Canadian Dollar Trades Lower Against Most Majors

21 Fevereiro 2024 - 7:16AM

RTTF2

The Canadian dollar traded lower against its most major

counterparts in the European session on Wednesday amid falling oil

prices, as investors weighed signs of tighter supplies against a

still-shaky demand outlook.

Investors also awaited key PMI data and U.S. inventory reports

for hints on the outlook for demand.

Middle East tensions persist, helping limit the downfall in oil

prices.

Supply concerns lingered, with Houthi rebels saying ships in the

Red Sea and Arabian Sea are their latest maritime targets.

The minutes from the Federal Reserve's latest policy meeting are

due later today, which could offer more clarity regarding the

possible timing of the first rate cut.

Strong economic data released last week pushed back expectations

for immediate rate cuts from the Fed.

Traders are also on edge ahead of the release of fourth quarter

results from Nvidia after the close of today's trading.

The loonie eased to 1.4624 against the euro and 110.85 against

the yen, off its early highs of 1.4598 and 111.09, respectively.

The loonie is seen finding support around 1.48 against the euro and

108.00 against the yen.

The loonie touched 1.3536 against the greenback, setting a 6-day

low. The loonie is poised to challenge support around the 1.38

level.

In contrast, the loonie recovered against the aussie and was

trading at 0.8860. If the currency rises further, it is likely to

test resistance around the 0.86 region.

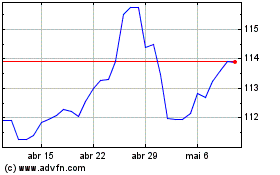

CAD vs Yen (FX:CADJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

CAD vs Yen (FX:CADJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024