This Bitcoin Metric Peaks Again: Will BTC Hit $60,000 As Before?

27 Outubro 2023 - 5:00PM

NEWSBTC

The price of Bitcoin stands firm around the critical area of

$34,000, hinting at further bullish potential. However, market

analysts wonder if enough clues point to the upside or if BTC will

return to $20,000. Related Reading: Bitcoin Price Rally: Analyst

Sets $45,000 Target And It’s Closer Than You Think As of this

writing, BTC trades at $34,150 with sideways movement in the last

24 hours. The cryptocurrency recorded a 15% profit the previous

week and remains a top coin performer by market cap. Bitcoin

On-Chain Activity Rises Hinting At A Bull Run? Data from the

analytics platform mempool.space shows an increase in on-chain

activity on the Bitcoin network. This spike occurred in February

2023, when BTC transactions rose above 50 Mega Virtual bytes (MvB).

According to the analytics platform, the above metric measures the

size of transactions and blocks on the BTC network. The larger the

transaction, the more space they required. As seen in the chart

below, each time there is a rise in the price of BTC, there is a

surge of activity leading to the rally. This happened in 2017, and

2021, and it is happening this year, which suggests the ecosystem

is blooming, onboarding more users, and preparing for a more

significant rally like in the previous year. In addition to the

increase in activity, it is possible to see the decline in the

metric during the bear market and conclude bull markets record high

activity. In contrast, the bear market records much less user

activity, and they are generally cheaper to transact. However,

unlike 2017 and 2021, this year, this ecosystem saw the

implementation of non-fungible tokens (NFTs) and new applications

boosting these metrics. Thus, it is harder to determine if the

current rally can reach similar levels than in previous years as

the BTC DeFi ecosystem attracts more users looking to leverage the

network for utility rather than long-term investing. BTC DeFi Makes

A Difference In Key BTC Metric? A Chat With The Team Behind

“Leather” The surge in BTC on-chain activity could be attributed to

the cyclical nature of the crypto market. When the price of BTC and

others rise, or there is an expectation of further profits, more

users on-board the network. As a result, the number of transactions

recorded increases. However, many believe that with the

implementation of NFTs in the BTC ecosystem, transaction activity

can no longer be attributed to a new bullish cycle. Related

Reading: XRP Price Could Blast Off In 18 Days, Here’s Why If so,

rising activity metrics could become useless when measuring the

sustainability of a BTC rally. To answer this question, we spoke

with Mark Hendrickson, a General Manager at Trust Machines, a

company working on a Bitcoin DeFi wallet. This is what he told us:

What is “Leather,” and what is your goal in the Bitcoin ecosystem?

A: Leather is a web3 wallets built around Bitcoin based

technologies and applications. And so you can think of Leather,

simply put as MetaMask for Bitcoin in the sense that we want to

provide a robust user experience for connecting to applications

built with Bitcoin and Bitcoin layers in which users can do a lot

of the same sort of things that they can concurrently only do on

smart contracts enabled L1 chains, but to do them actually on

Bitcoin. So, Leather has the ability to connect the applications,

identify yourself to those applications based on your Bitcoin

addresses and your associated assets with those applications

prompts for signed transactions that are essentially actions for

those applications and to do so across layers. (…) We also want to

facilitate the movement of liquidity between L1 and L2 (networks)

and do so in a very seamless manner. A lot of people, for

many reasons, are unfamiliar with the Bitcoin DeFi ecosystem. Can

you tell us more about it, and what is Leather’s role in it? Also,

what do you say to users who want Bitcoin to remain unchanged, the

way it has been since its inception in 2009? A: Bitcoin based DeFi,

I’d say is generally taking place these days or sort of emerging in

two places. You have primitives for Bitcoin based divide on Bitcoin

itself. That’s an L1 (Layer one), mostly driven by Ordinals and

within Ordinals fungible token standards like BRC 20. And then you

have also Bitcoin related taking place on Layer2 like Stacks that

have smart contract functionality. (…) most of that’s taking place

via Ordinals on the layers. It’s taking place mostly through the

native smart contracting capabilities of those layers. To the

question of people who want Bitcoin to remain unchanged, I think

that the folks who are working on Bitcoin-related functionality,

I’d say Bitcoin web3 in general, which includes DeFi. We’re trying

actually to do more with Bitcoin without having to change Bitcoin

really at all. So actually our general approach is to try to extend

what you can do with Bitcoin without having to change it

fundamentally because we do, of course, want to respect all the

work that’s gone into Bitcoin to date and we’d love the security

profile of Bitcoin. And that has to do with taking a relatively

conservative approach. And so if you look at Ordinals, for example,

which is really an innovation based on taproot introduced fairly

recently, there’s a lot of innovation going on as a result of

taproot ordinals without having really changed anything else about

Bitcoin. It is a design space that is actually quite respectful of

Bitcoin as blockchain. There is a theory that every bull run

is preceded by an increase in on-chain activity, with fees

following prices on their way to new highs. What do you think of

network activity right now? Do you think much of it can now be

attributed to Ordinals and other applications? A: Going back to the

start of the year, Ordinals has been a huge exception to the

general rule of the crypto bear market because we’ve experienced

essentially two bull runs inside of Ordinals itself, which I think

have boosted Bitcoin’s position and definitely has boosted network

activity on Bitcoin and fee rates have gone up as a result of it.

And really shown that this idea of storing data on chain on Bitcoin

beyond just simple transactions and applying those primitives to

various web3 applications, whether it’s art or whether it’s new

token standards, that can have a huge effect on just how Bitcoin is

used and also valued. (…) it’s hard for me to really pinpoint any

given reason why any given month the Bitcoin may have gone up in

price because of other factors, but it, it’s pretty clear that it

has an overall effect (on network activity). Ordinals has been a

positive influence on the interest in Bitcoin. ETFs, store

of value, Gold 2.0, Halving, and now Bitcoin DeFi, what is the

current narrative dominating the BTC market? And which narrative

will gain more prominence in the long run? A: I think the dominant

narrative around Bitcoin is probably that in the wake of the last

crash, really it’s a spillover from last year. I think there are a

lot of weaker technologies, weaker platforms and assets that were

shaken out and people ran away from and they’ve taken more safe

harbor and Bitcoin come back to Bitcoin as really the one that’s

stood the test of time. So that combined with the fact that people,

since the start of the year with Ordinals in particular have opened

up to that there are more frontiers to what you can do with

Bitcoin. I think that combination has really driven sort of a

renewed enthusiasm around Bitcoin. It’s a combination of, it’s been

around the longest, it’s the most secure, plus it’s not a dinosaur

that can’t evolve still. It actually has a lot of potential. It

actually has both of those qualities that are very attractive,

secure and conservative in one way, but it’s also more innovative

and there’s more potential than people had realized before on the

other hand. Cover image from Unsplash, chart from Tradingview

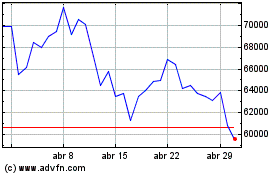

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024