BHP (NYSE:BHP), Anglo American

(LSE:AAL) – BHP announced a $38.8 billion bid for Anglo American,

boosting the latter’s shares by 12.4%. The proposal, aiming to

create the world’s largest copper miner, offers a 31% premium to

Anglo’s shareholders, who are reviewing the offer. The deal could

trigger a wave of consolidation in the industry, with BHP aiming to

strengthen its position in the copper sector, crucial for the

global energy transition.

Micron Technology (NASDAQ:MU) – U.S. President

Joe Biden will unveil in Syracuse, New York, a preliminary deal

with Micron Technology for up to $6.14 billion in chip plant

subsidies, boosting national manufacturing and reducing foreign

dependence. The historic investment promises to create over 70,000

jobs. Biden will highlight his administration’s role in

revitalizing the industry and national security during his visit.

Micron’s shares rose 0.6% in pre-market trading.

Meta Platforms (NASDAQ:META),

Microsoft (NASDAQ:MSFT), Alphabet

(NASDAQ:GOOGL) – Investors are expressing growing unease with the

massive investments in artificial intelligence by tech giants,

especially after Meta announced plans for more robust spending.

Significant drops in the stocks of Meta, Microsoft, and Alphabet

reflect concerns about the rising costs of generative AI while the

industry seeks to monetize these technological advances.

Meta Platforms (NASDAQ:META) – An adviser to

the Court of Justice of the EU recommended that Meta Platforms’

Facebook not use public information about users’ sexual orientation

for personalized advertising, according to EU data protection

rules. The non-binding opinion arises from a case involving privacy

activist Max Schrems and highlights the need to preserve user

privacy. The final decision is expected in the coming months.

Apple (NASDAQ:AAPL) – The senior leader of

product marketing for Apple’s new Vision Pro headset, Frank

Casanova, retired after the launch. With 36 years at the company,

Casanova had key roles, including driving the iPhone’s expansion.

The Vision Pro, priced at $3,499, points to Apple’s vision for the

future of computing but faces challenges after a promising

start.

Nvidia (NASDAQ:NVDA) – Nvidia announced the

acquisition of Israeli startup Run:ai, specializing in AI resource

management software. The deal, whose value was not disclosed,

strengthens the collaboration that began in 2020. Nvidia also plans

to acquire Deci AI, according to sources. Israel is a key market

for Nvidia, which has already made several acquisitions in the

country, including Mellanox Technologies Ltd. for $7 billion in

2020.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC unveiled that its new “A16” chip technology will

be in production in the second half of 2026, challenging Intel

(NASDAQ:INTC) in speed. TSMC believes AI chip companies will be the

first to adopt the technology, without needing new expensive

machine tools.

ASML (NASDAQ:ASML) – Christophe Fouquet, 50,

takes over as the new CEO of ASML, Europe’s largest technology

company. Without the need for a vote, his appointment was approved

at the annual meeting in Veldhoven, Netherlands. Fouquet, a 15-year

veteran at the company, replaces Peter Wennink, who retires after

leading ASML since 2014.

Cisco Systems (NASDAQ:CSCO) – Cisco Systems

revealed that hackers compromised some of its digital security

devices, exploiting unknown vulnerabilities in the Adaptive

Security Appliances. The group, identified as “UAT4356”, was

described as sophisticated and state-sponsored, targeting global

government networks. The vulnerabilities have been fixed, but

immediate software updates by customers are required.

General Motors (NYSE:GM) – The total

compensation of General Motors CEO Mary Barra in 2023 fell to $27.8

million, while that of President Mark Reuss rose to nearly $18

million. The Chief Financial Officer Paul Jacobson received $11.1

million, and the General Counsel Craig Glidden, $11.5 million.

Toyota (NYSE:TM) – Toyota Motor announced on

Thursday that it reached global sales and production records for

the year ending March 31, driven by strong demand and a lack of

semiconductor supply constraints. However, it plans to delay the

production of electric vehicles in the U.S. to ensure quality.

