U.S. Futures Steady as Markets Await Key Inflation Data, Oil Prices Climb

12 Agosto 2024 - 6:47AM

IH Market News

U.S. index futures are mostly unchanged in pre-market trading on

Monday, as investors anticipate crucial inflation data. After a

partial recovery from last week’s sharp drop, the market remains

cautious. Analysts suggest that volatility may persist, but strong

economic data could ease concerns and drive a recovery.

At 4:57 AM ET, Dow Jones futures (DOWI:DJI) dropped 23 points,

-0.06%. S&P 500 futures gained 0.06%, and Nasdaq-100 futures

rose 0.13%. The 10-year Treasury yield stood at 3.947%.

In commodities, oil prices rose for the fifth consecutive time

following a 3% gain last week. This recovery is driven by reduced

U.S. recession fears and escalating Middle East tensions.

Geopolitical risks, especially potential retaliation from Iran and

the intensifying Gaza conflict, have heightened uncertainty and

pushed oil prices higher.

West Texas Intermediate crude for September rose 0.91% to $77.54

per barrel, while October Brent crude increased 0.64% to $80.17 per

barrel.

On Monday’s U.S. economic calendar, the monthly federal budget

report for July is due at 2:00 PM ET. The median forecast is for a

$241 billion deficit, compared to the previous $221 billion

deficit.

Asia-Pacific markets posted mixed results on Monday, with South

Korea’s Kospi up 1.15%, driven by SK Hynix’s performance.

Australia’s S&P/ASX 200 rose 0.46%. Hong Kong’s Hang Seng saw a

slight increase of 0.13% in late trading. In contrast, China’s CSI

300 fell 0.17%. Japan was closed for a holiday.

Investors were also focused on key economic indicators from

India, including inflation and industrial production data. India’s

annual inflation is expected to have dropped to 3.65% in July from

5.08% in June, with June’s industrial production projected at 5.5%,

slightly below May’s 5.9%.

Meanwhile, Bharti Enterprises, a major Indian conglomerate,

plans to acquire 24.5% of BT Group for around $4 billion, initially

purchasing 9.99% from Altice and the rest after regulatory

approval. Adani Group shares dropped following accusations from

Hindenburg Research about potential conflicts of interest involving

the head of India’s market regulator, though most losses were

recovered.

In South Korea, memory chip exports to Taiwan surged 225.7% in

the first half of the year compared to the previous year. This

growth was driven by SK Hynix’s (KOSPI:000660) high-bandwidth chips

supplied to Nvidia (NASDAQ:NVDA), which uses Taiwan’s TSMC

(NYSE:TSM) for chip manufacturing.

European markets started the week higher, led by the financial

services and insurance sectors, buoyed by optimism after last

week’s volatility. Investors are focusing on upcoming U.S. and UK

inflation reports, with Wednesday’s UK inflation data being

particularly relevant following the recent 25-basis-point rate cut

by the Bank of England.

In the last session, U.S. stocks closed slightly higher,

extending Thursday’s gains and easing the earlier week’s sell-off.

On Friday, the Dow Jones rose 0.13%, the S&P 500 advanced

0.47%, and the Nasdaq gained 0.51%. The lack of significant

economic data and caution ahead of this week’s crucial inflation

and retail sales reports reflected market hesitation. Last week,

the S&P 500 fell less than one-tenth of 1%, the Nasdaq declined

0.2%, and the Dow dropped 0.6%.

Before the market opens, companies reporting quarterly results

include

Monday.com (NASDAQ:MNDY), Barrick

Gold Corporation (NYSE:GOLD), Esperion

Therapeutics (NASDAQ:ESPR), KE

Holdings (NYSE:BEKE), Ballard Power

Systems (NASDAQ:BLDP), Orla

Mining (AMEX:ORLA), China Vuchai

International (NYSE:CYD), Central

Puerto (NYSE:CEPU), Adaptimmune

Therapeutics (NASDAQ:ADAP), Beasley

Broadcast Group (NASDAQ:BBGI).

After the market closes, reports are expected from

Terawulf (NASDAQ:WULF), Freightcar

America (NASDAQ:RAIL), Arq

Inc (NASDAQ:ARQ), Adecoagro (NYSE:AGRO), DoubleDown

Interactive Company (NASDAQ:DDI), Rumble

Inc (NASDAQ:RUM), Sun Life

Financial (NYSE:SLF), DHT

Holdings (NYSE:DHT), Perspective

Therapeutics (AMEX:CATX), Crescent

Capital BDC (NASDAQ:CCAP), and others.

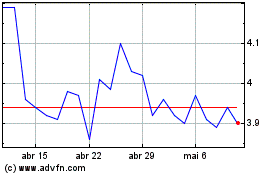

Orla Mining (AMEX:ORLA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

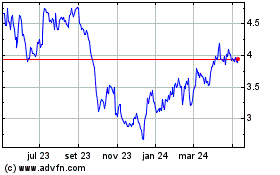

Orla Mining (AMEX:ORLA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024