U.S. index futures rose in premarket trading on Thursday after

the Federal Reserve unexpectedly cut interest rates by half a

percentage point.

At 5:31 AM ET, Dow Jones futures (DOWI:DJI) climbed 466 points,

or 1.11%. S&P 500 futures gained 1.48%, and Nasdaq-100 futures

advanced 1.96%. The 10-year Treasury yield stood at 3.698%.

Today’s U.S. economic calendar highlights initial jobless claims

for the week of September 14 at 8:30 AM ET, with expectations of

230,000, matching the previous figure. The Philadelphia Fed

manufacturing index for September is forecast to improve to 2.7,

after -7.0 the prior month. At 10:00 AM, existing home sales for

August will be released, with a projection of 3.88 million units,

slightly below July’s 3.95 million. Additionally, a 0.4% drop in

leading economic indicators for August is expected.

In commodities, oil prices rose after the Federal Reserve’s 0.5%

rate cut, but global demand concerns capped gains. China’s economic

slowdown and signs of a weaker U.S. labor market continue to weigh

on prices, with analysts forecasting softness in 2025.

West Texas Intermediate crude for October rose 1.03%, to $71.64

per barrel, while November Brent gained 1.21%, to $74.54 per

barrel.

Copper (CCOM:COPPER) hit its highest price since July, driven by

the Federal Reserve’s rate cut aimed at supporting U.S. growth. The

metal rose 2.35%, with zinc and aluminum (CCOM:ALUMINUM) also

posting gains. Despite the increase, weak Chinese demand continues

to affect outlooks. Analysts believe the rate cut may benefit

metals sensitive to economic activity. Copper inventories in China

are returning to normal levels, signaling a mild market

recovery.

Wheat prices fell due to weak demand in Europe and improved

weather conditions in the U.S., overshadowing the Federal Reserve’s

rate cut. This reflects expectations of further rate cuts, though

the downtrend may be temporary. Analysts expect long-term wheat

price increases, driven by reduced global supply and droughts in

Russia and Ukraine.

Asia-Pacific markets closed positively, reacting favorably to

the Federal Reserve’s rate cut, with many Asian assets appreciating

in response. Japan’s Nikkei 225 rose 2.13% to 37,155.33. Hong

Kong’s Hang Seng climbed 2.17% in final trading, while China’s CSI

300 gained 0.8%. Taiwan’s Weighted Index rose 1.68%. South Korea’s

Kospi closed up 0.21%, and Australia’s S&P/ASX 200 hit a new

record, rising 0.61%.

Following the Fed’s move, the Hong Kong Monetary Authority

reduced interest rates by 50 basis points, reaching 5.25% due to

the local currency’s peg to the U.S. dollar. In New Zealand, Q2 GDP

fell by 0.2%, beating the forecast of a 0.4% decline. Taiwan’s

central bank is expected to announce a crucial rate decision and

update its economic forecasts on Thursday.

Traders are also monitoring the Bank of Japan’s (BOJ) statements

on potential rate adjustments, which could impact the volatility of

Japanese stocks and the yen. After the yen’s recent weakening, many

investors fear a shift in monetary policy could trigger market

uncertainties.

Governor Kazuo Ueda’s comments are critical, especially after

the unexpected rate hike in July, which already rattled the market.

The likelihood of a BOJ rate hike is around 30%, with December

being the most probable month for action.

Additionally, Japanese stocks may become more volatile after the

Tokyo Stock Exchange extends its trading hours by 30 minutes in

November. While the change aims to boost trading volumes, some

investors fear liquidity may decline, increasing volatility. South

Korea’s experience suggests longer hours don’t guarantee higher

volumes.

China is expected to cut key interest rates, according to a

Reuters survey, following the Federal Reserve’s move, which eased

risks for the yuan. The People’s Bank of China is expected to

loosen its monetary policy, especially with weak economic data and

the need to stimulate growth.

In Australia, August employment exceeded expectations, with a

rise of 47,500 jobs, though the unemployment rate held steady at

4.2%. The data suggests that rate cuts from the Reserve Bank of

Australia are unlikely in the near term as the labor market remains

strong.

European markets posted significant gains, with all sectors

rising except utilities. Norway’s central bank held interest rates

at 4.5%, the highest level in 16 years, and announced plans to

start cutting borrowing costs early next year.

Following the Federal Reserve’s rate cut, attention now turns to

the Bank of England (BoE), which is expected to hold rates at 5.0%

on Thursday amid high services inflation. The BoE is also expected

to address plans to reduce its gilt balance by £100 billion ($132

billion) next year.

On Wednesday, U.S. stocks experienced high volatility after the

Federal Reserve cut rates by 0.5%, marking the first reduction in

four years. Despite setting new intraday records, major indexes

closed lower. The Dow Jones fell 0.25%, the S&P 500 dropped

0.29%, and the Nasdaq closed down 0.31%. The Fed lowered rates to a

4.75%-5.00% range, with projections for further cuts through 2025.

Volatility is expected to persist, but the market is forecast to

reach new highs by year-end.

Before Thursday’s opening, Darden

Restaurants (NYSE:DRI), FactSet (NYSE:FDS), Endava (NYSE:DAVA), Cracker

Barrel (NASDAQ:CBRL)

and MoneyHero (NASDAQ:MNY) will report

their quarterly results.

After the close,

FedEx (NYSE:FDX), Lennar (NYSE:LEN), MillerKnoll (NASDAQ:MLKN), Research

Solutions (NASDAQ:RSSS), LightPath (NASDAQ:LPTH)

and iPower (NASDAQ:IPW) will

release their earnings.

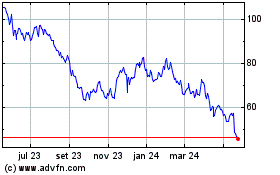

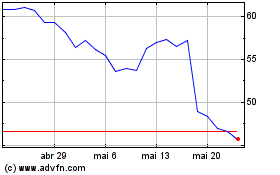

Cracker Barrel Old Count... (NASDAQ:CBRL)

Gráfico Histórico do Ativo

De Set 2024 até Out 2024

Cracker Barrel Old Count... (NASDAQ:CBRL)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024