VANCOUVER, BC -- May 24, 2017 -- InvestorsHub NewsWire -- When

Kenadyr Mining (TSXV:KEN)(OTCQB:KNDYF) listed at the

end of March 2017, it gave investors a double opportunity. First,

to own a quality venture that has the potential to confirm massive

historical resources noted by previous drilling. Second, the Kyrgyz

Republic is home to some of the world's largest gold mines,

including the tongue twisting Taldy-Bulak Levoberejny ("TBL") mine,

owned by China's largest mining company, Zijin.

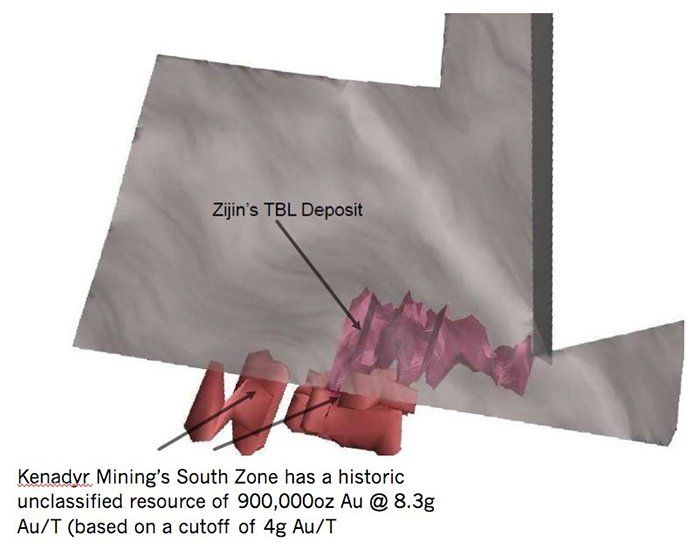

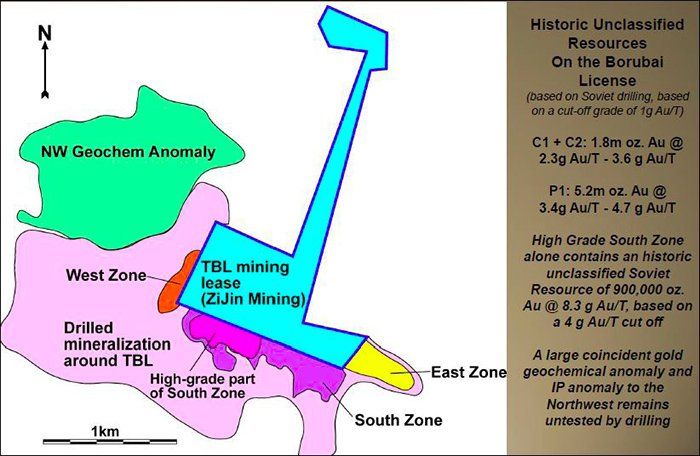

The story gets very interesting quite quickly. Here's the

graphic for context. And the best part is that Kenadyr has begun

drilling, ahead of schedule on those areas potentially connected to

the massive TBL mine. (Uncovered red as opposed to red under

grey)

Zijin's TBL orebody connects to Kenadyr's high grade "South

Zone" its highest priority target. The soviet estimate within a

portion of the south zone (based on 24 drill holes in the area

directly adjacent to the TBL orebody) shows an initial unclassified

historic estimate of 900,000 oz. Au at a grade of 8.3 G Au/T. This

historic estimate is open in all directions and to depth.

Two key facts:

- TBL: Newly built and producing with a cap cost of $296

million, it contains 3.2 M oz. Au in reserves and resources at a

grade of 7.2g Au/T. The mine is designed to produce 125,000 oz.

Au/annum.

- KEN: The Soviet estimate within a portion of the South Zone

(based on 24 drill holes in the area directly adjacent to the TBL

orebody) shows an initial unclassified historic estimate of 900,000

oz. Au at a grade of 8.3 G Au/T. This historic resource is open in

all directions and to depth.

Kenadyr President Bryan Slusarchuk states: "Drilling this type

of high grade gold target anywhere on the planet should be

compelling to investors. Drilling it right next door to a

super-major's operating mine makes it more compelling yet." He

continues; "Poor core recovery during Soviet drilling (averaging

60%) and the use of predominately ICP analysis (versus fire assay)

may have understated the resources and grades at the south and

other zones – comparison of previous soviet drilling results at the

TBL to recent drilling results show a significant increase in

average gold grades. "

The Company makes no conclusions as to deposit or reserves,

actual or inferred. The goal is to prove or exceed the metrics of

previous Soviet drilling, which consisted of the gold zones

identified by Soviet drilling (81,800m in 139 holes) that are

adjacent to Zijin's TBL deposit (using a 1g au/T cut off). The

historic Global Estimate is 6m oz. Au grading 2.3– 4.7g au/T.

