Bitcoin Whales Increase Their Holdings By $3 Billion – Is A Price Surge Imminent?

28 Janeiro 2024 - 12:30PM

NEWSBTC

It’s only been a month into 2024, and Bitcoin has already

experienced a whirlwind of activity. These events range from the

SEC’s approval of spot Bitcoin ETFs to the cryptocurrency’s price

underperforming with a decrease over the past month and selloffs

from the Grayscale BTC Trust. Amidst all these, on-chain data has

revealed an interesting sentiment of strategic accumulation among

whales of the largest cryptocurrency. According to

information provided by crypto analytics firm IntoTheBlock, Bitcoin

whales have added over 76,000 BTC worth approximately $3 billion to

their holdings since the beginning of the year. Bitcoin

whales have increased their $BTC holdings by ~$3B (76,000 BTC) sine

the start of this year. pic.twitter.com/0hi3Q7WXEo — IntoTheBlock

(@intotheblock) January 27, 2024 Bitcoin Whales Increase Holdings

By $3 Billion Despite Market Downturn The price of Bitcoin climbed

shortly after the approval of spot ETFs in the US to reach a

20-month high of $48,600. However, in a surprising turn of events,

the crypto has suffered a price dip, reaching as low as $38,880

during the week. Related Reading: Helium (HNT) Heats Up: 21%

Jump After Telefónica Deal Ignites Growth Despite this series of

events, on-chain data suggests that the selloff is coming mostly

from small-term holders and a few large whales, as the majority of

whales have been taking advantage of the price dip to scoop up more

Bitcoin into their wallets. The total balance among Bitcoin whales

has jumped by 76,000 in January, with the count now nearing 7.8

million BTC. Consequently, addresses holding more than 1,000 BTC

have now reached a new all-time high. Despite the negative price

movement, Bitcoin held in addresses with over 1,000 BTC has reached

a new yearly high! pic.twitter.com/4qQhbXSD9S — IntoTheBlock

(@intotheblock) January 26, 2024 Price Surge Incoming? BTC’s future

price outlook looks unclear at the moment, as the crypto is

currently trading at a minor resistance around the $42,000 level.

According to analyst Michaël van de Poppe, Bitcoin could continue

consolidating between $37,000 and $48,000 for the coming months,

giving altcoins a time to shine. BTC is currently trading at

$42,522. Chart: TradingView.com However, fundamentals surrounding

Bitcoin point to a price growth in the longer term. Renowned

economist Peter Schiff recently commented that Bitcoin has the

possibility of surging to $10 million within the next decade if it

becomes a hedge against the devaluation of the US dollar. Related

Reading: Shiba Inu On Fire: Over 12 Million SHIB Vaporized – Impact

On Price The community and investors also like to keep an eye out

for crypto whales because they can significantly influence price

movements. When whales stock up on BTC, it often signals they

believe the price is undervalued and ready to rise substantially in

the near future. If the whale accumulation continues, it could lead

to a change to positive sentiment among the wider Bitcoin investing

market. The next Bitcoin halving is also on its way, and many

analysts predict a price growth around the event.

Featured image from Pexels

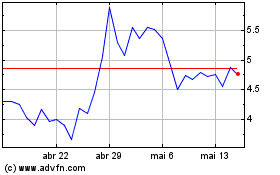

Helium (COIN:HNTUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Helium (COIN:HNTUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025