Antipodean Currencies Decline

20 Março 2023 - 11:48PM

RTTF2

Australia and New Zealand currencies weakened against their

major currencies in the Asian session on Tuesday, as traders' focus

shifted towards the U.S. Federal Reserve's monetary policy

announcement on Wednesday despite the latest efforts initiated to

address the turmoil in the global banking sector.

Traders are focusing their attention on the Fed's monetary

policy announcement on Wednesday, with CME Group's FedWatch Tool

currently indicating a 26.9 percent chance interest rates will

remain unchanged and a 73.1 percent chance of a 25-basis point rate

hike.

Ihe Australian dollar also fell after the release of minutes

from the Reserve Bank of Australia's Monetary Policy Board's March

7 meeting that reconfirmed a rate pause will be considered at the

April meeting. The board acknowledged that inflation is expected to

remain above the bank's target range for at least the next two

years.

At the meeting, the RBA hiked its key interest rate by a

quarter-point to 3.60 percent, as widely expected. The interest

rate on Exchange Settlement balances was also raised by 25 basis

points to 3.50 percent. The RBA has tightened its monetary policy

by altogether 350 basis points since May 2022.

In economic news, data from Statistics New Zealand showed that

the nation posted a merchandise trade deficit of NZ$714 million in

February. That beat forecasts for a shortfall of NZ$1,450 million

following the downwardly revised NZ$2,113 million deficit in

January.

Exports were worth NZ$5.23 billion, easing from the downwardly

revised NZ$5.30 billion in the previous month. Imports came in at

NA$5,95 billion, down from NZ$7.42 billion a month earlier.

In the Asian session today, the Australian dollar fell to a

6-day low of 1.6018 against the euro and a 4-day low of 0.9152

against the Canadian dollar from yesterday's closing values of

1.5949 and 0.9175, respectively. If the aussie extends its

downtrend, it is likely to find support around 1.62 against the

euro and 0.89 against the loonie.

The aussie dropped to 87.81 against the yen, from yesterday's

closing value of 88.18. On the downside, the aussie may find its

support around the 86.00 level.

Against the U.S. dollar, the aussie edged down to 0.6690 from

yesterday's closing value of 0.6715. The AUD/USD pair is likely to

find its next support around the 0.64 area.

The NZ dollar fell to 5-day lows of 1.7236 against the euro and

1.0772 against the Australian dollar, from yesterday's closing

quotes of 1.7153 and 1.0746, respectively. If the kiwi extends its

downtrend, it is likely to find support around 1.775 against the

euro and 1.09 against the aussie.

Against the U.S. dollar, the kiwi dropped to a 4-day low of

0.6219 from yesterday's closing value of 0.6245. The kiwi may find

its support around the 0.60 area.

The kiwi edged down to 81.58 against the yen, from yesterday's

closing value of 82.01. The NZD/JPY pair may find its support

around the 80.00 level.

Looking ahead, Swiss trade data for February and U.K. public

sector finance data for February are slated for release at 3:00 am

ET.

German ZEW economic sentiment index for March and Eurozone

construction output for January are set to be released at 6:00 am

ET.

In the New York session, Canada CPI data for February and U.S.

existing home sales data for February are due to be released.

Japanese stock market is closed for Vernal Equinox holiday.

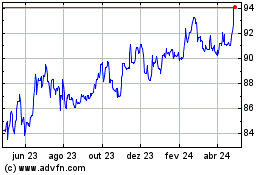

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

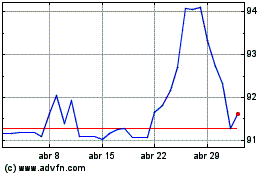

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024