American International Group (NYSE:AIG) – AIG

has appointed Keith Walsh as Executive Vice President and Chief

Financial Officer, effective October 21. Walsh brings over 20 years

of experience, having been CFO at Marsh and an equity analyst at

Citi. He will succeed Sabra Purtill and report to CEO Peter

Zaffino.

Progyny (NASDAQ:PGNY) – Progyny announced that

a “significant” client, responsible for around 670,000 members and

12% of its revenue in the first half of the year, will terminate

its service contract as of January 1. Despite this, Progyny

maintains expectations of membership growth in 2025. Shares fell

23.9% in pre-market trading after closing down -1.5% on

Wednesday.

Exicure (NASDAQ:XCUR) – Exicure received an

extension for its Nasdaq listing, conditional on proving it meets

all applicable criteria by November 14. The biotech company

recently regained compliance with the minimum bid price requirement

of $1 last week. Shares surged over 190% in pre-market trading,

priced at $6.57, after closing up 3.6% on Wednesday.

Alibaba (NYSE:BABA) – Alibaba is releasing over

100 of its language models to the open-source community, marking a

significant advance in artificial intelligence. The initiative

includes models from the Qwen 2.5 series, covering language, audio,

and vision. The announcement was made during Alibaba Cloud’s annual

event in Hangzhou. Shares rose 4.2% in pre-market trading after

closing down -0.3% on Wednesday.

Moody’s (NYSE:MCO), Fifth Third

Bancorp (NASDAQ:FITB), First Citizens

(NASDAQ:FCNCA), Regions Financial (NYSE:RF),

Huntington Bancshares (NASDAQ:HBAN) – Moody’s

upgraded the debt outlook for Fifth Third Bancorp, First Citizens,

Regions Financial, and Huntington Bancshares from negative to

stable, citing stronger balance sheets. The improvement reflects

enhanced capital and liquidity positions, despite challenges from

high deposit costs. First Citizens’ acquisitions also received

praise.

Microsoft (NASDAQ:MSFT) – Microsoft President

Brad Smith warned of increased foreign interference in U.S.

elections in the 48 hours before voting. He referenced lessons from

Slovakia’s election, where a fake audio circulated before the vote.

Microsoft identified manipulated videos from Russian groups, while

tech executives highlighted AI’s role in creating disinformation.

Shares rose 1.5% in pre-market trading after closing down -1.0% on

Wednesday.

OpenAI, Coursera (NYSE:COUR) – OpenAI has hired

Leah Belsky, a former Coursera executive, as its first general

manager of education. She will lead efforts to integrate the

company’s products into schools and universities, as well as work

on academic partnerships. Belsky will focus on engaging educators

and students, promoting responsible AI use in education. Shares

closed down -4.1% on Wednesday.

Qualcomm (NASDAQ:QCOM) – The EU General Court

upheld an antitrust fine of €238.7 million against Qualcomm,

slightly reduced from €242 million. The European Commission imposed

the penalty in 2019, claiming Qualcomm sold chipsets below cost to

undercut Icera. Qualcomm argued that its market share was too small

to exclude competitors. Shares rose 2.5% in pre-market trading

after closing down -0.2% on Wednesday.

Analog Devices (NASDAQ:ADI) – Analog Devices

and India’s Tata Group have signed an agreement to explore

semiconductor manufacturing in India. Tata Electronics, investing

$14 billion in plants in Gujarat and Assam, is seeking to produce

Analog’s semiconductors. The deal supports India’s initiative to

bolster its chip industry, driven by Prime Minister Narendra

Modi.

Alphabet (NASDAQ:GOOGL), Sea

Limited (NYSE:SE) – Google offered to sell its AdX

advertising marketplace to resolve an EU antitrust investigation,

but European publishers rejected the proposal as insufficient. They

want Google to divest more assets to avoid conflicts of interest in

the advertising supply chain. Meanwhile, YouTube and Shopee

announced an online shopping service in Indonesia, with plans to

expand across Southeast Asia in response to growing competition

from TikTok. The service will allow users to purchase products seen

on YouTube through Shopee. The service will also expand to Thailand

and Vietnam soon. Waymo, an Alphabet subsidiary, is in talks with

Hyundai to outsource manufacturing of its autonomous vehicles using

the Ioniq 5 model. The discussions follow high tariffs on Chinese

imports as Waymo continues to validate its autonomous driving

technology. Hyundai has not confirmed new deals. Alphabet shares

rose 1.7% in pre-market trading, while Sea shares rose 2.4%.

EQT (NYSE:EQT) – EQT and its shareholders plan

to sell Open Systems, a network and cybersecurity provider, to

Swiss Post. Since EQT acquired Open Systems in 2017, revenue has

nearly doubled, and profits have significantly increased. The sale

is expected to close in Q4 2024, pending regulatory approvals.

Shares rose 0.8% in pre-market trading after closing up 0.8% on

Wednesday.

