Mining for technology all the technology

What a time to be alive! Civilization has developed at an

increasingly rapid pace over the last few decades. Technology has

enabled us to work and play in ways we would have considered too

futuristic to comprehend only ten years ago, but almost every part

of that progress depends on an important series of metals to

exist.

Your iPad and iPhone and electric car and your smart thermostat

and your smoke alarm and your solar panel and the tiny little clock

in your microwave they need what are called 'strategic metals' to

operate properly. Metals such as graphite, lithium, vanadium and

cobalt are part of that group.

You might not have heard of those and maybe the idea of

investing in mining doesn't fit with your world view. But without

these metals, all the things we take for granted in today's

technology world couldn't exist, and if we don't mine those metals

in North America, where we have rules and environmental standards

and oversight, we end up getting it from child labour, and at low

grades, and without environmental protections from places like

Africa and Asia.

So we need strategic metals. And we need standards. And

we don't want to exploit people for them.

Here's the problem: We don't mine that stuff anymore.

Not in Canada. Not in the US. Not in the numbers needed. We

bring it in from places far away, from people who source it in ways

not always in keeping with our values.

From electric vehicles to smart phones to eco-friendly homes to

fully automated industrial buildings, from mining cryptocurrency to

the immense potential of blockchain tech, these advancements in how

we engage with the world need two things; smart people to think of

them, and the metals needed to build them, make them run, and store

power for them.

So we might as well get them the right way.

THE ELECTRIC AUTO REVOLUTION

Both Britain and France have pledged to completely ban the sale

of fossil fuel vehicles by 2040, but they may not even have to

because consumers are flocking to the cheaper-to-run greener

options.

Every major car company is bolstering efforts to offer electric

vehicles, while some plan to make their entire fleet electric

powered, and eco-friendly. Tesla is now worth more than Ford

because of this.

Few would deny that's a great thing. But these visionary dreams

will need lithium. They'll need cobalt, and vanadium. And they'll

need graphite. Lots of graphite.

And they won't need it in 2040. They need it

now.

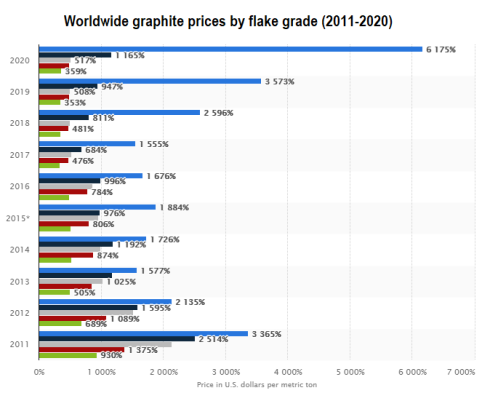

The demand for more and more of these strategic metals is

already straining the small existing supply which is, in turn,

creating very high prices for the key energy metals. Look at the

spot prices of graphite, lithium, cobalt, nickel and zinc in the

last two-years and you'll see most of them have run in a big way.

Indeed, the lithium industry was the first one to really benefit

from the Tesla shift, with hundreds of millions of dollars being

raised eighteen months ago to explore and start new lithium

operations. Cobalt has also had a big leap in the months since.

And without new mines coming on-line, the demand and cost

problem should only increase going forward, bringing more metals

into the same price climb.

WHO CAN SUPPLY THOSE METALS?

There are several exploration companies that can supply one, a

handful that might be able to supply two, but the only company

we've found that has a bead on four is Berkwood Resources

(OTCMKTS:

CZSVF, TSX-V:

BKR, FSE:

A2DNV4).

Over the last six months, Berkwood has acquired three projects,

all in mining-friendly Quebec Canada, with potential that could add

to the much needed supply of the energy metals that will fuel your

phones, cars, tablets, and gigantic crypto-currency mining centres

on the planning boards today. Prior to that, Berkwood had a

strategic positioning beside a developing graphite company that is

considered one of the first potential large scale graphite mines in

Canada.

