Bumble (NASDAQ:BMBL) – The dating and

networking app reported a Q2 profit of $37.7 million (22 cents per

share), beating the expected 15 cents, but its revenue was $268.6

million, below the $273 million forecast. For 2024, the company

projects revenue growth of 1% to 2%, below the previous

expectations of 8% to 11%. Shares fell 35.7% pre-market.

Warner Bros. Discovery (NASDAQ:WBD) – The

global media and entertainment company reported a Q2 loss of 36

cents per share, above the expected 22 cents, with revenue of $9.7

billion, below the $10.07 billion forecast. The company announced a

$9.1 billion write-down. Streaming added 3.6 million subscribers,

totaling 103.3 million. Shares fell 9.7% pre-market.

Digital Turbine (NASDAQ:APPS) – The mobile app

distribution platform reported Q1 2025 revenue of $118 million, up

5% from the previous quarter but down 19% year-over-year. The GAAP

net loss was $25.2 million (25 cents per share), compared to a loss

of $8.4 million (8 cents per share) the previous year. Non-GAAP

adjusted net income was $7.3 million (7 cents per share), compared

to $18.2 million (18 cents per share) the previous year. Adjusted

EBITDA was $14.5 million, down 46% year-over-year. The 2025 revenue

forecast is $540-560 million, with adjusted EBITDA of $85-95

million. Shares rose 18.4% pre-market.

Zillow (NASDAQ:Z) – The real estate and

valuation platform reported adjusted Q2 earnings of 39 cents per

share, beating analysts’ estimates by 12 cents. Revenue of $572

million also exceeded the $538 million forecast.

Klaviyo (NYSE:KVYO) – The e-commerce marketing

automation company reported adjusted Q2 earnings of 15 cents per

share, while revenue reached $222 million, above analysts’

expectations of 10 cents per share and $212 million.

Dutch Bros (NYSE:BROS) – The coffee and

beverage chain raised its annual revenue forecast to between $1.215

billion and $1.23 billion, close to the $1.228 billion estimate by

LSEG. In Q2, Dutch Bros reported quarterly earnings of 19 cents per

share, beating the 13 cents estimate. Quarterly revenue was $324.9

million, up 30% year-over-year and 2.55% above expectations. The

company opened 36 new stores, with same-store sales up 4.1%. Shares

fell 20.2% pre-market.

Monster Beverage (NASDAQ:MNST) – Monster

Beverage reported Q2 net sales of $1.90 billion, below the $2.01

billion estimate. Earnings per share were 41 cents, lower than the

45 cents forecast. The weak performance reflected reduced consumer

spending and the impact of higher costs on essential items. Shares

fell 8.0% pre-market.

Beyond Meat (NASDAQ:BYND) – The plant-based

meat producer exceeded Q2 revenue expectations and raised its

annual forecast, driven by price increases and cost cuts. Net

revenue was $93.2 million, above the $87.8 million estimate, and

the margin rose to 14.7%. Beyond Meat reported a loss of 53 cents

per share, versus the expected 51 cents per share loss. The company

raised its annual revenue projection to between $320 million and

$340 million.

JFrog (NASDAQ:FROG) – The artifact management

platform projected Q3 earnings per share of 9 to 11 cents and

revenue of $105 million to $106 million, while analysts expected 14

cents per share and $108 million in revenue, according to LSEG. For

fiscal 2024, it expects $422-424 million, below analysts’

expectations. In Q2, JFrog reported earnings of 15 cents per share,

above the 14 cents estimate. Revenue was $103 million, slightly

below the $103.59 million forecast. Shares fell 28.1%

pre-market.

Robinhood Markets (NASDAQ:HOOD) – Robinhood

reported Q2 earnings of 21 cents per share and record revenue of

$682 million, beating estimates of 16 cents per share and $640

million in revenue. Net income was $188 million, up from $25

million the previous year. The 2024 outlook is for strong growth,

highlighting subscriber increases and new products. Shares rose

3.1% pre-market.

Duolingo (NASDAQ:DUOL) – The language learning

app reported Q2 earnings of 51 cents per share, above the 32 cents

expected by LSEG analysts, and revenue of $178 million, $1 million

above expectations.

Occidental Petroleum (NYSE:OXY) – Occidental

Petroleum exceeded Q2 forecasts with adjusted earnings of $1.03 per

share, above the 77 cents estimate. Revenue was $6.82 billion,

exceeding the $6.80 billion forecast. Production reached 1.26

million boepd, surpassing the 1.22 million the previous year. The

company maintained its production guidance for the year. Shares

rose 1.5% pre-market.

Marathon Oil (NYSE:MRO) – Marathon Oil reported

adjusted Q2 earnings of 63 cents per share, below the 69 cents

estimate. The company reported revenue of $1.71 billion, better

than the $1.70 billion analysts’ estimate. Revenue was impacted by

a 24.9% drop in natural gas prices, which fell to $1.42 per

thousand cubic feet. Total production fell to 393,000 boepd, with a

production peak expected in Q3.