Amazon (NASDAQ:AMZN) – Amazon will raise the

wages of its U.S. fulfillment and transportation staff by at least

$1.50 per hour, with total spending exceeding $2.2 billion. Base

wages will increase from $22 to over $29 per hour, including

benefits, and will be accompanied by free Prime memberships. Shares

rose 1.7% in pre-market trading after closing down -0.2% on

Wednesday.

X – X, formerly Twitter, bypassed Brazil’s ban

by updating its structure to use Cloudflare IP addresses, making it

harder to block the platform, which unexpectedly returned for

Brazilian users. The company stated the restored access is

“temporary” and hopes to resolve the situation with the government.

The Brazilian Supreme Court continues to monitor the issue.

Meta Platforms (NASDAQ:META) – Meta Platforms

had a lawsuit dismissed, which accused it of misleading

shareholders by concealing the impact of Apple’s privacy changes on

its ads. Judge Yvonne Gonzalez Rogers also dismissed allegations of

misused resources by former COO Sheryl Sandberg and the transition

to Reels. The court ruled that there were no securities law

violations. Additionally, Meta agreed to buy up to 3.9 million

carbon offset credits from BTG Pactual through 2038 without

disclosing the deal’s value. The transaction, valued at up to $16

million, aims to help Meta achieve net-zero emissions by 2030. The

credits come from reforestation projects in Latin America. Shares

rose 1.8% in pre-market trading after closing up 0.3% on

Wednesday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group shares fell 3.22% on Wednesday

after a CNBC poll showed economists and strategists expect Kamala

Harris to win November’s presidential election against Donald

Trump. The survey had only 27 respondents. Shares rose 0.8% in

pre-market trading.

Playtika (NASDAQ:PLTK) – Playtika announced the

acquisition of SuperPlay for up to $1.95 billion, including $700

million upfront and up to $1.25 billion based on financial targets.

The transaction, expected to close in Q4, will unite games like

Bingo Blitz and Dice Dreams.

GameStop (NYSE:GME) – GameStop CEO Ryan Cohen

agreed to pay nearly $1 million to settle a U.S. Federal Trade

Commission allegation. He failed to disclose his purchase of more

than $100 million in Wells Fargo shares in 2018, violating

notification requirements. Cohen also interacted with the bank’s

management and sought a board seat. He reported the transactions to

the FTC in 2021. Shares rose 1.8% in pre-market trading after

closing down -2.5% on Wednesday.

T-Mobile (NASDAQ:TMUS) – T-Mobile announced it

expects adjusted free cash flow between $18 billion and $19 billion

by 2027 during its event in San Francisco. The company projects

strong growth due to customer additions and partnerships with

Nvidia and OpenAI. Additionally, it plans to return up to $50

billion to shareholders by 2027. Shares rose 0.5% in pre-market

trading after closing down -3.0% on Wednesday.

Car-Mart (NASDAQ:CRMT) – Car-Mart is planning a

$65 million stock sale through an underwritten public offering. The

company stated that the proceeds would be used to pay down the

balance on its revolving credit line and for general corporate

expenses.

Tesla (NASDAQ:TSLA) – Elon Musk supports Donald

Trump in the presidential race, but employees at his companies,

including Tesla and SpaceX, are donating more to rival Kamala

Harris. Contributions to Harris total $42,824, while Trump received

$24,840. This reflects a political divide between Musk and his

staff. Shares rose 2.8% in pre-market trading after closing down

-0.3% on Wednesday.

General Motors (NYSE:GM) – Starting this month,

General Motors EV customers can use Tesla’s Superchargers following

an agreement between Mary Barra and Elon Musk. GM model owners can

access Tesla’s 17,800 chargers with a $225 adapter. From 2026, new

GM vehicles will have standard charging ports. Shares rose 1.6% in

pre-market trading after closing up 2.4% on Wednesday.

Stellantis (NYSE:STLA) – The United Auto

Workers (UAW) is threatening strikes against Stellantis, accusing

the company of breaking contractual promises. Last year’s strike

cost Stellantis about $834 million. The UAW seeks to resolve issues

such as investment delays and possible changes to Dodge Durango

production. Shares rose 4.2% in pre-market trading after closing up

0.7% on Wednesday.

Ford Motor (NYSE:F) – The United Auto Workers

(UAW) has set a strike deadline for Ford’s tool and die unit at the

River Rouge Complex, with a walkout planned for September 26 if

contract issues like job security and pay parity are not resolved.

Ford expressed willingness to negotiate. Shares rose 2.0% in

pre-market trading after closing up 0.7% on Wednesday.

Boeing (NYSE:BA) – Boeing will grant temporary

leaves to U.S. workers to save money during the ongoing strike. CEO

Kelly Ortberg stated that many employees, including executives,

will be affected. Ortberg and other executives will take pay cuts.

The union seeks a 40% wage increase, while Boeing offers 25%. The

China Development Bank Financial Leasing ordered 50 Boeing 737 MAX

8 jets, helping the manufacturer amid a drop in Chinese orders.

