OpenAI, Microsoft (NASDAQ:MSFT),

Apple (NASDAQ:AAPL) – Microsoft has given up its

observer seat on OpenAI’s board, which has attracted regulatory

attention in Europe and the US, following improvements in the AI

startup’s governance over the past eight months. Apple, which

recently integrated OpenAI’s ChatGPT into its devices, also opted

not to take on the observer role, contrary to expectations,

according to the Financial Times. OpenAI plans a new approach to

engagement with strategic partners like Microsoft and Apple through

regular stakeholder meetings. Microsoft shares rose 0.56% in

pre-market trading.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – TSMC, the world’s largest contract chipmaker, reported

strong second-quarter revenue growth, surpassing market forecasts

due to high demand for AI applications. April-June revenue was

$20.67 billion, up 32% from the same period last year. TSMC expects

a 30% increase in second-quarter net profit. Shares rose 1.83% in

pre-market trading.

Apple (NASDAQ:AAPL) – Global shipments of

personal computers rose 3% in the second quarter, driven by demand

for devices with artificial intelligence capabilities, with Apple

posting the highest growth among manufacturers, according to

preliminary data from IDC. This marks two consecutive quarters of

growth after two years of decline. Apple shares rose 0.38% on

Tuesday, closing the day with a market capitalization above $3.5

trillion. The recent increase was driven by the company’s new AI

strategy and potential better iPhone sales in China. Shares rose

0.14% in pre-market trading.

Samsung Electronics (KOSPI:005935) – Samsung

Electronics will launch a new health tracking feature that Apple

watches do not yet have, in an attempt to gain an advantage over

the American electronics leader. The new Galaxy Watch models will

monitor the Advanced Glycation End Products (AGEs) index, which can

indicate the user’s metabolic health and biological age.

Nvidia (NASDAQ:NVDA) – Nvidia shares closed up

2.5% on Tuesday, boosted by positive analyses and investments in AI

infrastructure. Following a recent correction, the shares are

approaching their all-time high, with predictions of increased

demand for chips and data center expansion. Shares rose 0.91% in

pre-market trading.

Intel (NASDAQ:INTC) – Intel shares are

recovering after a significant 38% drop in the first half of the

year. The company saw a 1.8% increase on Tuesday and has gained

12.2% over the last five trading sessions, marking its best

five-day performance since November 2023. Some analysts see the

recent rise as a result of short position adjustments, while others

are skeptical about a sustainable recovery beyond current levels.

Shares rose 0.17% in pre-market trading.

Aehr Test Systems (NASDAQ:AEHR) – Aehr Test

Systems released preliminary financial results for the fourth

quarter and fiscal year 2024. The company expects revenue of

approximately $16.6 million and net income of about $23.8 million

in the fourth quarter. For 2024, it expects $66.2 million in

revenue and $33.1 million in net income. Shares rose 14.50% in

pre-market trading.

Smart Global Holdings (NASDAQ:SGH) – Smart

Global Holdings reported third-quarter fiscal profit despite a 13%

annual revenue decline, totaling $300.6 million. The company

estimates fourth-quarter sales between $300 million and $350

million, differing from analysts’ expectations of $325 million.

Shares rose 5.21% in pre-market trading.

Baidu (NASDAQ:BIDU) – Baidu saw a significant

increase in interest in its Apollo Go robotaxi service in China,

resulting in a rise in optimistic purchase options for the company.

This growing interest is related to Beijing’s recent announcement

to support robotaxis for transport fleets and car rentals,

signaling potential technology expansion. Shares rose 1.57% in

pre-market trading.

Meta Platforms (NASDAQ:META) – Meta announced

it will begin removing more posts attacking “Zionists” when the

term is used to refer to Jews and Israelis, rather than supporters

of the political movement. The policy update follows consultations

with various groups and comes amid rising tensions in the Middle

East.

Oracle (NYSE:ORCL) – Elon Musk’s AI startup,

xAI, and Oracle ended negotiations on a potential $10 billion

server deal, according to The Information. The discussions aimed to

expand an existing agreement where xAI rented Nvidia AI chips

through Oracle. Negotiations stalled over Musk’s demands for rapid

supercomputer construction and Oracle’s concerns about power

capacity at the desired site.

