Charlie Lee Sums Up Litecoin’s 10 Years History. Part Four: SegWit Activation

13 Outubro 2021 - 6:25AM

NEWSBTC

Today is the day, Litecoin’s 10th anniversary. Congratulations to

Charlie Lee and everyone involved in the project over the years. We

are exploring Litecoin’s history through the eyes of its creator.

We covered its fair launch, the long-hard road to exchanges

adopting LTC, and we introduced the SegWit story. It’s time to

finish it. The last time, we introduced Bitmain’s co-founder

Jihan Wu. Reportedly, he was singlehandedly stopping SegWit

adoption in the Bitcoin blockchain. Lee’s plan was to use Litecoin

as a Testnet of sorts for SegWit. “I realized that here’s a chance

for Litecoin to do something to help Bitcoin. If we can get SegWit

on Litecoin, it can clear out all the FUD and prove that SegWit is

safe and a good upgrade for Bitcoin.” To accomplish that, he had to

convince miners to side with him and not with the manufacturer of

the most efficient ASICs. Related Reading | New To Bitcoin? Learn

To Trade Crypto With The NewsBTC Trading Course According to

Coindesk, there was another important incentive for Litecoin to

adopt SegWit: “Since SegWit could potentially pave the way for

technologies that expand the value proposition of cryptocurrencies,

the move toward accepting the upgrade has reignited excitement

around the normally less-popular cryptocurrency. Litecoin’s price

has nearly tripled since the end of March as a result.” And this is

where today’s story starts. LTC price chart for 10/13/2021 on FX |

Source: LTC/USD on TradingView.com Charlie Lee Talks To Litecoin‘s

Miners During the end of 2016 and the beginning of 2012, Lee talked

to everyone. One of his first victories was to get “Innosilicon,

another LTC ASIC maker,” to his side. In this part of the story, we

can see how hard Jihan Wu was playing. A “huge LTC Miner” was ready

to signal for SegWit in principle, but, since his machines were in

a farm controlled by Jihan Wu, he was afraid that he might lose

access to cheap electricity. Innosilicon was immediately on board

with SegWit. They agreed with me that it's the best path forward.

And they were able to convince some of their customers to support

SegWit. One of their customers was a huge LTC miner. He owned about

5% of the hashrate. Having him was huge. — Charlie Lee

(@SatoshiLite) October 8, 2021 The objective was to get “75% of

blocks signal for SegWit within a 2-week timeframe.” Easier said

than done. LitecoinPool was the first great pool to side with

SegWit. Another big mining pool, F2pool, also promised to do it,

but they didn’t right away. This turned out to be great for the

cause because they provided a clear signal that the market

supported the SegWit transition. Lee narrates, “over the next

month, F2pool actually flipped flopped. They would signal and then

stop signaling. The market reacted accordingly. When F2pool started

signaling, the price will go up, and vice versa.” To

complicate things, “Jihan wanted me to personally visit him and the

miners in China to convince them about SegWit.” Lee didn’t like the

power-play, but that was nothing. As more and more miners signaled

for SegWit, Jihan turned to the ace up his sleeve. There was a

rumor that “Bitmain was building a ton of LTC miners and was going

to turn them all on themselves to block the upgrade.” Over the next

week, more and more miners started signaling for SegWit and it

started to look inevitable. And then this happened. Bitmain was

building a ton of LTC miners and was going to turn them all on

themselves to block the upgrade. 😡https://t.co/Zvs9srExJJ — Charlie

Lee (@SatoshiLite) October 8, 2021 It was time for Charlie Lee to

call in the big guns. The User Activated Soft Fork Since both the

miners and the market were clearly signaling in support of SegWit,

Charlie Lee felt he had the right “to pull the UASF trump card

out.” One of the wonders of decentralized organizations is that the

users can also activate a soft fork. “If the majority of users and

exchanges run the UASF code, SegWit will activate.” If that

happened, miners had to comply and adopt SegWit as well. UASF

stands for User Activated Soft Fork. What it means is that instead

of having the soft fork (SegWit) being miner activated, the user

decides to activate the soft fork in a future date. If the majority

of users and exchanges run the UASF code, SegWit will activate. —

Charlie Lee (@SatoshiLite) October 8, 2021 The threat of a UASF was

too much to bear, so the miners agreed to meet with Charlie Lee

online and work things out. Yes we will do roundtable online

with @SatoshiLite ASAP, not need to wait for June.

https://t.co/rVWQjLu5kJ — Jiang Zhuoer BTC.TOP (@JiangZhuoer) April

20, 2017 And the rest is history, “On April 21, I met with Jihan,

Innosilicon, and miners for over 8 hours IIRC. It was exhausting.“

They reached an agreement, this is the blog post announcing it.

Among other things, it says: “We agree that protocol upgrade should

be made under community consensus, and should not be unilateral

action of developers nor miners. We advocate that Litecoin protocol

upgrade decision should be made based on the needs of the users,

through the roundtable meeting voting process, and activated by

miner voting.” Charlie Lee reflects, “Although this seems so bad

for a decentralized cryptocurrency to have a closed door meeting to

make decisions that affect the future of Litecoin, I felt like it

was a compromise I’m willing to take. It’s better than an all out

war between the miners and I.” On May 10th, 2017, SegWit was

activated on Litecoin. SegWit has activated on Litecoin! 💥😁

pic.twitter.com/lpeklpQpZe — Charlie Lee (@SatoshiLite) May 10,

2017 After that, a few historic transactions took place On THE SAME

DAY, a notorious Bitcoin developer completed the first Lightning

Network transaction. A few days later, Lee posted an anonymous “$1m

bounty on a SegWit address:” The text says: “A lot of people have

been saying that segwit is unsafe because segwit coins are

“anyone-can-spend” and can be stolen. So lets put this to the test.

I put up $1MM of LTC into a segwit address. You can see it’s a

segwit address because I sent and spent 1 LTC first to reveal the

redeemscript.” A few months later, Bitcoin activated SegWit through

a UASF. “It’s hard to know exactly how much Litecoin helped with

this. I feel like it definitely has helped.” Days later, Charlie

Lee and Strike’s Jack Mallers starred in the first Lightning

Network request/ payment transaction on Litecoin. That man Jack

Mallers has a way to get involved in historic transactions, like

this one, and this one. That same month, Lee did his first Atomic

Swap transaction. “This shows how one can move coins between

different chains in a decentralized way. It was a great proof of

concept and paved the way for decentralized exchanges.” And later,

he did another Atomic Swap but this time with Bitcoin. And the next

month, Lee did “the first ever cross-chain swap between BTC and LTC

via Lightning.” This time it was with the now world-famous

Lightning Labs. Related Reading | Binance Burns Record $600 Million

BNB In Its 15th Quarter Wasn’t that an amazing, amazing story? We

learned so much. And, even though we said this was the last chapter

in the Litecoin 10-year history, Charlie Lee has another story to

tell. Join us tomorrow for the infamous story of Charlie selling

all of his Litecoin. Another legendary moment in crypto land.

Featured Image: Charlie Lee's picture from this tweet | Charts by

TradingView

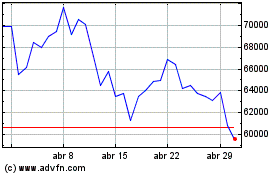

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025