U.S. Index Futures Dip Amid Wall Street Anxiety; Oil Prices Decline

22 Maio 2024 - 7:38AM

IH Market News

U.S. index futures started Wednesday with a slight decline in

pre-market trading, with an air of anticipation due to the imminent

results from Nvidia (NASDAQ:NVDA) and after the S&P 500 and

Nasdaq indices reached record highs the previous day.

At 6:29 AM, Dow Jones futures (DOWI:DJI) fell 47 points, or

0.12%. S&P 500 futures declined by 0.13%, and Nasdaq-100

futures lost 0.09%. The 10-year Treasury yield stood at 4.441%.

In the commodities market, West Texas Intermediate crude for

July dropped 1.18%, to $77.73 per barrel. Brent crude for July fell

1.13%, near $81.94 per barrel. Iron ore traded on the Dalian

exchange rose 2.7%, to $127.22 per metric ton.

On Wednesday’s economic agenda, the U.S. Department of Commerce

will release April’s existing home sales data at 10 AM.

Subsequently, at 10:30 AM, the Department of Energy (DoE) will

present last week’s oil stock positions.

European markets are operating lower, influenced by UK

inflation, which hit 2.3% in April, surpassing the forecast of

2.1%. This data lowered expectations of interest rate cuts by the

Bank of England in the summer, with the probability of a June cut

dropping to 13%.

Asia-Pacific markets showed mixed performance. China’s Shanghai

index rose 0.02%, defying the general downtrend seen in other

markets. In Japan, the Nikkei 225 closed down 0.85%, despite a

slight increase in business sentiment as shown by the

non-industrial Reuters Tankan index, which reached +26.

Additionally, Japan demonstrated a 2.7% increase in machinery

orders compared to the previous year, above expectations, and a

significant rise in exports, though the country registered a

larger-than-expected trade deficit.

In South Korea, the Kospi index fell 0.03%, while Hong Kong’s

Hang Seng lost 0.2% at the close. Australia had a stable close with

the S&P/ASX 200, and in New Zealand, the S&P/NZ50 rose

0.14% after the Central Bank kept the monetary rate unchanged at

5.5%, justifying the measure as necessary to control inflation.

On Tuesday, the S&P 500 and Nasdaq reached new records after

closing up 0.22% and 0.25%, respectively. Meanwhile, the Dow Jones

rose 0.17% to 39,872.99 points. Volatility prevailed as investors

reassessed the market’s strength. The expectation of interest rate

cuts by the Federal Reserve boosted gains despite uncertainty from

divergent comments. Individual stocks, like

Peloton (NASDAQ:PTON) and

AutoZone (NYSE:AZO), showed significant movements,

while tobacco and banks performed positively.

Quarterly reports are scheduled before the market opens from

Target (NYSE:TGT), Pinduoduo

(NASDAQ:PDD), TJX (NYSE:TJX),

Williams-Sonoma (NYSE:WSM), Analog

Devices (NASDAQ:ADI), Dorian LPG

(NYSE:LPG), Arbe Robotics (NASDAQ:ARBE),

Golden Ocean (NASDAQ:GOGL), and

Walkme (NASDAQ:WKME), among others.

After the close, investors await numbers from

Nvidia (NASDAQ:NVDA), Snowflake

(NYSE:SNOW), Synopsys (NASDAQ:SNPS), VF

Corp (NYSE:VFC), Elf Beauty (NYSE:ELF),

Agora Inc. (NASDAQ:API), Grupo

Supervielle (NYSE:SUPV), LiveRamp

Holdings (NYSE:RAMP), Star Bulk Carriers

(NASDAQ:SBLK), and more.

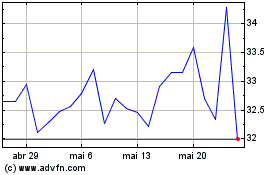

LiveRamp (NYSE:RAMP)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

LiveRamp (NYSE:RAMP)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024