UiPath (NYSE:PATH) – UiPath announced on

Tuesday that it will cut 10% of its global workforce, eliminating

about 420 jobs as part of a restructuring plan to reduce operating

expenses. This decision marks a significant shift since Daniel

Dines resumed as CEO after Rob Enslin’s resignation in May. Shares

rose 0.84% in pre-market trading.

LegalZoom (NASDAQ:LZ) – LegalZoom lowered its

full-year sales forecast and announced the departure of its CEO,

who will be replaced by one of the company’s largest individual

shareholders. Jeffrey Stibel, current chairman of the board with

approximately 3.5% ownership, will immediately assume the CEO role,

replacing Dan Wernikoff. The platform, which provides legal,

accounting, and other services for small businesses, now expects

sales between $675 million and $685 million, down from the previous

forecast of $700 million to $720 million. Shares fell 17.2% in

pre-market trading.

Goldman Sachs (NYSE:GS) – Goldman Sachs Asset

Management predicts that the US economy will grow more slowly in

the second half of 2024, around 2%, with stock indexes projected to

remain predominantly stable due to slowing profits and political

anxieties. GSAM sees opportunities in AI stocks and fixed-income

markets, especially in high-yield bonds and structured credit.

Citigroup (NYSE:C) – Citigroup strategists led

by Drew Pettit suggest that despite the strong performance of

AI-related stocks, investors should consider taking profits,

especially among chip manufacturers. Although sentiment is

optimistic, with cash flow forecasts exceeding expectations, they

warn of potential volatility and highlight the need for

diversification within the AI sector.

HSBC Holdings (NYSE:HSBC) – HSBC is

restructuring parts of its investment bank to resemble competitors

like Citigroup Inc. Sector coverage groups are being combined to

increase banker efficiency in providing services to clients in

response to challenging market conditions.

Wells Fargo (NYSE:WFC) – Wells Fargo announced

the appointment of Alexandra Barth as co-head of its leveraged

finance business, strengthening its team while seeking to expand

its investment banking operations. The bank has bolstered its

investment banking unit, adding more than 50 bankers and operators

since 2020. Barth, who previously co-led leveraged finance at

Deutsche Bank, where she worked for nearly 25 years, will now lead

the team alongside Trip Morris, reporting to Tim O’Hara.

UBS Group AG (NYSE:UBS) – UBS is changing its

leadership in Florida, appointing Lane Strumlauf as market

executive for the state, replacing Brad Smithy. Strumlauf, who has

been with UBS for 17 years and recently served as market executive

in Atlanta, will now oversee approximately 600 employees in over 20

offices in Florida. The change reflects the growing importance of

the Florida market for UBS, which has attracted many wealthy

clients in recent years.

Fifth Third Bancorp (NASDAQ:FITB) – Fifth Third

Bancorp agreed to pay $20 million in fines and compensate 35,000

consumers for unauthorized account openings and illegal car

repossessions. The Cincinnati bank, without admitting or denying

the charges, will also pay specific fines to resolve these issues,

as announced by the U.S. Consumer Financial Protection Bureau

(CFPB).

Blackstone (NYSE:BX) – Blackstone has hired

Tyler Dickson, former global head of investment banking at

Citigroup, to lead client relations in its credit and insurance

unit. Dickson, a 30-year Citi veteran, will now oversee the

Institutional Client Solutions team at Blackstone Credit &

Insurance (BXCI).

BlackRock (NYSE:BLK) – BlackRock Investment

Institute (BII) stated that the recent UK parliamentary elections

made the valuation of UK stocks attractive, while Japanese stocks

remain their top equity investment choice. The historic defeat of

the British Conservative Party in the election increased perceived

political stability, improving sentiment, according to Wei Li,

BlackRock’s chief investment strategist.

KKR & Co (NYSE:KKR) – Kokusai Electric

announced a secondary offering of up to 60.4 million shares, valued

at approximately $2.02 billion, including additional lots. This

follows a significant increase in the shares of the Japanese chip

equipment maker, driven by expectations of investments in

technology such as artificial intelligence. KKR’s stake, which

plans to sell part of its shares, would fall to 23%, down from

about 43% previously.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway’s stock portfolio exceeded $400 billion, mainly driven by

the performance of Apple, its largest holding, which hit a record

high on Tuesday. Despite the increase in portfolio value,

Berkshire’s stock price rose only about 1% this quarter, lagging

the S&P 500’s performance. The company, dominated by its Apple

holding, which accounts for about 44% of its stocks, expects to

report results on August 3.

