U.S. index futures fell in premarket trading on Tuesday after

the Dow Jones ended a three-day winning streak. Investors are

focused on interest rate comments and Q3 earnings, with 20% of the

S&P 500 reporting profits this week. However, concerns over

excessive 2025 expectations remain.

At 5:00 AM ET, Dow Jones futures (DOWI:DJI) dropped 128 points,

or 0.30%. S&P 500 futures fell 0.36%, and Nasdaq-100 futures

declined 0.46%. The 10-year Treasury yield stood at 4.208%.

In commodities, oil futures dropped on Tuesday due to U.S.

efforts for a Middle East ceasefire and weak Chinese demand. A

strong dollar also pressured oil prices, making it more expensive

for foreign buyers.

On Monday, Brent and WTI rose nearly 2% after falling 7% the

previous week. The market remains volatile, concerned about

potential supply disruptions from conflicts and possible surpluses

in the coming quarters.

West Texas Intermediate crude for November fell 0.20% to $70.42

a barrel, while December Brent crude dropped 0.27% to $74.09 a

barrel.

Gold (PM:XAUUSD) increased 0.50% to $2,735.12 an ounce, near

record highs. Despite higher Treasury yields, investors sought

safety in the metal amid economic uncertainties, interest rate cut

expectations, geopolitical tensions, and upcoming U.S.

elections.

Citi Research raised its gold price forecast to $2,800 in three

months and $3,000 in 6-12 months, driven by U.S. labor market

weakness, rate cuts, and geopolitical uncertainties. For the 6-12

month horizon, silver (PM:XAGUSD) was raised to $40, while platinum

(PM:XPTUSD) remains neutral-optimistic at $1,100, and palladium

(PM:XPDUSD) is expected to decline to $900.

Global sugar supply is expected to hit a six-year low in 2025

due to drought in Brazil, the largest exporter. Sugarcane

production is affected, delaying the harvest and driving prices up.

Brazil is expected to account for 75% of global raw sugar exports

this year.

On today’s U.S. economic calendar, Philadelphia Fed President

Patrick Harker will give a speech at 10:00 AM ET.

Asia-Pacific markets mostly closed lower. The Nikkei fell 1.39%

due to election concerns. Australia’s S&P/ASX 200 dropped

1.66%, and South Korea’s Kospi lost 1.31%. However, Hong Kong’s

Hang Seng rose 0.12% in the final hour of trading, and China’s CSI

300 gained 0.57%.

In China, the youth unemployment rate for those aged 16-24

dropped to 17.6% in September, down from 18.8% in August. This

provided relief to officials after two consecutive months of rising

rates. Youth unemployment peaked at 21.3% in June 2022 before a

methodology adjustment.

A Reuters poll revealed that South Korea’s economy likely

returned to growth in the last quarter, with a 0.5% expansion

driven by exports, following a 0.2% contraction in the previous

quarter. However, domestic demand likely remained weak due to high

borrowing costs, despite the Bank of Korea cutting its base

rate.

In Hong Kong, short selling hit its lowest level in three and a

half years following Chinese stimulus measures, which boosted the

market. The proportion of short positions fell to 9.7% on Friday,

with a modest recovery to 10.7% on Monday, as the Hang Seng has

gained 20% since September.

The U.S. is in talks with the Philippines, Singapore, and

Thailand about deploying small modular nuclear reactors (SMRs) to

provide low-carbon energy. These Southeast Asian nations are

seeking alternatives to meet growing energy demand while reducing

fossil fuel use.

Hyundai Motor India’s shares fell as much as 6%

on their market debut following lukewarm retail investor response

to its initial public offering price. Listed at 1,934 rupees,

shares dropped to 1,882.10 rupees, below the offer price.

Westpac Banking announced that its 2024 profit

would be impacted by $82.26 million due to losses in economic

hedges and inefficiencies. Net profit for 2023 was A$7.195 billion,

with 2024 results set to be released on November 4.

Horizon Robotics, a Chinese autonomous driving

technology provider, priced its Hong Kong IPO at the top of its

range, raising $696 million (HK$5.4 billion). The IPO, scheduled

for Thursday, saw strong demand, with Alibaba and Baidu committing

to invest around $220 million.

