TSMC Net Profit Hits $7.6B; Nokia Sees 32% Decline in Operating Profit; Novartis Boosts Outlook After Profit Surge

18 Julho 2024 - 6:53AM

IH Market News

Taiwan Semiconductor Manufacturing Company

(NYSE:TSM) – TSMC exceeded earnings and revenue expectations in the

second quarter with $20.82 billion in revenue and a net profit of

$7.6 billion. Strong demand for advanced chips for AI applications

drove a 40.1% increase in revenue and a 36.3% rise in profit

year-over-year. TSMC also adjusted its capital expenditure to up to

$32 billion. The company maintains substantial investments in

technology development and plans to start mass production of

2-nanometer chips in 2025. Revenue is expected to reach up to $23.2

billion this quarter, raising its sales growth estimates beyond the

previously forecasted 20%. Shares rose 3.67% in pre-market

trading.

Nokia (NYSE:NOK) – Nokia reported a 32% drop in

operating profit for the second quarter, amounting to $462.38

million, due to weak demand for 5G equipment. Net sales fell 18% to

$4.9 billion, particularly in India. The revenue figure excludes

its submarine cable business, which it is selling. The company

reported an increase in gross margin to 44.7%, thanks to Mobile

Networks. The operating margin remained at 9.5%, with robust free

cash flow driving an accelerated share repurchase program. Nokia

reaffirms its full-year outlook, anticipating improved demand and a

sales rebound in the second half of the year. Shares fell 6.92% in

pre-market trading.

Novartis (NYSE:NVS) – Novartis’ second-quarter

profit increased 43%, rising from $2.28 billion to $3.24 billion.

Earnings per share increased from $1.69 to $1.97. Net sales grew

9%, from $11.43 billion to $12.51 billion. Novartis raised its

forecast for 2024 for the second time this year due to strong sales

performance of heart drugs and others. Operating income is

projected to grow from high single digits to low double digits.

Expectations exceed analysts’ forecasts, reflecting robust growth

in global markets. Shares fell 1.74% in pre-market trading.

United Airlines (NASDAQ:UAL) – United Airlines

reported adjusted earnings of $4.14 per share in the second

quarter, surpassing the analysts’ estimate of $3.93 per share as

polled by LSEG. However, revenue of $14.99 billion was lower than

the expected $15.06 billion. Shares fell 0.87% in pre-market

trading.

Alaska Air Group (NYSE:ALK) – Alaska Air Group

reported second-quarter earnings above expectations with $2.55 per

share, surpassing estimates of $2.38, and an operating revenue of

$2.9 billion. However, it forecasts a 50-cent per share drop in the

third quarter due to a new flight attendants’ contract implying an

average salary increase of 32%. The company projected adjusted

earnings of $1.40 to $1.60 per share for the period, compared to

LSEG estimates of $2.05 per share.

Discover Financial Services (NYSE:DFS) – The

bank reported second-quarter earnings per share of $6.06, exceeding

the estimate of $3.08. Revenue was $4.54 billion, above the

expected $4.18 billion. There was a 17% increase in revenue

year-over-year, rising from $3.88 billion.

Equifax (NYSE:EFX) – In the second quarter,

revenue rose 9% to $1.43 billion, and adjusted earnings reached

$1.82 per share, surpassing projections. Equifax forecasted revenue

of $1.43 to $1.45 billion for the third quarter, below Wall Street

expectations, due to the impact of high interest rates on mortgages

and other loans.

Alcoa (NYSE:AA) – The aluminum company

announced adjusted earnings of 16 cents per share, beating

analysts’ forecast of 9 cents per share as indicated by LSEG.

Revenue also exceeded expectations, reaching $2.91 billion, while

analysts anticipated $2.84 billion.

Kinder Morgan (NYSE:KMI) – The pipeline

operator reported second-quarter earnings per share of $0.25, $0.01

below analysts’ estimate of $0.26. Quarterly revenue was $3.57

billion, compared to the consensus estimate of $4.14 billion.

Steel Dynamics (NASDAQ:STLD) – The steel

producer reported earnings per share of $2.72 in the second

quarter, with revenue of $4.63 billion. Analysts consulted by LSEG

expected earnings of $2.67 per share and revenue of $4.43

billion.

Prologis (NYSE:PLD) – Prologis, specializing in

logistics real estate, raised its annual forecast for Core Funds

from Operations (FFO), expecting between $5.39 and $5.47 per share

in 2024, due to improved demand and growth in data centers. Rental

revenue in the second quarter rose to $1.85 billion, driven by

clients like Amazon, Home Depot, FedEx, and UPS.

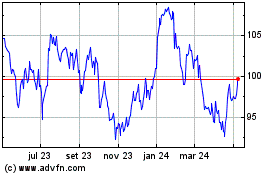

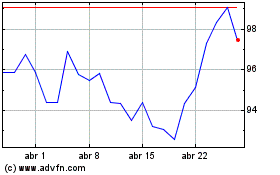

Novartis (NYSE:NVS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Novartis (NYSE:NVS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025