Yorkton Equity Group Inc. Announces Final Approval from the TSX Venture Exchange and Closing of Previously Announced...cont

13 Maio 2021 - 3:44PM

InvestorsHub NewsWire

Yorkton

Equity Group Inc. Announces

Final Approval from the TSX Venture

Exchange

and

Closing

of

Previously

Announced

Private Placement

Edmonton,

Alberta -

May

13th,

2021 -

InvestorsHub NewsWire - Yorkton Equity Group Inc. ("YEG" or the

"Company") (TSXV: YEG) is pleased to announce

the

receipt of final acceptance

from the TSX Venture Exchange and closing of its non-brokered

private placement financing ("Private Placement") for gross

proceeds of $2,825,000

or

11,300,000

units

("Units") at a price of $0.25

per Unit, which was

over-subscribed by over approximately 40%. The Private

Placement was announced on March 9, 2021 and

was upsized due to demand on several occasions on April 27, 2021,

May 3, 2021 and May 4, 2021.

The Company intends

to use the proceeds from the Private Placement towards the purchase

of the Kelowna property as announced on April 19, 2021, renovations

and upgrades to the Riviera Gardens Property, soft development

costs of Yorkton 108, the purchase of the

Langford, Victoria Property as announced on March 9, 2021 and

general working capital including

pursuing

new

acquisition opportunities. While the Company is

securing

additional

financing through CMHC to complete the

aforementioned

acquisitions,

we are pleased to announce that CMHC financing on the Kelowna

property has been approved at an

advantageous mortgage rate

of less than

2.0%

per

annum for a 5 year term,

and the

scheduled

closing of

this

purchase is targeted

for on or before July

8, 2021 as per our

lawyers.

Each

Private

Placement Unit is comprised

of one (1) common share of the

Company ("Common Share")

and one

(1) warrant ("Warrant"), whereby each Warrant entitles the holder

to purchase one (1) Common

Share

at a price of $0.40 for a period of two

(2)

years

from

the date of closing. If after four months and one day

following the date of closing, the closing price of the

Common

Shares

is equal to or exceeds $0.60

per Common

Share

for twenty (20) consecutive trading days, the Company will have the

right to accelerate the expiry date of the Warrants.

In the event of

acceleration, the expiry date will be accelerated to a date that is

thirty (30) days after the date that written notice has been given

to the warrant holder or the date that the Company has issued a

press release announcing the exercise of the acceleration right;

and thereafter, no further notification will be provided by the

Company to the subscribers. The Common

Shares and

Warrants

issued pursuant to

the

Private

Placement shall be subject to

a four (4) month hold from the date of

closing.

About Yorkton

Yorkton Equity

Group Inc. is a fully integrated, growth-oriented real estate

investment company committed to providing shareholders with growing

assets, and stable income through the accretive acquisitions,

organic growth, and the active management of multi-family rental

properties with significant upside potential.

Our geographical

focus is in primary and secondary markets across Canada with

diversified, growing economies, and strong population in-migration,

with an initial focus in British Columbia. Our business objectives

are to achieve stable Net Operating Income (NOI) and growing Net

Asset Value (NAV) in our multi-family rental property portfolio by

deploying a risk-averse

business model to create the ultimate value proposition for our

shareholders.

Yorkton Equity

Group Inc. is built on the solid foundations of the Yorkton Group

of companies with strong financial capacity, and well over 30 years

of real estate experience.

Further information

about Yorkton is available on the Company's website at

www.yorktonequitygroup.com and the SEDAR website at

www.sedar.com.

Neither

the TSX Venture Exchange nor its Regulation Services Provider (as

that term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

For further information on Yorkton, please contact:

Ben

Lui

President and Chief

Executive Officer

Tel: (780) 409-8228

(Ext. 222)/Mobile: (780)

907-5263

Email:

ben.lui@yorktongroup.com

Forward-Looking

Information

This press release

may include forward-looking information within the meaning of

Canadian securities legislation concerning the business of Yorkton.

Forward-looking information is based on certain key expectations

and assumptions made by the management of Yorkton. Although Yorkton

believes that the expectations and assumptions on which such

forward-looking information is based are reasonable, undue reliance

should not be placed on the forward-looking information because

Yorkton can give no assurance that they will prove to be correct.

Forward-looking statements contained in this press release are made

as of the date of this press release. Yorkton disclaims any intent

or obligation to update publicly any forward-looking information,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

This news release

does not constitute an offer to sell or a solicitation of an offer

to buy any of the securities described herein in the United States.

The securities described herein have not been and will not be

registered under the United States Securities Act of 1933, as

amended, or any applicable securities laws or any state of the

United States and may not be offered or sold in the United States

or to the account or benefit of a person in the United States

absent an exemption from the registration requirements

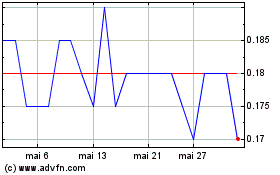

Yorkton Equity (TSXV:YEG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

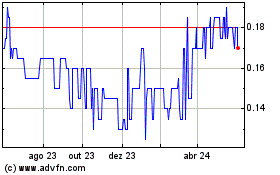

Yorkton Equity (TSXV:YEG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025