European markets were mixed on Tuesday, with the FTSE 100 and

CAC 40 down, while the DAX rose. Real estate, telecoms, and

utilities underperformed, while tech and miners gained.

Global bond selloffs have impacted the market. Among individual

stocks, SAP (TG:SAP) shares rose after solid

quarterly results, while AP Moller-Maersk A/S

(TG:DP4A) fell after early gains.

HEIQ (LSE:HEIQ) shares dropped 64.1% after the

company announced plans to delist from the London Stock Exchange

and restructure to cut costs. HEIQ aims to reduce expenses by 20%

by the end of 2025 due to weak demand and recovery expectations

only in the second half of 2025.

Luxury brand Mulberry (LSE:MUL) rejected a

second takeover bid from Mike Ashley’s Frasers

Group (LSE:FRAS), calling it “unsustainable.” Frasers

offered 150 pence per share, valuing the company at $144 million

(£111 million), but the largest shareholder, Challice Limited, did

not support the offer.

Randstad (EU:RAND) reported slightly

better-than-expected quarterly profit, with EBITA of $212 million

(€196 million), and also announced the purchase of Zorgwerk for

€323 million, aiming to expand its healthcare sector presence.

Sosandar (LSE:SOS) expects revenue below

forecasts for the fiscal year, projecting £40 million compared to

the £45.6 million estimate. The company reduced its first-half loss

to £0.7 million despite declining revenue. Gross margin rose to

62%, reflecting the success of its new pricing strategy.

In Britain, the commercial real estate market is recovering

post-pandemic, with lower prices on high-value office properties.

Investors are selling at reduced prices, and demand for new offices

with advanced amenities is growing. Falling inflation and interest

rates are encouraging investment.

On Monday, U.S. markets closed mixed, with the Dow down 0.8% due

to declines in stocks like American Express

(NYSE:AXP) and Merck (NYSE:MRK), while the S&P

500 fell 0.2%. The Nasdaq, however, rose 0.3%, reaching its highest

level since July.

The Conference Board reported that the U.S. leading economic

index fell 0.5% in September, beating the forecast of 0.3%. The

August decline was revised to 0.3% from the initial 0.2%, signaling

a larger-than-expected economic slowdown.

Three Federal Reserve members expressed support for gradual

interest rate cuts, citing economic strength and future

uncertainty. Jeffrey Schmid, Neel Kashkari, and Lorie Logan

suggested that the pace of cuts should be cautious to avoid

volatility. The next decision will be made in November after the

quiet period.

Schmid, president of the Kansas City Federal Reserve, advocated

for gradual rate cuts to avoid aggressive measures. He believes

inflation is close to the 2% target and the labor market is

stabilizing, preferring a cautious approach to avoid financial

volatility.

Mary Daly, president of the San Francisco Federal Reserve,

stated that rate cuts should continue as rates remain high enough

to restrict the economy. She seeks a “soft landing,” with 2%

inflation, a strong labor market, and adjusted wages.

In earnings reports, figures are expected from

Verizon (NYSE:VZ), General

Motors (NYSE:GM), RTX (NYSE:RTX), 3M (NYSE:MMM), Freeport-McMoRan (NYSE:FCX), GE

Aerospace (NYSE:GE), Lockheed

Martin (NYSE:LMT), Quest

Diagnostics (NYSE:DGX), Fiserv (NYSE:FI)

and Denny’s (NASDAQ:DENN) before the

market opens.

After the close, reports are expected from Enphase

Energy (NASDAQ:ENPH), Brandywine Realty

Trust (NYSE:BDN), Seagate (NASDAQ:STX), Baker

Hughes (NASDAQ:BKR), Canadian National

Railway (NYSE:CNI), Volaris (NYSE:VLRS), Texas

Instruments (NASDAQ:TXN), Nabors

Industries (NYSE:NBR), PennyMac (NYSE:PFSI)

and Matador Resources (NYSE:MTDR).

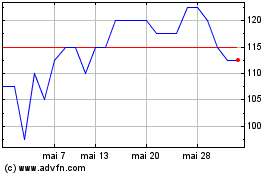

Mulberry (LSE:MUL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Mulberry (LSE:MUL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025