Tesla (NASDAQ:TSLA) – Tesla shares are on an

impressive winning streak, making them the most expensive in over

two years. After nine consecutive days of gains, totaling about

39%, and an increase of more than 80% since the 52-week low before

the first-quarter earnings announcement, which exceeded

expectations. On Tuesday, shares closed up 3.7%, while the

price-to-earnings ratio rose significantly, indicating that the

shares are now valued at 88 times future earnings. With Tesla

anticipating improvements such as higher battery storage sales and

vehicle deliveries, along with a future robotaxi event, investors

are optimistic but cautious about the company’s valuation. Shares

rose 0.92% in pre-market trading.

VinFast Auto (NASDAQ:VFS) – The Vietnamese

electric vehicle manufacturer is seeking a bank loan of about $250

million to finance the construction of its assembly plant in

Subang, Indonesia. Controlled by Pham Nhat Vuong, the company aims

to expand regionally and compete in the global electric vehicle

market.

Ford Motor (NYSE:F) – Ford Motor is receiving a

reduced incentive package from the state of Michigan for its

battery plant in Marshall, after cutting expected production to

match electric vehicle demand. The revised package offers up to

$409 million, down from $1.03 billion previously. The plant will

start production in 2026. Shares rose 0.1% in pre-market

trading.

Boeing (NYSE:BA) – Boeing reported that June

had the highest number of commercial jet deliveries of the year,

with 44 aircraft, a 27% reduction from the previous year due to

legal and production challenges. The company faces supply chain

difficulties and increased regulatory scrutiny. Shares rose 0.15%

in pre-market trading.

Delta Air Lines (NYSE:DAL) – Riyadh Air, Saudi

Arabia’s new airline, partnered with US-based Delta Air Lines to

expand its network before starting commercial operations next year.

Riyadh Air will be the second national airline, based in Riyadh,

alongside Jeddah-based Saudia. Delta will be Riyadh Air’s only

partner in North America, offering access to hundreds of

destinations in the US.

Goodyear Tire & Rubber Company (NASDAQ:GT),

Yokohama Rubber Co (TG:YRB) – Japan’s Yokohama

Rubber is negotiating the purchase of Goodyear Tire & Rubber’s

off-road tire division for at least $1 billion, according to

Bloomberg. Goodyear shares rose 1.42% in pre-market trading.

Helen of Troy (NASDAQ:HELE) – On Tuesday, Helen

of Troy reported financial results below expectations, with

adjusted earnings of 99 cents per share and revenue of $416.8

million, against estimates of $1.59 per share and $446 million in

revenue. The company expects first-quarter fiscal issues to

continue, adjusting its 2025 revenue forecast to a 6% to 3.5%

decline, worse than previous estimates.

Koss Corp. (NASDAQ:KOSS) – Koss Corp. shares

closed down 5.4% on Tuesday, after already dropping 21.4% on

Monday. Rumors of investment by Keith Gill, the Roaring Kitty, led

to a 143.8% gain in the stock on July 3, the largest daily gain

since January 2021. In 2024, Koss shares have risen 196.1%,

outperforming the S&P 500 index. The company also reported a

22% revenue decline in the third fiscal quarter, attributed to

reduced consumer spending due to high inflation and energy and loan

costs. Shares rose 5.65% in pre-market trading.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle

Mexican Grill veteran Jack Hartung will retire as CFO on March 31.

Adam Rymer, with 15 years at Chipotle and current vice president of

finance, will succeed him as CFO starting January 1. Shares rose

0.12% in pre-market trading.

Kura Sushi USA (NASDAQ:KRUS) – Kura Sushi

increased sales last quarter after adjusting menu prices but faced

a loss due to high labor costs. Revenue grew 28%, reaching $63.1

million, in line with expectations. The net loss was $558,000, or

-5 cents per share, compared to a profit of $1.7 million, or 16

cents per share, in the same period last year. FactSet analysts

expected 1 cent per share profit. The company revised its annual

revenue projections to $235 million to $237 million, down from the

previous range of $243 million to $246 million.

