Bitcoin Bet For Amazon? 5% Stake Proposal Raises Eyebrows

09 Dezembro 2024 - 8:30PM

NEWSBTC

Bitcoin might become part of Amazon’s treasury strategy as the

online retail giant’s shareholders are pushing for the adoption of

the cryptocurrency in its assets. If Amazon embraces digital

assets, it will join other business titans exploring the inclusion

of Bitcoin in their asset portfolios. Related Reading: Countdown To

$5 XRP: Engineer Predicts Milestone On ‘Strong Fundamentals’

Bitcoin As Financial Reserve Option Shareholders of Amazon urged

the online retail store to evaluate the possibility of adding

Bitcoin to its balance sheet, saying that the firstborn

cryptocurrency could enhance the investors’ value in the long term

because it is one way of protecting it from inflation. A US-based

think tank told Amazon to assess the prospect of using a portion of

its financial reserve to hold Bitcoin to increase its shareholder’s

value and fight off inflation. According to a recommendation made

by the National Center for Public Policy Research (NCPPR), the

shareholders of the company are asking its Board to investigate if

including cryptocurrencies into the treasury of the online retail

store serves the best long-term interests of shareholders. HISTORY:

SHAREHOLDERS ARE PETITIONING $2.3 TRILLION AMAZON TO BUY #BITCOIN

BTC IS IN THE BEST “LONG-TERM INTEREST OF SHAREHOLDERS” 🚀

pic.twitter.com/Nj2wCNrVUn — The Bitcoin Historian (@pete_rizzo_)

December 9, 2024 The NCPPR submitted the shareholder proposal to

Amazon to consider the crypto strategy during the company’s 2025

annual shareholders’ meeting. The American think tank suggested

that Amazon should assess the benefits of holding some Bitcoin,

encouraging the company to allot even 5% of its $585 billion assets

to the cryptocurrency. “Though Bitcoin is currently a volatile

asset – as Amazon stock has been at times throughout its history –

corporations have a responsibility to maximize shareholder value

over the long-term as well as the short-term,” NCPRR stated in the

document. The researchers said that including some Bitcoins can

diversify the company’s balance sheet, solving this problem without

taking on too much volatility. Fighting Inflation The NCPRR said

that the inflation rate in the US is going up, adding that cash and

bonds are no longer the best approach to protect Amazon’s money.

The US-based think tank cited that in the last four years, the

average inflation rate in the country is pegged at 4.95%, which

even went up to 9.1% in June 2022. It added that the true inflation

rate is significantly higher, saying that several studies showed

that it is nearly double the Consumer Price Index on occasion.

“Amazon should – and perhaps has a fiduciary duty to – consider

adding assets to its treasury that appreciate more than bonds, even

if those assets are more volatile short term,” NCPPR remarked.

Simple. Accept bitcoin payments? 🤷♂️ https://t.co/ud5PVNYHrj — CZ

🔶 BNB (@cz_binance) December 8, 2024 Bitcoin A Good Option The

NCPPR believes that Amazon could preserve billions of dollars of

shareholder value by simply holding Bitcoin. The researchers

explained that the alpha crypto has been increasing in value unlike

cash and bonds whose value is lower than the “true inflation rate”,

adding that the digital asset surged by 130% this year, which is

performing better than bonds. Related Reading: Ethereum Surge

Coming? Analyst Eyes $16,000 Milestone Within 2 Years Data showed

that in the last five years, Bitcoin’s value skyrocketed to a

phenomenal 1,200%. The company’s shareholders said that by holding

Bitcoin, Amazon protects its profits from inflation and potentially

generates better returns in the future. In a post, former Binance

executive Changpeng Zhao supports the proposal, offering a simple

solution on how Amazon can build its Bitcoin holdings by adding a

payment option using cryptocurrency on its platform. Featured image

from Pexels, chart from TradingView

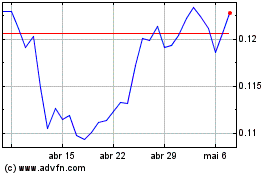

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024