This is the largest order from a Chinese customer since 2015, with

deliveries scheduled between 2028 and 2031. Shares rose 1.3% in

pre-market trading after closing down -0.8% on Wednesday.

BHP Group (NYSE:BHP) – BHP has halted plans to

back two new nickel trading platforms aimed at challenging the

London Metal Exchange due to a suspension of its operations in

Western Australia. This hindered the platforms’ ability to compete,

as they relied on BHP’s nickel supply. Both initiatives are now

seeking other supply sources. Shares rose 4.1% in pre-market

trading after closing down -0.8% on Wednesday.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase

created a new role to oversee its junior bankers and analysts,

aiming to combat overwork on Wall Street. Ryland McClendon was

named global associate of investment banking and will lead

initiatives to promote employee well-being. Shares rose 1.2% in

pre-market trading after closing down -0.8% on Wednesday.

Morgan Stanley (NYSE:MS) – A team of financial

advisors from Morgan Stanley managing nearly $1.8 billion in assets

has left the firm to join Wells Fargo’s independent brokerage unit,

known as FiNet. The group, now called Verismo Financial, seeks

greater independence to better serve its clients. Shares closed

down -0.5% on Wednesday.

HSBC Holdings (NYSE:HSBC) – HSBC cut its prime

lending rate in Hong Kong from 5.875% to 5.625%, its first

reduction since 2019. The move, followed by other major banks,

reflects U.S. Federal Reserve policy and may ease borrowing costs

but will pressure profit margins. Shares rose 1.3% in pre-market

trading after closing up 0.5% on Wednesday.

Bank of Nova Scotia (NYSE:BNS) – The Bank of

Nova Scotia has appointed Jean-Francois Courville as president of

its Quebec operations, aiming to expand in the province. Starting

November 12, he will report to Aris Bogdaneris and focus on growth

in retail, wealth management, and capital markets.

Truist Financial (NYSE:TFC) – Truist Financial

announced it would cut its prime lending rate by 0.50%, bringing it

down to 8% starting Thursday, aligning with the U.S. Federal

Reserve’s recent rate cuts. Shares rose 1.9% in pre-market trading

after closing up 0.3% on Wednesday.

Blackstone (NYSE:BX) – Blackstone views Asia as

a strategic growth area, with strong activity in India, Japan,

Australia, and Southeast Asia. In India, where it holds $50 billion

in investments, it stands out for complex transactions.

Additionally, talks are progressing to sell a stake in VFS Global,

valued at around $7 billion. Shares rose 1.1% in pre-market trading

after closing down -0.1% on Wednesday.

Marriott International (NASDAQ:MAR) – Marriott

International CEO Anthony Capuano stated that the company is

monitoring whether high-income consumers will continue to cut back

on travel spending in the third quarter. While they prioritize

travel, there was a slight drop in auxiliary spending, such as food

and spa services, in the second quarter. Capuano will assess

whether this trend is temporary.

AMC Entertainment (NYSE:AMC) – AMC noteholders

have sued the company, alleging that the July restructuring deal

harmed their rights. They claim essential guarantees were removed,

prioritizing less senior creditors. The lawsuit seeks to restore

priority rights over transferred assets. AMC used the deal to

reduce debt and extend maturities. Shares rose 1.1% in pre-market

trading after closing down -0.8% on Wednesday.

Steelcase (NYSE:SCS) – Steelcase issued

third-quarter sales forecasts below expectations, citing weak

demand from large clients and in China. The company expects sales

of $785 million to $810 million, compared to estimates of $812

million, and adjusted earnings per share between 21 cents and 25

cents, versus FactSet’s forecast of 23 cents. Second-quarter net

income was $63.1 million, exceeding the prior year. Shares fell

8.9% in pre-market trading after closing up 0.7% on Wednesday.

GSK (NYSE:GSK) – GSK announced a settlement in

two California lawsuits related to Zantac, a discontinued heartburn

medication allegedly linked to cancer, but admitted no liability.

The company faces thousands of lawsuits, particularly in Delaware,

where a judge allowed the cases to proceed, resulting in an appeal.

Shares rose 0.9% in pre-market trading after closing down -0.3% on

Wednesday.

Hims & Hers Health (NYSE:HIMS) – Hims &

Hers announced it would offer compounded versions of the drug

Wegovy for $99 per month to military personnel, teachers, nurses,

and first responders. The company also offers semaglutide

injections for $199 in 12-month plans. The move aims to make weight

loss treatments more affordable. Shares rose 3.4% in pre-market

trading after closing up 1.3% on Wednesday.

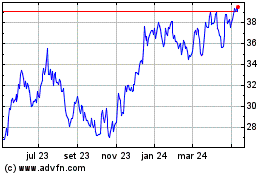

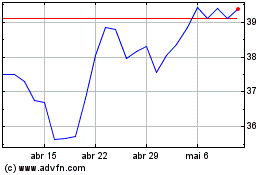

Truist Financial (NYSE:TFC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Truist Financial (NYSE:TFC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024