Let's go through each of those metals:

Graphite Exposure: Surrounding a $300m

player

Berkwood's graphite project has been successful

in hitting mineralization in every single drill-hole it attempted

this year and, because of that success, the company increased their

land position by a whopping four times what it originally held, in

a very quick time.

But there's another reason they went on a land claiming spree;

their project is right next to a big, highly valued neighbour and

now Berkwood surrounds it.

That neighbour, Mason Graphite (OTCMKTS:

MGPHF, TSXV:LLG),

is shifting from exploration to production in the very near future,

and that decision to move forward is being kicked ahead by the

sheer demand for what it could produce, and what that will be worth

going forward.

That combo of ore in the ground and potential at market has

brought Mason a market cap of CAD$335 million.

Here's Berkwood's CEO Mr. Thomas Yingling

talking about the success his company is having, and how their

geologists are identifying what's coming out of the ground as being

extremely similar to what Mason has already found: https://vimeo.com/236430355

With Berkwood hitting graphite in every hole it

drills, you'll likely wonder what kind of upside value that could

be for an investor. I'll lay it out like this; the company they are

surrounding that is planning to start production soon, was trading

at $0.30 less than two years ago. Their graphite deposit is

their only asset and today their stock price is sitting at

$2.90.

Comparing market capitalizations between the two; the

soon to be producer is sitting approximately at CAD$335 million

while Berkwood is at $7.9 million.

Now let's not get to ahead of ourselves - we are comparing a

soon-to-be-producer vs an exploration company in the early stages

of their progression.

But there is tremendous upside for BKR if they continue to hit

their targets, and even moreso if Mason comes looking to

expand.

Without a doubt, Mason is already watching

Berkwood and wondering if they should have let the

scrappy competitor snap up all that land on their border. In

addition, Berkwood's technical team were a part of

Mason's group when they first formulated that company and planned

to explore for graphite in Quebec, so there's lots of connective

tissue between the groups.

Lithium Exposure: It's right there in the name

'lithium ion battery'

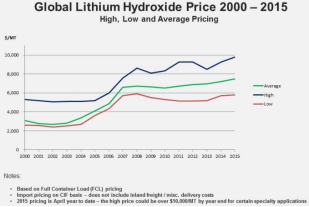

Lithium has been a hot new-age commodity for the last couple of

years now, and it's no secret as to why.

With the demand for more lithium-based batteries for automotive,

home, and industrial uses, this is another classic case of supply

being dwarfed by demand.

As illustrated in the charts above, the demand is forecast to

continue to increase for years to come. UBS estimates that lithium

demand could potentially increase by a factor of 25x, assuming 100%

of all vehicles sold globally would be a battery electric vehicle

in the future, instead of today's fossil fuel-driven sales mix.

If you look at a handful of lithium companies over the last

year, many have gone up multiples already.

Liberty One Lithium (OTCMKTS:

LRTTF TSXV:

LBY) was up nearly 300% a couple weeks ago and that's just

within 6 months, Standard Lithium is up 375% since the beginning of

the year & MGX Minerals (OTCMKTS:

MGXMF CNSX:

XMG) is up 550% in the last 12 months.

Yeah. Lithium is hot. While lithium stock prices were on a

bubble-like tear a few years ago, they've slowed down recently as

the market tried to figure out which companies can actually get at

their lithium inexpensively and efficiently, and which ones were

just market plays.

But now we're starting to see consolidation and upward momentum

again, so BKR is smart to have a lithium play of their own.

Quebec-based, just 9 hours drive from Montreal, the property was

geologically mapped in 1975, revealing the presence of multiple

copper-zinc-nickel and lithium-beryl-niobium-

tantalum-uranium-thorium mineralizations.

Now, a lot of people have flown planes over this property and

walked over it and taken samples and scratched their chins about

it, trying to figure out if there's enough copper or zinc or

tantalum or uranium there to justify a mine, but the lithium, for

most of those years, was just stuff in the way of the really

valuable things.

