Research Firm Predicts Bitcoin Game Theory In Global Adoption Race

30 Julho 2024 - 1:30PM

NEWSBTC

In an analysis released on Monday, ASXN, an emerging crypto

research firm, outlines the dynamics of global Bitcoin adoption

through the lens of game theory. The report titled “The Game Theory

of Bitcoin Adoption Among Nations” provides an examination of how

nations can leverage mathematical game theory to strategically

adopt Bitcoin. The report follows on the heels of Donald Trump’s

announcement at the Bitcoin 2024 conference that he’ll convert all

BTC’s owned by the US government through enforcement actions into a

“strategic Bitcoin stockpile”. Bitcoin Game Theory Explained The

report begins by framing BTC adoption within the broader context of

game theory, a discipline that evaluates the strategic decisions

made by individuals or entities under conditions of uncertainty and

competing interests. According to ASXN, “Game theory provides a

structured framework to predict the outcomes of nation-level

strategies in adopting digital currencies, taking into account not

only the economic benefits and technological advancements but also

the potential geopolitical shifts.” Related Reading: Minimal

Bitcoin On-Chain Resistance Ahead: Price Set For New ATH? According

to the concept of ‘First Mover Advantage’, early adoption of BTC

can position nations advantageously on several fronts. The report

states, “Nations acting as first movers in the Bitcoin arena may

set precedents in legal and regulatory frameworks, attract global

crypto enterprises, and secure a significant share of the

blockchain innovation landscape.” However, it contrasts these

advantages with the pitfalls of premature regulatory frameworks and

the volatility of Bitcoin’s market value, which could pose

substantial risks to national economies. The report adds, “Once a

few influential nations adopt Bitcoin, others will follow suit to

avoid being left behind – creating a bandwagon effect. This effect

is driven by both the returns to adoption as well as the risks of

non adoption. This is when the Bitcoin adoption cycle enters the

steepest part of the s-curve.” The ‘Payoff Matrix’—a fundamental

tool in game theory—is applied by ASXN to dissect the

decision-making process of countries considering Bitcoin adoption

for nations. ASXN elaborates on how this matrix helps countries

assess the potential returns and risks associated with various

strategic choices. “Each nation faces a unique matrix based on its

economic structure, political climate, and market dynamics. The

optimal strategy, while generally skewing towards adoption due to

the projected global ascendancy of cryptocurrencies, must still be

tailored to individual national circumstances,” the report

elaborates. Furthermore, the report also introduces the concept of

the ‘Best Reaction Function’ in the context of Bitcoin adoption,

explaining how nations develop strategies by anticipating the

decisions of others. “A nation’s strategy is influenced not only by

its direct gains from adopting Bitcoin but also by the expected

actions of other nations, which might alter the global economic and

technological landscape,” the report states. Related Reading:

Bitcoin Bull Cycle Likely To Go On Till Mid-2025: CryptoQuant CEO

The researchers add how the bandwagon effect could play out; “The

logic plays out something like – Nation 1 assesses the cost benefit

trade off and decides on adoption. Nation 1 realizes that all other

nations are also going to choose adoption, Nation 1 concluded that,

given that all nations will choose adoption, they should increase

adoption speed so as not to lose competitive edge. Slowly, then all

at once.” ASXN uses several real-world applications to illustrate

the theoretical concepts discussed. The case of El Salvador is

examined in depth, showcasing how its early adoption has influenced

other nations’ perceptions and strategies towards Bitcoin. The

analysis extends to how Wisconsin’s pension fund investment in

Bitcoin ETFs reflects a broader trend of sub-national entities

assessing cryptocurrency as a viable component of their financial

strategies, and the substantial commitment by MicroStrategy is

highlighted as a corporate parallel to national strategies. Looking

forward, the report discusses the potential future trajectories of

Bitcoin adoption, influenced by both technological advancements and

evolving geopolitical dynamics. It specifically addresses Robert

Kennedy Jr.’s proposal at Bitcoin Nashville 2024 to acquire 550 BTC

daily until the US amasses 4 million BTC, which represents 19% of

the total available BTC supply. This approach aims to reflect the

proportion of global gold reserves that the US currently maintains

in comparison to other countries. And the Bitcoin game theory is

already playing out. “Whilst the ideas Trump presented at

Bitcoin Nashville may or may not happen, the simple fact he

publicly acknowledged Bitcoin & it’s properties is a win &

we are already seeing early signs of the effects of this,” the

researchers conclude. They refer to Johnny Ng, a member of Hong

Kong’s Legislative Council, who has been advocating for the

incorporation of Bitcoin into the city’s financial reserves

following Trump’s announcement. At press time, BTC traded at

$66,660. Featured image created with DALL·E, chart from

TradingView.com

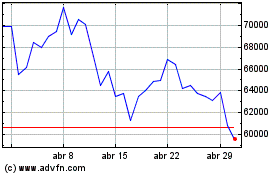

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024