Bitcoin falls on Monday but maintains positive performance for the

month

Bitcoin (COIN:BTCUSD) and related stocks, such as Coinbase

Global (NASDAQ:COIN) and MicroStrategy (NASDAQ:MSTR), are down on

Monday. After reaching a high of $66,566.28 last week, Bitcoin is

down 3.3% at the time of writing, sitting at $63,450.

The drop was triggered by several factors. Shigeru Ishiba’s

selection as Japan’s prime minister, who supports tighter monetary

policies, caused global market turbulence, impacting Bitcoin’s

price. Rising geopolitical tensions between Israel and Lebanon,

along with strikes at U.S. ports, also influenced the pullback from

risk assets.

Despite the daily drop, Bitcoin is on track for its best

September on record, with a monthly gain of 10.7% so far. This

monthly rise in 2024 outpaces its negative September history, which

used to average a -3.68% drop, and far exceeds the -13.38% fall in

September 2019. Coinbase has dropped 1.3% for the month, while

MicroStrategy has surged 30.1%.

With October typically being strong for cryptocurrencies,

participants have dubbed it “Uptober.” A potential rally could be

fueled by new accounting rules and a post-halving environment.

Investors will be watching the impact of U.S. port strikes, as

well as awaiting more clarity after U.S. elections and potential

interest rate cuts. Interest rate reductions are expanding

globally, with central banks outside major markets lowering

borrowing costs. Countries like Canada, Switzerland, and Sweden

have cut rates three times in 2024, with more reductions expected.

This environment favors risk investments, such as

cryptocurrencies.

According to data from Token Unlocks, $735 million in

cryptocurrencies will be unlocked in the first week of October, out

of a total of $3.46 billion throughout the month. Celestia

(COIN:TIAUSD), Worldcoin (COIN:WLDUSD), and Solana (COIN:SOLUSD)

lead the unlocks, with $1.12 billion, $336 million, and $360

million, respectively. These unlocks could increase selling

pressure in the market, affecting various digital assets.

Bithumb plans U.S. IPO with Nasdaq listing in 2025

Bithumb, South Korea’s second-largest cryptocurrency exchange,

plans to go public in the U.S. with a potential Nasdaq listing in

2025. After a failed attempt to list on the Korean market in 2020,

Bithumb is seeking international alternatives. Samsung Securities

will be its main underwriter. The company has already launched

Bithumb Investment to strengthen its public offering. With 10-20%

of the South Korean market and a 283% profit increase in Q1

compared to the same period last year, the company seeks to follow

in the footsteps of other major crypto firms that have gone

public.

Matrixport acquires Crypto Finance to expand in Europe

Matrixport, a cryptocurrency financial services firm managing $6

billion in assets, based in Singapore, has acquired Crypto Finance

(Asset Management) AG, a Swiss asset manager, through an all-cash

transaction. Renamed Matrixport Asset Management AG, the unit will

manage the first crypto fund approved by Switzerland’s Financial

Market Supervisory Authority, expanding Matrixport’s presence in

Europe.

Trump backs WLFI in support of U.S. stablecoins

Donald Trump announced the whitelist process for World Liberty

Financial (WLFI), highlighting his support for cryptocurrencies.

WLFI requires KYC for early access but has no plans to launch a

native token yet. Accredited U.S. and international investors can

participate, while retail investors are left out due to regulatory

barriers. The project aims to maintain the U.S. dollar’s dominance

with stablecoins, partnering with Aave. WLFI’s advisors now include

Matthew Morgan from Mixie AI and Ryan Fang from Ankr.

X ban in Brazil impacts crypto industry

The ban of X (formerly Twitter) in Brazil in August

significantly impacted the crypto community, which relies on the

platform for global communication and promotion. The court decision

that disconnected 22 million users was due to the spread of

misinformation. Crypto influencers, companies, and events lost

reach, visibility, and engagement, forcing them to seek

alternatives. The industry fears that without X, real-time access

to critical information like security updates will be hindered,

negatively affecting the cryptocurrency sector in the country.

Taiwan allows access to crypto ETFs for qualified investors

Taiwan’s Financial Supervisory Commission has authorized

professional investors to access foreign cryptocurrency ETFs

through local financial institutions. The move aims to ensure

regulatory compliance and protect investors, limiting access due to

the risks involved. Securities firms must implement suitability

systems and provide education on digital assets.

Solana could rise in October with optimistic momentum

Solana (COIN) has faced resistance at $160 in recent months, but

optimistic expectations for “Uptober” may boost the token. Factors

such as the Fed’s rate policy and a potential altcoin season could

increase liquidity and favor SOL’s growth. Additionally, technical

advancements reinforce confidence in Solana’s ecosystem. The launch

of Frankendancer on the mainnet and the anticipation for Firedancer

in 2025 mark important milestones for Solana. Firedancer, developed

by Jump Crypto, achieved over 1 million transactions per second

(TPS) in tests, reinforcing Solana’s status as a high-performance

Layer 1 blockchain. This new client will significantly increase

network throughput while diversifying validators, making Solana

more resilient to attacks and technical failures. With these

improvements, investor interest is expected to return.