The market today places a very different value on lithium that

it did in the 1970's, and spodumene lithium, which is what's found

around the neighbourhood, is much easier to process than the big

lithium ponds you'll find in South America.

From the company website:

A pegmatite sample (sample 1903119324) was taken in 2013 from an

outcrop, in the center of the property. Assay returned

1,290ppm Li, 300ppm Cs, 107ppm Ga, 1,000ppm Rb and

126ppm Ta.

Now, it's more likely that the company will find economically

feasible piles of nickel to draw from on this property than

lithium, but that's no sad story, if that's how it all turns out.

Nickel is as in demand for electric vehicles as anything, and a

sideline of lithium dollars would be a nice little earner. There's

a lot more work to be done, but it's all upside.

Cobalt Exposure: Bringing it locally instead of from

African child labour

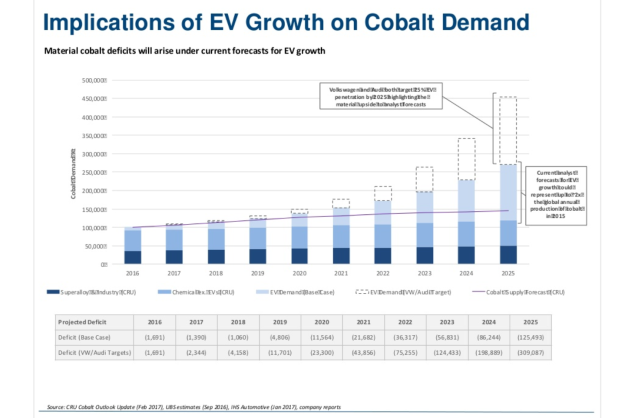

A Tesla S requires 63kg of lithium carbonate. If you assume that

25% of passenger vehicles move to electric in time, the world will

need some six times current lithium and cobalt mine supply. These

are staggering numbers for an industry that normally has very slow

growth, and give vindication to those companies that can focus on

the metals needed and can raise the capital for discovery to a

resource.

The largest producing nation of cobalt globally is the

Democratic Republic of Congo which, if you had to take an African

vacation, might not be in your top ten options.

Congo had little competition for the byproduct metal until the

last decade or so, when big purchasers of the stuff started asking

questions as to how it's obtained.

Let's put it this way: Dropping kids into deep, dark, toxic 3

foot-wide holes on a rope, with a sharpened stick and a bucket,

then yanking them up again after a few hours, is not the preferred

way for children to be raised, nor ore sourced.

Canada is well-known as a friendly mining jurisdiction that

adheres to social economics, environmental standards, and builds

projects together with its First Nations groups. The instability

and harsh working conditions in the DR Congo has made their cobalt

supply nearly non-touchable to major automobile and battery

companies due to the global growing concern of purchasing conflict

minerals. Chinese middle-man companies have stepped in to provide

plausible deniability, taking their piece and claiming, 'we have no

idea where it comes from', but lower processing standards have

contributed to situations where the end product is

sub-standard.

You may recall that period where Samsung phones with

spontaneously igniting a few years ago, leading airlines to ban

them from flights? That's what happens when you bring different

grades of cobalt together and pretend they're the same in your end

product.

Cobalt has fast become one of the core ingredients of our

technology-driven lifestyles and many companies, including

Berkwood, have acquired projects with known cobalt

mineralization to fill the increasing demand for 'clean'

cobalt.

With roughly 49% of the demand for cobalt being driven by

batteries, in cellphones, and increasingly self-driving cars, the

demand for this metal will only increase.

Berkwood has its eyes on graphite, and it has its eyes on

lithium, but it also has its eyes on cobalt.

Once again, the property is in mining friendly Quebec, where

Berkwood's other projects are located., which keeps things very

easy to follow.

This is another property that has had exploration work done in

the past, mostly looking for copper, nickel and gold, because

cobalt was for a long time not seen as a primary target, back in

the day. Indeed, silver mines in Ontario used to toss it in piles

at the top of the shaft and 'eventually' get around to selling

it.

