Market Signals Point To Caution: Bitcoin’s 3-Day Chart Shows Potential Sell Alert

25 Fevereiro 2025 - 10:30PM

NEWSBTC

Bitcoin (BTC), the market’s leading cryptocurrency, has officially

entered a new downtrend phase following a period of consolidation

around the mid-$90,000 levels. After reaching an all-time

high of $109,000 in January, Bitcoin has now seen a significant

drop of 7%, bringing its current price to approximately $87,400.

This decline raises concerns about the sustainability of the

broader bull market as investor sentiment shifts towards fear.

Could A Drop Below $80,000 Be Imminent? Market expert Jesse Olson

recently took to social media platform X (formerly Twitter) to

question whether Bitcoin is nearing a local top or possibly “the”

top for this market cycle. Olson referenced historical data

suggesting that previous pivot points for Bitcoin often signal

significant downturns. He highlighted two notable instances: In

April/May 2021, the Bitcoin price experienced a pivot point about

20% below its local top, leading to a price drop of 56%. In

November 2021, the pivot was around 15% from “the” top, resulting

in a staggering 77% decline. Currently, the price sits

approximately 15% below the recent peak, and Olson notes a pending

sell signal on BTC’s 3-day chart, indicating potential further

downside. Related Reading: Litecoin Trading Activity Increases Over

The Past Month – Potential LTC ETF Draws Speculation The expert

also mentioned that while Bitcoin has hit Target 2 of 4 in his

analysis, several indicators suggest the price could drop below

$80,000, with higher time frames beginning to show bearish signals.

Arthur Hayes Warns Of Bitcoin Downturn Adding to the bearish

sentiment, market expert Arthur Hayes expressed concerns in a

recent post on X, warning of a potential extension of Bitcoin’s

downturn. Hayes highlighted that many holders of BlackRock’s

Bitcoin exchange-traded fund (ETF), IBIT, are hedge funds that have

gone long on the ETF while simultaneously shorting Chicago

Mercantile Exchange (CME) futures to earn a yield greater than

short-term US treasuries. Should Bitcoin’s price continue to fall,

Hayes suggests that these funds may unwind their positions, selling

IBIT and buying back CME futures. This profit-taking strategy could

lead to further declines in Bitcoin’s price, potentially pushing it

down toward the $70,000 mark. Related Reading: Dogecoin Activity

Levels Crash To 4-Month Lows, Does This Spell Doom For The Meme

Coin? Despite the prevailing bearish outlook, analyst Doctor Profit

presents a more optimistic perspective. He emphasizes that the

production cost of Bitcoin is currently at $95,000, meaning the

market price is below this critical threshold. Historically, prices

trading below production costs have signaled prime buying

opportunities for investors. Doctor Profit argues that this

situation creates a compelling case for potential investors, as the

market often sees price rebounds when production costs are higher

than market prices. Featured image from DALL-E, chart from

TradingView.com

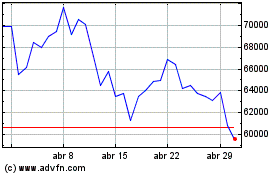

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025