Tyson Foods (NYSE:TSN) – Tyson Foods agreed to

sell a chicken processing facility to House of Raeford Farms as

part of its strategy to regain profitability. Raeford Farms, a

family-owned meat producer, plans to maintain operations at the

Georgia plant with the current workforce and grower network. Tyson

will continue to fulfill customer orders from other locations.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – Kroger disclosed details of the stores, distribution

centers, and plants it plans to sell to gain regulatory approval

for its merger with Albertsons Cos. The sale, including 579

locations in several states, aims to address antitrust concerns

before a trial scheduled for August.

Cigna Group (NYSE:CI), CVS

Health (NYSE:CVS), UnitedHealth Group

(NYSE:UNH) – The federal government intensified its campaign

against pharmacy benefit management companies with a critical

report from the Federal Trade Commission, alleging these companies

are raising drug costs and harming independent pharmacies. The

report, the result of a two-year ongoing investigation, blames the

industry for high drug prices in the US, highlighting the control

they exert, negatively impacting independent pharmacies. Despite

the criticism, the commission does not plan immediate regulatory

actions.

Tempus AI (NASDAQ:TEM) – Wall Street brokers

began covering Tempus AI, backed by SoftBank, with an optimistic

view, betting that its library of clinical and molecular data will

drive more powerful diagnostics and tests. Seven brokers, including

JPMorgan and Morgan Stanley, gave a “Buy” or “Overweight” rating,

boosting the company’s shares. The company sells genomic tests in

various medical fields and expects revenue and profit growth in the

coming years. Shares rose 2.61% in pre-market trading.

Pfizer (NYSE:PFE) – Mikael Dolsten, Pfizer’s

Chief Scientific Officer and a key figure in the development of the

Covid-19 vaccine, will leave the company after more than 15 years.

During his tenure, Dolsten led major projects, including the

Comirnaty vaccine and drugs like Vyndaqel and Eliquis. The search

for his successor has already begun. Shares fell 0.11% in

pre-market trading.

Novo Nordisk (NYSE:NVO), Eli

Lilly (NYSE:LLY) – An analysis showed that Eli Lilly’s

treatment promotes faster and more significant weight loss than

Novo Nordisk’s treatment. The analysis, which is not a direct

clinical trial, was based on health records and showed better

weight loss results with Mounjaro compared to Ozempic. Novo Nordisk

stated that direct comparisons in clinical trials are necessary,

while Lilly is conducting a more comprehensive study expected to

conclude this year. Novo shares fell -0.45% in pre-market

trading.

United Parcel Service (NYSE:UPS) – UPS

appointed longtime employee Brian Dykes as the new Chief Financial

Officer. Dykes, with over 25 years at the company, replaces Brian

Newman. The change comes as UPS faces higher labor costs due to the

new contract with the Teamsters and won an air cargo contract from

USPS, replacing FedEx.

Union Pacific (NYSE:UNP) – Union Pacific

reported that it has resumed most of its operations in Texas,

affected by Hurricane Beryl, but expects some disruptions until

power and road access are fully restored. Except for the Galveston

area, all impacted track segments were quickly reactivated. The

company warns of potential delivery delays by train in affected

areas.

Vale (NYSE:VALE) – Consulting firm Russell

Reynolds presented Vale’s board, one of the world’s largest iron

ore miners, with 15 potential candidates to replace current CEO

Eduardo Bartolomeo. The nominees include leaders from major

Brazilian companies like Francisco Gomes Neto from Embraer, Gustavo

Werneck from Gerdau, and Cristiano Teixeira from Klabin. Vale

expects to announce the new CEO by December. Shares fell 0.26% in

pre-market trading.

ArcelorMittal (NYSE:MT) – ArcelorMittal South

Africa decided to keep its long steel production unit, providing

South Africa with an opportunity to revitalize local manufacturing,

according to Philippa Rodseth, executive director of the

Manufacturing Circle. The move could sustain 270,000 jobs if

supported by industry, government, and workers. Shares rose 0.63%

in pre-market trading.

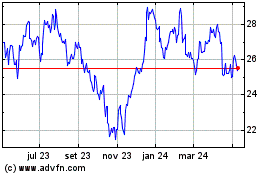

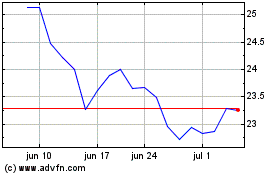

Arcelor Mittal (NYSE:MT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Arcelor Mittal (NYSE:MT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024