There are more legs to the Kenadyr story. CEO Dr. Alexander

Becker's mining provenance in Asia is impressive. Experienced in

the Kyrgyz Republic over more than two decades, he has many

successes including the acquisition of acquiring the gold potential

of the Chaarat deposit in the Kyrgyz Republic (gold resource of 6.5

million ounces). He is primarily in-country and runs the operation

on the ground. His local, industry and government contacts are

peerless.

Dr. Becker, Kenadyr's CEO states "The commencement of drilling

represents the start of an exceptional period for Kenadyr and our

shareholders. The current drilling is to test and confirm

previously reported high grade historical results. This drilling is

in the South Zone, not the only area of gold mineralization on the

property, but an extremely important zone as it is a large and high

grade target and of course is immediately adjacent to Zijin's TBL

Mine."

The other bit of investor intrigue is the potential that

Zijin could either partner or acquire Kenadyr or claims/land under

its control. Zijin purchased the TBL Mine in 2011 and in

2015:

- 50% of Barrick's Porgera Mine for USD

$298M

- 12,836,826 shares of Pretium at CAD $6.30/share for a purchase

price of CAD $81M

- Zijin purchases 49.5% stake in Ivanhoe's Kamoa copper project

for USD $412M

Drills Turning Now

A full month ahead of schedule, Kenadyr with contractor Quest

Exploration Drilling (QED) has begun drilling on the South Zone to

an anticipated depth of 850 meters.

In addition to initial drilling in the high priority South Zone

it will proceed with bull dozer trenching and sampling cuts on the

SS Zone and SS Trend. As well as drilling, the Company intends to

take approximately 1,250 channel samples and 2,200 soil

geochemistry samples in this area.

Given that KEN has no debt and $7 million in cash, the Company

is in a strong financial position to take advantage of drilling

opportunities and offsets should that be necessary. Drilling

updates are planned over the summer with assay results available in

late Q3, early Q4, 2017.

Conclusion

While still speculative, Kenadyr is intriguing in that it could

well end up greater than the sum of its already interesting

parts.

Aa a KEN investor/shareholder the potentialities are intriguing,

albeit yet to be crystalized. First, KEN is in an area that until

now investment exposure was not available. The actions of Zijin in

the area could well have ramifications for KEN, particularly as the

Company proves up reserve numbers.

The main benefit is for Kenadyr to prove up or exceed the

previous numbers associated with significant Soviet and Malaysian

drilling in the area.

Having historic drill and geological records, couple with

current technology certainly ups the potential to proving up a

significant resource.

Equally important is the presence of those drilling records to

direct and significantly reduce/mitigate the exploration risk.

Couple that with peerless in-country expertise and a look for spec

to spec/conservative investors seems worth some time.

While you might be reluctant to look Kenadyr over when words

like 'Asia' 'Chinese Mining' or the seeming isolation of the

property, these are not material factors.

Infrastructure includes good power, paved roads 100 km to town,

mining friendly jurisdiction and an experienced and willing

workforce.

All in all, most if not all the junior mining investment boxes

are checked; including the important three M's, Money, Moxey,

Management.

Legal Disclaimer/Disclosure: This document is not and should

not be construed as an offer to sell or the solicitation of an

offer to purchase or subscribe for any investment. No information

in this Report should be construed as individualized investment

advice. A licensed financial advisor should be consulted prior to

making any investment decision. We make no guarantee,

representation or warranty and accept no responsibility or

liability as to its accuracy or completeness. Baystreet.ca assumes

no warranty, liability or guarantee for the current relevance,

correctness or completeness of any information provided within this

Report and will not be held liable for the consequence of reliance

upon any opinion or statement contained herein or any omission.

Baystreet.ca has been compensated four thousand dollars for its

efforts in presenting the KEN profile on its web site and

distributing it to its database of subscribers as well as other

services. Furthermore, we assume no liability for any direct or

indirect loss or damage or, in particular, for lost

profit, which you may incur as a result of the use and existence of

the information, provided within this Report.

Kenadyr Metals (TSXV:KEN)

Gráfico Histórico do Ativo

De Dez 2024 até Dez 2024

Kenadyr Metals (TSXV:KEN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024