MORNING UPDATE: Man Securities Inc. Issues Alerts for ORCL, SBUX, DLTR, SWKS, and NCR

12 Abril 2005 - 11:49AM

PR Newswire (US)

MORNING UPDATE: Man Securities Inc. Issues Alerts for ORCL, SBUX,

DLTR, SWKS, and NCR CHICAGO, April 12 /PRNewswire/ -- Man

Securities issues the following Morning Update at 8:30 AM EDT with

new PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for ORCL, SBUX, DLTR, SWKS, and NCR,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "There's low volume and that's telling you

that the sidelines are packed with people waiting for some sort of

a headline to act as an inspiration telling them to buy or sell."

-- Paul Cherney, chief market analyst, Standard & Poor's. New

PriceWatch Alerts for ORCL, SBUX, DLTR, SWKS, and NCR... PRICEWATCH

ALERTS - HIGH RETURN COVERED CALL OPTIONS -- Oracle Corp.

(NASDAQ:ORCL) Last Price 12.40 - SEP 11.00 CALL OPTION@ $1.85 ->

4.3 % Return assigned* -- Starbucks Corp. (NASDAQ:SBUX) Last Price

47.51 - JUL 45.00 CALL OPTION@ $4.30 -> 4.1 % Return assigned*

-- Dollar Tree Stores Inc. (NASDAQ:DLTR) Last Price 24.84 - AUG

22.50 CALL OPTION@ $3.20 -> 4.0 % Return assigned* -- SkyWorks

Solutions Inc. (NASDAQ:SWKS) Last Price 5.75 - AUG 5.00 CALL

OPTION@ $1.15 -> 8.7 % Return assigned* -- NCR Corp. (NYSE:NCR)

Last Price 35.25 - MAY 35.00 CALL OPTION@ $1.60 -> 4.0 % Return

assigned* * To learn more about how to use these alerts and for our

FREE report, "The 18 Warning Signs That Tell You When To Dump A

Stock ", go to: http://www.investorsobserver.com/mu18 (Note: You

may need to copy the link above into your browser then press the

[ENTER] key) ** For the FREE report, "Is Your Investment Portfolio

Disaster Proof? - Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEDP NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

Verizon Communications, Abbott Laboratories, and Ameritrade Holding

Corp. lead the list of companies with the most news stories while

Shopping.com Ltd. and Bausch & Lomb Inc. are showing a spike in

news. Genentech Inc., The Boeing Co., and Alexion Pharmaceuticals

Inc. have the highest srtIndex scores to top the list of companies

with positive news while Qualcomm Inc. and MCI Inc. lead the list

of companies with negative news reports. Pepsi Bottling Group Inc.

has popped up with a high positive news sraIndex score. For the

FREE article titled, "Earnings Season Decoded - An Essential 15

Point Checklist For Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Trading overseas is deep into negative territory, as only three of

the 15 markets that we follow are in positive territory. The

cumulative average return on the group is a negative 0.198 percent.

Asian stocks were mostly lower on Tuesday as technology weakness

continued to plague most markets in the East. Meanwhile, Europe is

down as we head deeper into a week burdened with earnings from

retailers and outlooks for consumer spending. Futures are pointed

lower this morning, casting a somber tone across the Street. Crude

prices have continued to climb, edging closer to the $54-a- barrel

level. Meanwhile, investors are somewhat anxious ahead of the

February trade data that is due out today. Analysts are currently

forecasting the gap will widen to $58.4 billion from January's

$58.3 billion, marking the second largest trade gap. Be prepared

for the investing week ahead with Bernie Schaeffer's FREE Monday

Morning Outlook. For more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES Besides the start of another busy earnings season,

this week will also bring the usual complement of economic data.

Today, all eyes will turn towards the US Labor Department's latest

trade report -- one that is expected to show the deficit widening

from US$58.3 billion in February to US$59 billion last month. While

sturdy economic growth in the US is obviously upbeat, how long can

the country continue spending more than it can realistically

afford? Imports are sweeping into the US at a hearty pace, but

exports aren't keeping up, despite the dollar's weakness. The

situation isn't without precedent. Many other countries have

experienced depreciation in their currency, helping them gain

competitive advantage over others, beef up trade activity and, in

turn, trade surpluses. But some studies, including one by the

Organization for Economic Cooperation and Development, show that in

order for the US trade deficit to drop by 2% by the end of the

decade, the dollar would have to lose around a quarter of its

current value against the benchmark basket of major world

currencies. While that would arguably help out the US, others would

not be so fortunate. A weaker dollar and cheaper American exports

would be a big blow to Europe, already dependent on exports for the

majority of its economic growth, and struggling to muster any kind

of domestic consumer spending amid a jobless rate around 9%. That

goes double for Japan. While the European Central Bank could at

least cut interest rates (currently at 2%) to compensate, the Bank

of Japan has no room at all with rates already at zero. A strong

yen would cripple Japan's chances of engineering a sustained

economic recovery as exports fell. Read more analysis from the

247Profits Group every trading day with the FREE 247Profits

e-Dispatch, featuring insightful economic commentary, profitable

investment recommendations, and full access to a leading team of

financial experts. Register for free here:

http://www.investorsobserver.com/TP TODAY'S ECONOMIC CALENDAR 7:45

A.M. April 9 ICSC Store Sales Index 8:30 A.M. February Trade

Deficit 8:55 A.M. April 9 Redbook Retail Sales Index 11:20 A.M.

Pres Bush speaks on the War on Terror in Killeen, Texas 2:00 P.M.

March Treasury Budget Balance 5:00 P.M. April 9 ABC/Washington Post

Consumer Confidence Index 7:30 P.M. Philadelphia Fed President

Santomero speaks on the business cycle at University of Delaware in

Newark, Del. Man Securities Inc. is one of the world's leading

option order execution firms. Man's in-house broker team offers a

level of personal service and experience unavailable from no-frills

discount brokers. To improve your understanding of option pricing

get Man's FREE Margin/Option Wizard software at:

http://www.investorsobserver.com/mancd. Member CBOE/NASD/SPIC. CRD#

6731 This Morning Update was prepared with data and information

provided by: InvestorsObserver.com - Better Strategies for Making

Money -> For Investors With a Sense of Humor. Only $1 for your

first month plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must Quote.com QCharts- Real time

quotes and streaming technical charts to keep you up with the

market. Analyze, predict, and stay ahead. for a Free 30 day trial

go to: http://www.investorsobserver.com/MUQuote2 247profits.com:

You'll get exclusive financial commentary, access to a global

network of experts and undiscovered stock alerts. Register NOW for

the FREE 247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

John Gannon of Man Securities Inc., +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

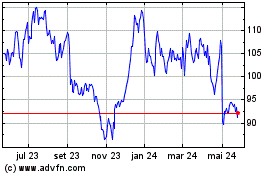

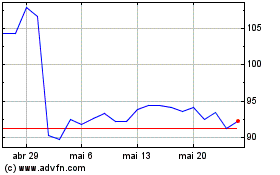

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024