ANZ partners with Chainlink to explore real-world asset

tokenization

ANZ, Australia’s second-largest bank, has partnered with

Chainlink Labs (COIN:LINKUSD) and ADD (COIN:ADDXUSD) to explore

tokenized real-world assets, integrating into the Monetary

Authority of Singapore’s (MAS) Project Guardian. The global

initiative seeks to revolutionize sectors like fixed income and

forex with digital assets. ANZ believes private blockchains can

facilitate the exchange of assets such as commercial papers,

highlighting the role of ANZ’s native token (A$DC) and the

interoperability provided by Chainlink’s CCIP protocol for the

growth of the tokenized economy.

Kin Capital launches $100M tokenized real estate fund

Kin Capital has launched a $100 million tokenized real estate

debt fund on the Chintai network. The fund, accessible to

accredited investors with a minimum investment of $50,000, offers a

14%-15% annual return with quarterly distributions. The first $5

million tranche is already available, with more offerings planned

until 2025. Asset tokenization aims for greater efficiency and cost

reduction, while Chintai, licensed in Singapore, manages the

infrastructure. Projections indicate tokenized assets could surpass

$10 trillion by the end of the decade.

BIO Association plans token launch to boost decentralized biotech

network

The BIO Association, a Swiss nonprofit organization, announced

the launch of the BIO token to support its decentralized biotech

network, the BIO Protocol. The goal is to democratize access to

scientific research and funding through BioDAOs, communities that

develop scientific intellectual property. The BIO token will launch

on the Ethereum network with a 45-day genesis phase or until

reaching $100 million in FDV. Token holders will be able to vote on

new BioDAOs and gain access to scientific funding.

TRON DAO strengthens security after ChainSecurity review

TRON DAO (COIN:TRXUSD) completed a security audit of the

Java-Tron platform with ChainSecurity. The analysis focused on key

aspects like the TRON Virtual Machine and consensus mechanisms,

uncovering vulnerabilities that could affect blockchain

performance. ChainSecurity found issues in PBFT messaging, block

censorship, and unsigned block processing, which the TRON team

addressed. With these improvements, TRON is better prepared to

ensure the network’s security and efficiency, protecting users’

assets and data while maintaining community trust.

TrustToken and TrueCoin settle SEC dispute with $700K fines

TrustToken and TrueCoin, responsible for the TrueUSD stablecoin

(COIN:TUSDUSD), agreed to pay $700,000 in fines and restitution to

the SEC after accusations of fraudulent and unregistered sales of

investment contracts. The SEC alleged that from 2020 to 2023, the

companies falsely marketed TUSD as fully backed by U.S. dollars,

while much of the assets were in a speculative offshore fund. The

companies opted to avoid litigation and focus on future operations,

despite the temporary impact on TUSD’s peg.

Onyx relaunches protocol after $3.8M hack

After an attack resulting in the loss of $3.8 million on

September 27, the Onyx DeFi protocol received community approval to

relaunch its network, Onyx Core. Proposal OIP-46, submitted the

same day, recommends closing the Ethereum-based lending market and

fully reimbursing lenders. The community supported the changes with

no dissenting votes, and implementation is scheduled for October 1.

The new protocol will function as a closed lending system, focusing

on increasing security and preventing future attacks. The team will

also release a revised whitepaper.

Harsh sentences mark crackdown on crypto-related crimes

A study by Social Capital Markets reveals that cryptocurrency

leaders are facing harsh prison sentences, with a 267% increase in

convictions between 2019 and 2023. Criminals like Ross Ulbricht and

Karl Greenwood have received lengthy sentences, reflecting the

growing legal action against financial crimes in the sector. The

average sentences in major cases exceed 20 years, with fraud and

money laundering representing most convictions. The disparity in

punishments between crypto and traditional financial criminals

raises questions about fairness in sentencing.

Scammers use meme coin trend list to steal cryptocurrencies

Criminals are exploiting the trend list on the GMGN website to

inflate the volume of fraudulent meme coins and deceive investors.

They create tokens with malicious code that allows developers to

steal users’ cryptocurrencies. Once on the list, the coins are

purchased by unsuspecting victims, whose assets are then

transferred to the scammers’ wallets. Investors are being advised

to avoid suspicious tokens on this list, which has caused

significant financial losses.

NFT sales continue to decline in September with a 20% drop

NFT sales totaled $296 million in September, a 20% decrease from

August and an 81% reduction compared to the peak of $1.6 billion in

March 2024. The number of transactions also fell by 32%, dropping

from 7.3 million to 4.9 million. This marks the lowest monthly

volume since January 2021. However, the average transaction value

increased by 18%, reaching $60.

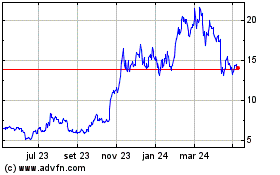

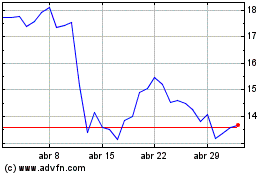

ChainLink Token (COIN:LINKUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

ChainLink Token (COIN:LINKUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025