focus on global

monetary policy. The Shanghai SE in China rose 0.55%, the Nikkei in

Japan increased 0.66%, and the Kospi in South Korea advanced 1.28%,

while the ASX 200 in Australia slightly retreated by 0.10%.

In the European markets, luxury sector icons such as

LVMH, Christian Dior, and

Hermes faced declines above 2%, with

Burberry experiencing a sharp fall of 4.7%. This

downward trend was catalyzed by a warning from

Kering, a prestigious Paris-based luxury

conglomerate, about a pullback in sales in Asia, resulting in a

significant 14% loss in its share value right after the market

opened. Concurrently, inflation in the UK proved softer than

anticipated, reaching 3.4% annually in February, according to

official data released on Wednesday, marking a decrease compared to

the 4% recorded in January.

On Tuesday, the U.S. stocks, initially under pressure,

surprisingly reversed, with the Dow Jones,

S&P 500, and Nasdaq closing

up 0.83%, 0.56%, and 0.39%, respectively. Nvidia

(NASDAQ:NVDA) rose 1.1% after announcing new AI chips, reflecting

the company’s influence on the market. Meanwhile, anticipation

around the Federal Reserve’s decisions and an increase in housing

starts were also key points.

For quarterly earnings, scheduled to present financial reports

before the market opens are Pinduoduo

(NASDAQ:PDD), General Mills (NYSE:GIS),

Jinko Solar (NYSE:JKS), BioNTech

(NASDAQ:BNTX), Ollie’s Bargain Outlet Holdings

(NASDAQ:OLLI), Signet Jewelers (NYSE:SIG),

Orla Mining (AMEX:ORLA), Kingsoft

Cloud (NASDAQ:KC), Sportrader Group AG

(NASDAQ:SRAD), among others.

After the close, earnings from Micron

Technology (NASDAQ:MU), Chewy

(NYSE:CHWY), Five Below (NASDAQ:FIVE), KB

Homes (NYSE:KBH), Guess (NYSE:GES),

HeartBeam, Steelcase Inc

(NYSE:SCS), Lithium Americas Argentina

(NYSE:LAAC), Worthington Enterprises (NYSE:WOR),

Alvotech SA (NASDAQ:ALVO), and more will be

awaited.

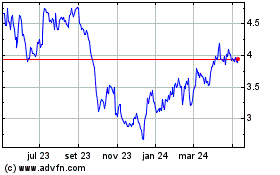

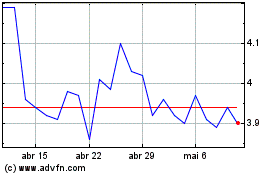

Orla Mining (AMEX:ORLA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Orla Mining (AMEX:ORLA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024