OP Plummets 7% As Optimism Postpones Hardfork

07 Março 2023 - 7:00PM

NEWSBTC

Weeks after its recent bedrock upgrade, aimed at enhancing network

performance via Optimism Collective, Optimism (OP) is still

thriving to stay relevant among the competitive Layer 2 network

markets. On Monday, Optimism announced its upcoming upgrade dubbed

“Regolith Hardfork” set to take place on March 17. The upgrade was

aimed at enhancing deposits on the Optimism network. The network

GitHub post wrote: The Regolith upgrade, named after a material

best described as “deposited dust on top of a layer of bedrock”,

implements minor changes to deposit processing, based on reports of

the Sherlock Audit-contest and findings in the Bedrock Optimism

Goerli testnet. Though the upgrade seemed like a crucial update the

network could need urgently, the L2 network eventually announced

earlier today the postponement of the Hardfork, citing “received

reports of issues.” Optimism noted in a Twitter post: Yesterday we

requested that infra providers update op-geth to a new version in

advance of the March 17 Optimism Goerli hardfork. We’ve received

reports of issues with this latest version and have pulled the

repository while we resolve these issues. Optimism added, saying no

action is required now and an updated version will be shared soon.

Meanwhile, Optimism’s native token OP has been facing a downward

trend along with the rest of the crypto market. OP has fallen from

a high of $2.8 as of March 3 to trading below $2.5 today.

Optimism Plummets By 7% Over the past month, Optimism has been

doing well in the chart following its gaining traction among the

crypto community. The layer 2 network has had several partnerships

and integration, mainly in the DeFi ecosystem, boosting its

recognition. Last week, one of the largest crypto exchanges,

Coinbase, announced the launch of its own layer 2 network called

Base on the Optimism’s OP stack, an open-source modular approach

for building blockchains. This update spiked OP’s price by nearly

20%, pushing its price to trade above $3. Related Reading: Optimism

(OP) Surges 17% As Coinbase Launches L2 On OP Stack However, just

as retrace always comes after a significant rally, OP has seen a

bearish trend ever since, plummeting from a high of $3.2 seen on

February 24 to trading for $2.45, at the time of writing down by 7%

in the past 24 hours. In contrast, OP’s trading volume has also

slowed in recent weeks, signaling a weak upward momentum. The

token’s volume has fallen from more than $960 million seen late

last month to $251 million in the last 24 hours. Notably, OP

still ranks #62 among the largest crypto assets by market cap after

a significant rally of over 2x since the beginning of the year. OP

has moved from its trading price below $1, seen late last year, to

record a new all-time high of $3.22 late last month. Global

Crypto Market Suffers Bearish Trend Furthermore, OP hasn’t been the

only crypto asset suffering a bearish trend over the past week,

Bitcoin and other altcoins such as Ethereum (ETH), Polygon (MATIC),

Binance coin BNB, and Cardano (ADA) have also been in a downward

trend following several circulating negative news in the industry.

The king of crypto, Bitcoin, has declined 5.1% in the past seven

days falling from on high of $23,829 as of March 1 to trading for

$22,349 at the time of writing down by 1% in the last 24 hours.

Related Reading: Bitcoin (BTC) And Ethereum (ETH) Fall 4% Amid

Silvergate Fallout ETH and MATIC have also been in a bearish trend

over the past week, with assets down by 4.3% and 7.1% in the last

seven days, respectively. ETH currently trades at $1,563, while SOL

is at $1.14 at the time of writing. BNB has also plummeted 5.6%% in

the past week, just as ADA has been in a bearish trend, down by

nearly 10% over the same period. BNB currently trades just below

the $290 mark, while ADA trades below a dollar with a market price

of $0.38. Featured image from istock, Chart from TradingView.

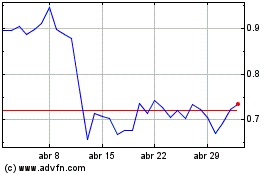

Polygon (COIN:MATICUSD)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Polygon (COIN:MATICUSD)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024