Stablecoins Steal The Spotlight: $150 Billion Market Cap, $122 Billion Daily Trades

22 Março 2024 - 6:20AM

NEWSBTC

Stablecoins have recently achieved a significant milestone,

surpassing $150 billion in market capitalization, with daily

trading volume reaching $122 billion. This achievement marks a

notable resurgence and growth in the stablecoin sector, with

implications for the broader cryptocurrency ecosystem. Related

Reading: BONK Bonked: Price Crashes 30% In 7 Days – More Pain

Ahead? Market Dynamics And Growth Factors Stablecoins are digital

assets designed to maintain a stable value by pegging their price

to a reserve asset, such as the US dollar or other fiat currencies.

They serve as a crucial bridge between traditional finance and the

crypto space, offering stability and liquidity for users and

investors. The recent surge in the stablecoin market can be

attributed to several key factors. Firstly, the growing demand for

stable assets in the volatile crypto market has driven increased

adoption of stablecoins as a safe haven for traders and investors.

Additionally, the rise of decentralized finance (DeFi) platforms

has fueled the demand for stablecoins as a means of conducting

transactions, providing liquidity, and earning yields. Source:

CoinMarketCap Tether’s Dominance And Market Impact Tether (USDT),

one of the most widely used stablecoins, has played a significant

role in driving the growth of the stablecoin market. With a market

capitalization exceeding $100 billion, Tether’s dominance

underscores its position as a key player in the crypto space.

Undoubtedly dominant in this sector, Tether commands a 70% market

share. With a market capitalization of over $31 billion, USD Coin

(USDC), the second largest stablecoin, grants Circle’s stablecoin a

market share exceeding 20%. At the time of writing, DAI held a 3%

market share and $4.7 billion, placing it in third position. Total

crypto market cap at $2.4 trillion on the 24-hour chart:

TradingView.com Tether’s market impact extends beyond its role as a

stable asset, as it has faced scrutiny and regulatory challenges

due to concerns about its reserve backing and transparency. Despite

these challenges, Tether’s resilience and continued dominance

highlight the strong demand for stablecoins and their utility in

the digital economy. Crypto Enthusiasts Celebrate Stablecoins’

Rising Market Cap The crypto community is cheering the rising

market cap of stablecoins, seeing it as a sign of coming

prosperity. Total Stablecoin Mcap: Mar 21st. $147b. Feb 21st.

$138b. Jan 21st. $133b. Dec 21st. $130b. Nov 21st. $127b. Oct 21st.

$124b. it is impossible and stupid to not be bullish on DeFi whilst

this chart is just up and to the right for the last 6 months.

pic.twitter.com/qkcERkIXi8 — ZeroToTom (@zerototom) March 21, 2024

A growing market cap suggests more money is flowing into crypto,

providing much-needed liquidity for trading and potentially pushing

prices up. Additionally, stablecoins offer a safe haven during

market dips, potentially encouraging more investors to enter the

broader crypto market. This increased comfort and investment could

fuel the entire market’s growth. Related Reading: Fantom (FTM) Bull

Run: Can FTM Hit $2 After 20% Price Spike? Implications For The

Crypto Ecosystem The surpassing of $150 billion in stablecoin

market capitalization signifies a maturing and expanding crypto

ecosystem. Stablecoins have become essential infrastructure in the

digital economy, enabling seamless transactions, cross-border

payments, and financial services innovation. Featured image from

Xverse, chart from TradingView

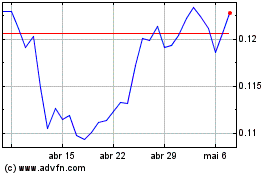

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024