$130M Silk Road Bitcoin Stash To Be Sold By US Government

25 Janeiro 2024 - 5:00PM

NEWSBTC

Since mid-January Bitcoin (BTC) has been facing mounting selling

pressure from various market players. This includes asset manager

Grayscale, bankrupt crypto exchange FTX, and now, the US

government, which is set to auction off a substantial amount of

Bitcoin seized from the infamous dark web marketplace Silk Road.

Sale Of Confiscated Silk Road Bitcoin The US government has filed a

notice to sell approximately $130 million worth of Bitcoin

confiscated from Silk Road. The filing states that the United

States intends to dispose of the forfeited property as directed by

the United States Attorney General. Individuals or entities, except

for the defendants in the case, claiming an interest in the

forfeited property must file an ancillary petition within 60 days

of the initial publication of the notice. Once all ancillary

petitions have been addressed or the filing period has expired, the

United States will obtain clear title to the property, enabling

them to warrant good title to subsequent purchasers or transferees.

Related Reading: XRP Faces Bearish Pressures Amid Market Downturn:

Analysts Divided On Next Move The ongoing selling pressure on BTC

has resulted in a sharp 20% correction over the past 10 days. This

trend is expected to continue and further amplify the selling

pressure. Adding to the situation, asset manager Grayscale, while

slowing down its selling activities, continues to transfer a

significant amount of Bitcoin to Coinbase. According to data

from Arkham Intelligence, Grayscale recently sent an additional

10,000 BTC worth $400 million to Coinbase. Since the approval

of the Bitcoin spot exchange-traded fund (ETF), Grayscale has

deposited a total of 103,134 BTC ($4.23 billion) to Coinbase Prime.

Currently, Grayscale holds 510,682 BTC ($20.43 billion). Ideal

Buying Opportunities? Adam Cochran, a prominent market

expert, has provided insights into the recent price action and the

expectations of Bitcoin buyers. Cochran highlights that aggregate

open interest (OI) for BTC has decreased by 17% from recent highs

but remains around 20% higher than the averages observed during

more stable market ranges. Cochran notes that the market has

seen attempts to catch falling prices, suggesting a mix of

“sophisticated” and leveraged buyers. Cochran further observes that

retail investors are driven by narratives surrounding the ETF and

halving events, leading them to buy dips on leverage. However, many

investors remain unconvinced about the market’s direction and are

waiting for a clear entry point, according to Cochran’s

analysis. Notably, Cochran highlights that the current

funding rates do not indicate a bearish sentiment, even in options

trading, suggesting an expectation of a bottom formation shortly.

The market’s dynamics are influenced by emotions and probabilities,

and Cochran believes that too many participants are overexposing

themselves emotionally by trying to catch the bottom of the market

on each dip. This behavior has increased the likelihood that

the recent price action may not mark the bottom yet. Cochran

suggests that a sentiment reset, a decline in the 3-month

annualized basis by around 25%, and a further decrease in open

interest would provide a healthier environment for major plays in

the market. Related Reading: Helium (HNT) Heats Up: 21% Jump After

Telefónica Deal Ignites Growth Ultimately, Cochran emphasizes the

need for a reset in expectations, highlighting that a period of

doom and despair is necessary for market participants to reassess

their positions. Cochran points out that a range between

$35,000 and $37,000 BTC could be a suitable level for larger spot

buys in the longer term. However, Cochran also notes that a

potential drop to the $28,000 to $32,000 range could provide ideal

conditions for confident, leveraged deployment. Currently, BTC is

trading at $39,800, up a slight 0.6% in the past 24 hours, but down

over 14% in the past fourteen days. Featured image from

Shutterstock, chart from TradingView.com

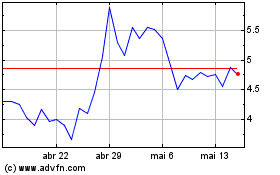

Helium (COIN:HNTUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Helium (COIN:HNTUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025