SushiSwap innovates with council structure in its new phase, Sushi

Labs

The decentralized exchange SushiSwap (COIN:SUSHIUSD) has

announced the transition of its management to a new format called

Sushi Labs. Replacing the DAO model, the new system adopts a

council structure to streamline decision-making and improve market

responsiveness. Launched on June 11, Sushi Labs will manage the

operational, technical, and administrative aspects of the

ecosystem. Jared Grey, now the director of the Labs, expressed

confidence in the structural renewal to revitalize the Sushi DEX,

especially following a significant financial decline since

2022.

PancakeSwap introduces gas-free transactions with Zyfi partnership

PancakeSwap (COIN:CAKEUSD), a popular decentralized exchange

(DEX), has significantly enhanced accessibility to DeFi by

integrating with Zyfi in the zkSync Era, enabling gas-free

transactions. This innovation eliminates the need for users to pay

gas fees, which were previously a significant barrier, especially

for newcomers who needed to acquire Ether first. Now, users can pay

fees using a variety of ERC-20 tokens, making transactions simpler

and less costly. This change not only improves the user experience

but also may increase the adoption of DEXs by making them more

competitive with centralized exchanges, offering a more

user-friendly interface and smoother trading processes.

Bitcoin slides below $67,000 ahead of inflation data

Bitcoin (COIN:BTCUSD) fell to $66,485 in the past 24 hours,

marking the lowest value of the month, in anticipation of a crucial

inflation report in the U.S. The 4.4% drop on Tuesday reflects

market tension ahead of the imminent release of macroeconomic data

and statements from the Federal Reserve.

Fernando Pereira, an analyst at Bitget, highlighted concerns

about the correlation between stock market behavior, represented by

the S&P 500, and Bitcoin’s price. “Something that is starting

to worry about Bitcoin’s price right now is the wedge formation

that the S&P 500 is making, with strong divergence in the RSI.

If this wedge breaks down, BTC could plummet, and what will

determine whether this break happens or not is the new Fed interest

rate, to be declared on Wednesday,” Pereira noted.

Traders are now watching critical supports, with some pointing

to the possibility of buying the dip. Meanwhile, the increase in

open contracts suggests a potential escalation in market

volatility.

Bitcoin ETFs in the U.S. see first net outflow after 19 days of

gains

After a record 19-day streak of net inflows, Bitcoin ETFs in the

U.S. faced outflows of $65 million on Monday. The Grayscale ETF

(AMEX:GBTC) led the losses with $40 million, followed by Invesco

(AMEX:BTCO) with $20 million. Recent market volatility and the

anticipation of significant economic events, such as Janet Yellen’s

speech and the FOMC meeting, may have influenced these

withdrawals.

SEC acknowledges ProShares Ethereum ETF proposal, approves changes

for 21Shares

The U.S. SEC acknowledged a proposed rule change for ProShares’

Ethereum ETF but has not yet approved the change, leaving a window

of up to 135 days for final deliberation. Meanwhile, the SEC

allowed 21Shares to proceed with changes, removing Ark Invest from

the project without usual delays, facilitating the continuation of

the process. Ark Invest decided not to proceed with its Ethereum

ETF, maintaining focus solely on the Bitcoin ETF.

Lido launches initiative with Mellow Finance to revitalize stETH

Lido (COIN:LDOUSD), prominent in the Ethereum DeFi ecosystem,

faces challenges with the “restake” trend. In response, it launched

a partnership with Mellow Finance to strengthen the position of

stETH (COIN:STETHUSD). This collaboration, part of the new Lido DAO

initiative, will allow traders to access advanced restake tools.

With this, Lido aims to reposition stETH as the preferred choice

for restaking, combating the loss of influence to new services like

EigenLayer.

ZKsync announces distribution of 3.675 billion tokens in airdrop

The ZKsync Association confirmed the airdrop of 3.675 billion ZK

tokens to users and contributors of the Ethereum Layer 2 network

next week. This represents 17.5% of the total 21 billion tokens.

Beneficiaries can claim their tokens until January 2025. Most of

the remaining tokens will be allocated to ecosystem initiatives,

with smaller percentages designated for investors and the Matter

Labs team, promoting greater community engagement and

governance.