Additionally, Toyota will partner with China’s Tencent, while

Nissan will join forces with Baidu (NASDAQ:BIDU),

highlighting the importance of artificial intelligence for

automakers. The partnerships reflect the need for Japanese

automakers to adapt to technological changes in China. Moreover,

Toyota launched a public transport pilot with nine fully electric

Hilux Revo pickups in Thailand, where Chinese brands challenge

Japanese dominance. The pickups were adapted for public transport.

This move occurs as China invests billions in the region.

XPeng (NYSE:XPEV) – The Chinese electric

vehicle manufacturer revealed that the European Commission’s

investigation into Chinese EVs and regulatory changes may require

investments in overseas factories or suppliers. The company aims to

increase its global presence, with the U.S. being a target market,

despite current challenges.

VinFast (NASDAQ:VFS) – Vietnamese billionaire

Pham Nhat Vuong plans to inject another $1 billion of his personal

fortune into VinFast, also considering listings of other companies

he controls. Vuong, chairman of Vingroup, highlighted his

commitment to VinFast despite the losses.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines flight attendants approved a new contract with an

immediate 22% wage increase, in a collective bargaining agreement

voted by nearly 20,000 employees. The contract includes annual

raises of 3% until May 2028, after two previous negotiation

attempts.

Morgan Stanley (NYSE:MS) – Morgan Stanley

Private Equity Asia (PEA) is restructuring its teams in the region

due to the retirement of the current CEO for Asia, Chin Chou,

according to an internal memo. The team will focus on investments

in China, with Jun Xu leading private equity investments in the

country.

Goldman Sachs (NYSE:GS), Bank of

America (NYSE:BAC) – Shareholders of Goldman Sachs and

Bank of America rejected proposals to separate the roles of CEO and

chairman, defying proxy advisor recommendations. Most investors

appear satisfied with the performance and do not want to risk

corporate stability, despite increased support for separating the

roles. Additionally, Goldman Sachs hired two senior bankers in

India to capitalize on the growing investor interest in the

country. Sunil Khaitan will lead financing, while Kamna Sahni will

handle Mergers and Acquisitions (M&A) in Mumbai. Both come from

Bank of America and will join Goldman in the coming months.

UBS Group AG (NYSE:UBS) – A recent lawsuit by

Appaloosa LP accuses the former Credit Suisse of misleading

investors about its stability before $17 billion in bonds were

wiped out in a rescue led by UBS. Credit Suisse, its CEO, and

former chairman are accused of lying about its liquidity.

Jefferies (NYSE:JEF) – Jefferies Financial

Group CEO Rich Handler sold $65 million in company shares to buy a

personal yacht. He sold 1.5 million shares at $43.50 each to

finance the purchase. He plans to buy a Westport 164 yacht from

billionaire Tilman Fertitta, remaining optimistic about Jefferies.

Handler, in office for 23 years, now owns 19.25 million shares

valued at over $850 million. The sale represents 7% of his

holdings.

Blackstone (NYSE:BX) – Blackstone agreed to

acquire Tropical Smoothie Cafe, valued at $2 billion. The chain,

started on a Florida beach, now operates over 1,400 locations in 44

states, offering smoothies, wraps, and sandwiches. The transaction

marks Blackstone’s latest investment in franchises.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens is establishing a new center focused on cell and gene

therapies for patients with complex chronic diseases, such as

cancer and cystic fibrosis, in Pittsburgh. This service, which will

conduct necessary checks and verifications, is part of Walgreens’

strategy to expand its pharmacy and health business.

Rubrik – Rubrik priced its initial public

offering at $32 per share, exceeding its target range of $28 to

$31. With 23.5 million shares, it plans to raise $752 million. Its

revenues reached $627.9 million in the most recent fiscal year,

with an increase in the number of customers.

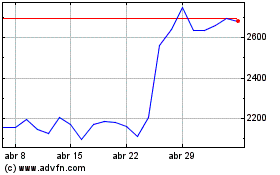

Anglo American (LSE:AAL)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

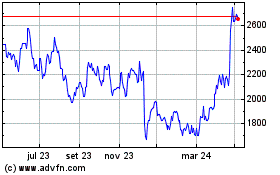

Anglo American (LSE:AAL)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024