PancakeSwap TVL Drops 12%, Did This Exchange Received A Lethal Blow?

10 Março 2023 - 6:31PM

NEWSBTC

PancakeSwap (CAKE), the leading multichain decentralized exchange

(DEX) running on the Binance Smart Chain (BSC), has suffered a

significant 12% drop in its total value locked (TVL) to $2.4

billion. The crypto crackdown by regulators targeting Binance’s

stablecoin BUSD triggered a decrease in the stablecoin supply. This

has negatively impacted the growth of the BNB Smart Chain,

affecting protocols and DEX’s TVL. What has set PancakeSwap

apart from UniSwap and SushiSwap exchange since its inception is

that it runs on the BSC instead of the Ethereum smart chain.

However, PancakeSwap has gone multichain, launching on both

Ethereum and Aptos. Unlike traditional exchange models, the AMM

allows traders to use permissionless liquidity pools to exchange

digital assets, which are given a liquidity provider (LP) token for

which they decide to add funds to the liquidity pool.

According to DeFiIgnas, decentralized finance (DeFi) researcher,

PancakeSwap overtook UniSwap by total value locked on November

29. Related Reading: Bitcoin Long-Term Holders Still Holding

Strong Despite Price Decline PancakeSwap Able To Mitigate The

Losses? In a bold move to address liquidity issues affecting the

decentralized exchange, PancakeSwap launched its market maker

integration on Ethereum and Atpos in February. The market maker

integration will serve as an additional source of liquidity to the

existing AMM to help traders operate and “enjoy better liquidity,”

according to the exchange. By integrating PancakeSwap’s MM

with its AMM, the exchange will improve swaps of ERC-20 tokens on

the Ethereum smart chain. In addition, PancakeSwap’s integration

with market makers on Ethereum will also result in the introduction

of Ethereum, Bitcoin, and Stablecoin trading pairs on the exchange.

The anonymous developer behind the exchange Chef, the co-founder of

the exchange, noted: We thought about how we could best serve our

community and new Ethereum users without excessively emitting

precious CAKE to acquire extremely high levels of TVL With the

integration on Ethereum, PancakeSwap will allow customers to be

directed to approved market makers and the AMM, according to

DeFiIgnas, which explained that this would result in lower fees and

better spot prices. He claimed: It is a creative solution to the

liquidity problem. Liquidity Providers (LPs) don’t deposit assets

into an AMM if there’s no trading volume to generate yield. And

user’s don’t trade where slippage is high. So, market maker

integration solves this Chicken & Egg dilemma. PancakeSwap Set

To Launch V3 On BSC PCS continues to bring innovation to the

protocol with the launch of V3 on April 1. The upgrade will add

features such as improved liquidity provision, competitive trading

fees, trading incentives, and yield farming tools that allow users

to maximize their returns and rewards. These products can

attract more users and capital to the exchange, increasing the

protocol’s revenue and enhancing PCS’s value to investors.

DeFiIgnas concluded: DEX space is the most fun to watch due to

cut-throat competition. My prediction for 2023 is that it will lead

to a diversification of their business model. The Market Maker

integration, uniqueCAKE veTokenomics, and various incentives make

PCS different. Related Reading: Polygon (MATIC) Down By 7% Amidst

Massive Whale Activity After burning 7 million tokens with a total

value of $27 million on Monday, the DEX’s native token has been

downtrend from its annual high of $4.68 in February. Currently, the

token is trading at $3.56 following the ongoing problems on the

exchange despite the recent announcements from PancakeSwap.

Featured image from Unsplash, chart from TradingView.com

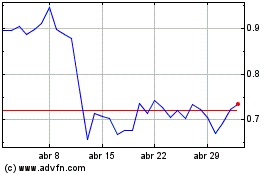

Polygon (COIN:MATICUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Polygon (COIN:MATICUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024