Bitcoin Plunges Under $63,000, Here’s Where Next On-Chain Support Is

19 Março 2024 - 1:00PM

NEWSBTC

Bitcoin has deepened its decline in the past day with its price now

slipping below $63,000. Here’s where the next potential support is,

according to on-chain data. Bitcoin Could Find Support At These

Price Levels In a new post on X, analyst Ali has discussed how the

Bitcoin support and resistance levels are looking like right now

based on on-chain data from Glassnode. The indicator of relevance

here is the “UTXO Realized Price Distribution” (URPD), which, in

short, tells us about the amount of coins (or more precisely,

UTXOs) that were last purchased at any given price level that the

asset has visited in its history so far. Related Reading: Bitcoin

Has Undergone This Bearish Structure Change, Analyst Explains Below

is the chart shared by the analyst that shows the data for this

distribution for the price levels around the recent spot value of

the cryptocurrency: Looks like the $72,880 mark is the level with

the richest amount of coins at the moment | Source: @ali_charts on

X From the graph, it’s visible that there are a few price levels

not far from the current one that particularly stands out in terms

of the amount of buying that took place at them. In on-chain

analysis, the potential for any level to act as support or

resistance is based on the total number of coins that have their

cost basis at the level in question. Levels thick with coins that

are situated under the current price would be probable to act as

points of support, while those above the spot value could prove to

be resistance walls. As is apparent from the graph, the $61,100,

$56,685, and $51,530 levels are the ones below the current price

that hold the cost basis of a notable amount of the supply right

now. Naturally, this means that should the decline continue

further, these would be the levels to watch for a possible rebound.

Two levels above, however, are even larger than all three of these

support levels: the cost basis centers around $66,990 and $72,880.

Interestingly, the latter of these is the single largest

acquisition level out of all the price levels listed in the chart,

implying that a large amount of FOMO buying has occurred at the

asset’s all-time high levels. In the scenario that Bitcoin regains

its upward momentum, these levels of high cost basis population

would be where the asset could be most probable to find some

trouble. Now, as for why acquisition centers are considered

relevant for support and resistance in on-chain analysis is the

fact that investors are likely to show some kind of reaction when a

retest of their cost basis takes place. Related Reading: Bitcoin

Sentiment Cools Off, Price Rebound Soon? When such a retest is from

above, the holders may decide to accumulate more, believing that

the price will go up again in the future. On the other hand, they

may sell instead if the retest is from below, as they may think

exiting at break-even is better than risking another drop. A large

number of coins having their cost basis at the same level means a

potentially large degree of one of these reactions happening and,

hence, a strong support or resistance effect on the price. BTC

Price Bitcoin is inching closer to the first major on-chain support

level as it has now dropped to $62,700. The price of the asset

appears to have plummeted over the last few days | Source: BTCUSD

on TradingView Featured image from Shutterstock.com, Glassnode.com,

chart from TradingView.com

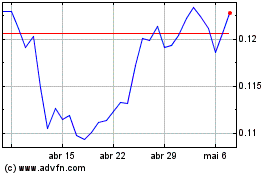

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024