Magnite (NASDAQ:MGNI) – The independent

sell-side advertising platform reported Q2 revenue of $162.9

million, up 7%. The net loss was $1.1 million, improving from the

previous $73.9 million loss. Adjusted EBITDA increased 20% to $44.7

million. Magnite projects annual growth of at least 10% in

Contribution ex-TAC and approximately 15% in adjusted EBITDA.

SolarEdge Technologies (NASDAQ:SEDG) – The

solar energy solutions company reported higher-than-expected Q2

revenue of $265 million compared to the $262 million estimate.

However, the adjusted Q2 loss of $1.79 per share was greater than

the $1.58 per share loss expected by LSEG analysts. Shares fell

7.3% pre-market.

Applovin (NASDAQ:APP) – The mobile monetization

and advertising platform reported Q2 earnings of 89 cents per

share, exceeding the 75 cents expected by LSEG analysts. Revenue of

$1.08 billion was in line with expectations, but the metric of

monthly active payers fell year-over-year. Shares rose 1.2%

pre-market.

HubSpot (NYSE:HUBS) – HubSpot reported Q2

adjusted earnings of $1.94 per share, beating the $1.64 estimate.

Revenue grew 20% year-over-year, reaching $637.2 million, above the

$619.28 million forecast. The company raised its annual outlook to

adjusted earnings of $7.64-7.70 per share and revenue of

$2.567-2.573 billion.

Fastly (NYSE:FSLY) – The content delivery

network issued a pessimistic full-year outlook. Fastly expects a

loss of 16 to 11 cents per share on revenue between $530 million

and $540 million, while analysts forecasted a loss of 11 cents per

share and $558 million in revenue, according to LSEG. The Q3

revenue forecast is $130-134 million, below the $140 million

expected. In Q2, Fastly had an adjusted loss of 7 cents per share,

better than the expected 8 cents. Revenue was $132.4 million, above

the $131.57 million forecast. Shares fell 18.6% pre-market.

Nextdoor Holdings (NYSE:KIND) – The social

network exceeded expectations with Q2 revenue of $63.3 million,

above the $58.3 million forecast. Adjusted EBITDA loss was $6

million, smaller than the $12.7 million estimate. The company

projected Q3 sales of $62 million, above analysts’ expectations of

$59.4 million.

Equinix (NASDAQ:EQIX) – The data center company

reported Q2 revenue of $2.16 billion, in line with analysts’

estimates. Adjusted core earnings were $1.04 billion, up 4% from

the previous quarter. For 2024, the company raised its adjusted

earnings forecast to $4.07-4.13 billion.

Viasat (NASDAQ:VSAT) – The satellite

communications and security company raised its 2025 fiscal year

revenue forecast, predicting steady or slightly upward growth due

to high demand for its connectivity solutions. In Q1, revenue rose

44% to $1.13 billion, beating the $1.08 billion estimate. The net

loss fell to $33 million, and communications and defense segment

revenue grew 48% and 37%, respectively.

Virgin Galactic (NYSE:SPCE) – Virgin Galactic

reported a loss of $4.36 per share, better than the estimated $4.98

loss. Revenue reached $4.22 million, surpassing the $3.34 million

forecast. Cash dropped to $182.3 million, about 50% less than last

year. Commercial flights with the Delta spaceship are expected to

begin in 2026, with tickets costing around $600,000 per seat. For

Q3, a negative free cash flow of $115-125 million is expected, with

a positive outlook in H2 2026.

McKesson (NYSE:MCK) – The pharmaceutical

distribution and services company reported Q2 revenue of $79.28

billion, 6% higher than the previous year but below the $82.53

billion estimate. Earnings per share were $7.00, with a net income

of $915 million. The quarterly dividend increased 15% to $0.71. The

2025 earnings per share forecast rose to $31.75-32.55, growing 16%

to 19%.

Sarepta Therapeutics (NASDAQ:SRPT) – The gene

therapy-focused biotech reported adjusted Q2 earnings of 44 cents

per share, exceeding the -13 cents estimate, but revenue was $362.9

million, below the $394.39 million forecast. For 2025, revenue is

projected at $2.9-3.1 billion, below the $3.241 billion

expectation.

Eli Lilly (NYSE:LLY) – Eli Lilly, whose stock

has dropped nearly 20% since July, will release financial results

on Thursday. Investors await updates on the Zepbound drug, facing

shortages and competition. Analysts expect Lilly to report $10

billion in quarterly sales and earnings of $2.74 per share,

according to FactSet. The company is expected to report $927

million in Zepbound sales and $2.4 billion in Mounjaro sales.

Shares fell 0.3% pre-market.

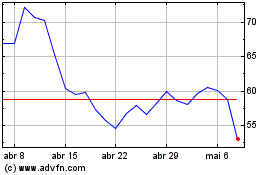

SolarEdge Technologies (NASDAQ:SEDG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

SolarEdge Technologies (NASDAQ:SEDG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024