U.S. index futures advanced in premarket trading on Monday after

a tough week marked by concerns over labor market slowdown.

Investors are awaiting two inflation reports this week that could

impact the Federal Reserve’s upcoming decisions on interest

rates.

As of 5:09 AM, Dow Jones futures (DOWI:DJI) rose 210 points, or

0.52%. S&P 500 futures gained 0.66%, and Nasdaq-100 futures

advanced 0.89%. The 10-year Treasury yield stood at 3.761%.

On today’s U.S. economic calendar, at 10 AM, July wholesale

inventories are expected to grow 0.3%, following a previous 0.2%

increase. At 3 PM, the August consumer credit report is expected,

with a forecasted rise of $12 billion, compared to $8.9 billion in

the previous period.

In the commodities market, oil futures rose due to the threat of

a potential hurricane in the U.S. Gulf Coast and market adjustment

after weaker-than-expected U.S. jobs data. West Texas Intermediate

crude for October rose 1.32%, reaching $68.56 per barrel, while

November Brent crude advanced 1.20%, to $71.91 per barrel.

Hedge funds are more bearish on crude oil than at any point in

the past 13 years, according to a Bloomberg report. They reduced

their positions in Brent and WTI to the lowest level since 2011,

according to ICE Futures Europe and CFTC data for the week ending

September 3. The drop in prices reflects concerns over demand and

supply expansion, including Libyan production and potential changes

in OPEC+ policies.

Morgan Stanley adjusted its forecast for Brent crude prices, now

projecting $75 per barrel in the fourth quarter due to demand

concerns and abundant supply. Brent recently fell to its lowest

level since 2021, with analysts highlighting risks of oversupply

and weak demand.

Iron ore futures fell for the seventh consecutive time on

Monday, hitting their lowest level since August. Weak economic data

from China and sluggish steel demand weighed on prices.

The most traded January iron ore contract on China’s Dalian

Commodity Exchange (DCE) closed the morning session down 1.32%, at

$94.70 per metric ton. Benchmark iron ore for October (SZZFV4) on

the Singapore Exchange fell 1.15%, to $90.65 per ton.

Asia-Pacific markets had a negative Monday following weak U.S.

jobs data, with Chinese inflation and Japanese GDP also falling

short of expectations.

In Hong Kong, the Hang Seng dropped 1.77% in the final hour of

trading, leading regional losses. China’s CSI 300 declined 1.19%,

while Japan’s Nikkei 225 lost 0.48%. In South Korea, the Kospi fell

0.33%, and in Australia, the S&P/ASX 200 slipped 0.32%.

In China, August consumer inflation rose to 0.6%, the highest in

six months, mainly due to high food prices caused by

weather-related disasters. However, core inflation remained low,

signaling deflation in producer prices and a weakening economy.

According to a Reuters poll, China’s exports are expected to

grow at the slowest pace in four months in August, with a projected

6.5% year-on-year increase, down from 7% in July. Imports are also

expected to rise by only 2%, indicating weak domestic demand and

economic challenges.

In Japan, the economy grew 2.9% in the second quarter, below the

3.2% forecast, due to revisions in corporate and household

spending. The Bank of Japan is considering further interest rate

hikes, focusing on boosting domestic demand and ending its long

period of monetary stimulus. Instability in consumption could

affect future growth.

Japanese company Mitsubishi Chemical (USOTC:MTLHY) is

considering selling its pharmaceutical unit, Mitsubishi Tanabe

Pharma, for over $3.5 billion, according to Nikkei. The company has

hired a financial advisor and is seeking potential buyers, but

negotiations are in the early stages. Mitsubishi Chemical denied

being in advanced talks and is reviewing its business

portfolio.

In Australia, Westpac (ASX:WBC), the country’s second-largest

mortgage lender, promoted Anthony Miller, former head of Deutsche

Bank in Australia, to CEO effective December 16. He will replace

Peter King, who is retiring after implementing governance

improvements and facing a period of regulatory turbulence.

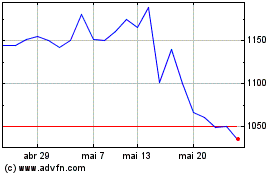

European markets are trading higher on Monday, with technology

and travel and leisure sectors leading gains, while luxury stocks

faced declines, with Burberry (LSE:BRBY) falling 5.3% after being

removed from the FTSE 100 index last week following a significant

drop in its share value, driven by weak demand. No major financial

results or economic data are expected today.

Eurozone officials indicated that the European Central Bank is

likely to cut interest rates on Thursday, setting the stage for the

U.S. Federal Reserve’s action the following week. This adjustment

reflects a global trend of monetary easing, with investors watching

for possible additional cuts later this year and the ECB’s upcoming

decisions.

Barratt Developments (LSE:BDEV) formed a joint venture with

Lloyds Banking Group (NYSE:LYG) and Homes England to build

thousands of homes in the UK. The partnership, called MADE

Partnership, will receive $197 million in funding and will focus on

large residential and community projects. The first projects are

expected to be delivered in 2028/29.

The Bank of London raised $55 million in a funding round led by

Mangrove Capital Partners last month. The funds will help expand

its presence in the UK. Customer deposits exceeded £500 million in

August. Recently, Stephen Bell took over as CEO, replacing Anthony

Watson, who now serves as senior advisor.

Schroders Plc (LSE:SDR) raised €400 million for its European

acquisition fund, Schroders Capital Private Equity Europe Direct

III. The capital, sourced from investors such as pension funds and

family offices, will allow the company to pursue mid-market

opportunities. Since January 2022, Schroders Capital has raised

over $2.6 billion for private equity investments.

On Friday, U.S. stocks fell after a weaker-than-expected jobs

report. The Nasdaq plunged 2.55%, while the S&P 500 and Dow

Jones dropped 1.73% and 1.01%, respectively. Concerns over economic

growth and a possible delay in the Federal Reserve’s actions to cut

interest rates fueled the sell-off.

The U.S. Labor Department’s jobs report showed non-farm payrolls

increased by 142,000 jobs in August, below expectations of 160,000

jobs. Additionally, June and July data were revised downward, with

a net loss of 86,000 jobs. The unemployment rate dropped to 4.2%,

increasing the chances that the Federal Reserve may not cut rates

by half a point. Despite the slowdown, wages grew, which should

sustain consumer spending and prevent a recession.

Last week, the Nasdaq fell 5.8%, the S&P 500 dropped 4.3%,

and the Dow Jones lost 2.9%, reflecting trader pessimism.

Before the market opens, Abivax

SA (NASDAQ:ABVX) will release its quarterly

report.

After the close, numbers are expected from

Oracle (NYSE:ORCL), Rubrik (NYSE:RBRK), Limoneira (NASDAQ:LMNR), BioStem

Technologies (USOTC:BSEM), Calavo

Growers (NASDAQ:CVGW), Mission

Produce (NASDAQ:AVO), Skillsoft (NYSE:SKIL), Matrix

Service Company (NASDAQ:MTRX) and Avid

Bioservices (NASDAQ:CDMO).

Burberry (LSE:BRBY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Burberry (LSE:BRBY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024