These days, the cobalt is worth the effort of going to get it.

So Berkwood plans to have another run at this property to see

exactly how much cobalt they can find. And if they find more

nickel, or gold, or copper, well that's just fine.

Vanadium Exposure: What the hell is

vanadium?

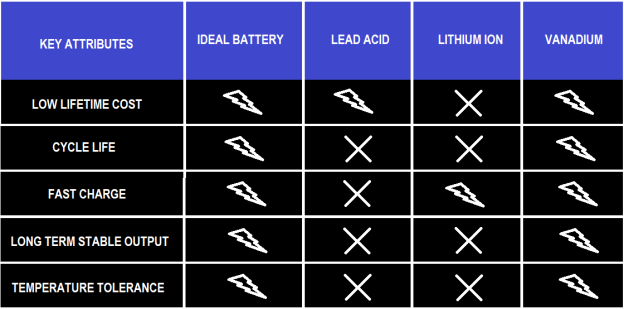

Vanadium could be the next wave metal. Supported by the US

Energy Department, a vanadium flow battery is being tested to

overthrow the reining lithium-ion battery, aka the Tesla

battery.

A redox flow battery is well-suited for storing intermittent,

renewable energy on the electricity grid, and is said to have an

indefinite lifespan vs lithium's 3-5-year lifespan.

Energy storage is the power driver for the lithium, graphite,

cobalt, and vanadium metals boom and a vanadium-based battery could

be the game changer.

A vanadium-based battery is completely non-flammable, but size

is an issue, which is something being worked on currently. When the

size issue is seen to, hold onto your socks because it should shake

up the battery world for the first time in decades, and the rush

for vanadium will then be on in full steam.

Here's a chart of different characteristics of three types of

batteries;

Let's take an example case of what can happen when you are next,

near-by or surrounding another company that is about to go into

production, production of a key technology metal.

Stina Resources (OTCMKTS:

STNUF CNSX:

SQA), over the last 12 months, is up 300% and recently raised

CAD$3 million as they move to progress their vanadium project.

Their neighbor, one with plans to go into production soon, is

Prophecy Development Corp. (OTCMKTS:

PRPCF TSX:

PCY), which raised nearly CAD$7 million this year and is up 50%

at the time of writing.

Prophecy's market capitalization is hovering around the CAD$30

million mark while Stina's is just over CAD$20 million.

Again: Berkwood's market cap is just $7.9 million, and it has a

graphite property, a cobalt property, a lithium property, and this

vanadium property, all of which aims to either lower your risk by

benefiting from more potential strikes, or roll into one 'energy

metals provider' if they do well on all fronts.

Conclusion:

Plugging into high-tech minerals is where investors obviously

want to be. Having exposure to metals such as graphite, lithium,

cobalt, and vanadium gives a whole lot of options to that one

company, to follow any sub-sector that goes on a price spike, to

provide customers with multiple products they need, and to benefit

if it turns out there's more copper or nickel on one of those

products, at a time when copper and nickel are needed.

There's only one company we know of that has a basket hedged on

all four of those new-age, technology driven metals and that's

Berkwood Resources (OTCMKTS:

CZSVF TSX-V:

BKR, FSE:

A2DNV4).

With the low market cap, there is a lot of potential

upside for shareholders to realize on the back of any single

win.

Berkwood deserves to be on not just your watch list but will

also potentially be on the shopping list of a lot of its

competitors, and even customers, if that market cap doesn't double

soon.

Chris Parry, www.equity.guru

Disclaimer:

The author owns shares in Berkwood Resources and provides

marketing services to the company. The author doesn't plan to sell

any shares upon release of this article and is holding long. Always

talk to a financial advisor before purchasing any stock in any

company. This article is provided to serve as part of your due

diligence, but all investors are advised to talk to a financial

professional and asses their risk profile before making any

investment.