MultiversX promises to revolutionize blockchain with enhanced

scalability

The MultiversX (COIN:EGLDUSD) platform promises a leap in the

efficiency of layer 2 blockchains, with up to a 100-fold increase

in transaction throughput thanks to new Sovereign Chains. This

technology allows L2 networks to inherit the scalability of

MultiversX, significantly boosting transactions per second. During

a test, the network achieved 77,000 TPS, with potential to reach

100,000 TPS. Sovereign Chains aim to simplify the interaction

between applications of different blockchains, enabling a seamless

and consistent user experience. These layers operate as invisible

backends, eliminating the need for users to understand the

technical complexity of each chain.

Ripple completes acquisition of Standard Custody & Trust

Company and launches XRPL fund for blockchain innovation in Asia

Ripple (COIN:XRPUSD) announced the completion of the acquisition

of Standard Custody & Trust Company, strengthening its

infrastructure with an NYDFS-regulated trust entity. This move,

following the purchase of Metaco, aims to improve Ripple’s product

offerings and facilitate the launch of a stablecoin. Jack McDonald,

CEO of Standard Custody, will also assume the role of senior vice

president of stablecoins at Ripple.

In related news, Ripple created the XRPL Japan and Korea Fund,

committing 1 billion XRP to stimulate blockchain innovation in

these markets. According to Emi Yoshikawa, VP of strategic

initiatives, the fund aims to integrate the XRP Ledger into

business operations and support developers and startups. Ripple

intends to strengthen its presence and impact in the region,

standing out in blockchain solution development and deepening XRP

Ledger adoption.

Tether plans to invest $1 billion in technology and biotech next

year

Tether (COIN:USDTUSD) CEO Paolo Ardoino revealed plans to invest

$1 billion in the next twelve months, focusing on sectors like

financial infrastructure, artificial intelligence, and

biotechnology. In a recent interview with Bloomberg, Ardoino

highlighted that the investment strategy continues the $2 billion

previously applied in these sectors. Additionally, part of the

profits from the reserves of the largest stablecoin operator USDT

will be reinvested in innovations that promote independence from

big tech.

Tiplink innovates cryptocurrency adoption with Google-linked wallet

Solana-focused startup TipLink introduced a new tool designed to

simplify blockchain access for beginners. The “TipLink Wallet

Adaptor” allows users to create a crypto wallet directly in the

browser, linked to their Google account. This solution dispenses

with the need for complex setups in traditional wallets like

Phantom or Solflare. Ian Krotinsky, the company’s CEO, bets that

this ease of use will attract a broader audience, especially those

less familiar with cryptocurrency technology.

DeFi Technologies applies innovative Bitcoin staking on Core Chain

Canadian company DeFi Technologies (USOTC:DEFTF) announced an

investment of over $100 million in Bitcoin (COIN:BTCUSD) to act as

a validator on the Core Chain, a first-layer blockchain. This move

follows the company’s strategy to adopt Bitcoin as its primary

reserve asset, starting with an initial acquisition of 110 BTC.

Through this commitment, DeFi Technologies reinforces its role in

the decentralized finance ecosystem, actively participating in

network consensus and leveraging the innovative Satoshi Plus

staking mechanism.

Metaplanet increases Bitcoin investment and boosts shares

Japanese investment company Metaplanet (TSX:3350) announced the

acquisition of additional bitcoins, totaling 250 million yen ($1.6

million), bringing its total to 141 BTC, approximately $9.4

million. The purchase marks the third acquisition since April 2024

and is part of the company’s strategy to use bitcoin as a reserve

asset in response to Japan’s high public debt and yen

volatility.

Crypto.com receives regulatory approval in Ireland and expands

operations

The Central Bank of Ireland granted Crypto.com, one of the

largest cryptocurrency trading platforms, authorization as a

virtual asset service provider (VASP). This approval allows the

company to expand its service offerings in the country, including

exchanges and fiat wallets. Crypto.com joins other major regulated

entities in Ireland, such as Coinbase Global (NASDAQ:COIN) and

Ripple.

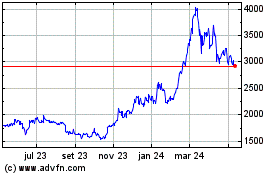

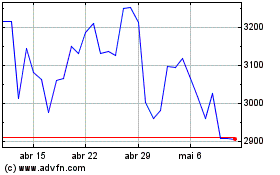

stETH (COIN:STETHUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

stETH (COIN:STETHUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025