Yen Slides As BoJ Pause Its Ultra-Loose Monetary Policy

18 Março 2024 - 11:59PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Tuesday, after the Bank of Japan decided to end

negative rates amid signs that inflation is strengthening.

The Bank of Japan raised its interest rates for the first time

in nearly two decades. The BoJ Policy Board, led by Governor Kazuo

Ueda, decided in a 7-2 vote to raise the overnight interest rate

around 0 to 0.1 percent from minus 0.1 percent.

The central bank also decided to end its yield curve control, or

YCC, policy that capped the interest on the 10-year Japanese

government bonds, or JGBs, around zero.

Markets had widely expected the BoJ to exit its unorthodox and

ultra loose policy measures that were adopted in 2016 to tackle the

deeply entrenched deflation.

This was the first hike since 2007 and came after recent data

showed inflation picking up. In recent weeks, many BoJ rate-setters

commented that the 2 percent inflation goal was in sight.

Meanwhile, traders await the U.S. Fed's monetary policy

announcement on Wednesday for clues about the outlook for interest

rates.

The Fed is widely expected to leave interest rates unchanged

after recent inflation readings reduced optimism about a rate cut

in June. However, the focus will be on the central bank's

accompanying statements and economic projections, which could have

a significant impact on the outlook for rates.

The Bank of England and the Swiss National Bank are also

scheduled to make their monetary policy announcements later in the

week.

In the Asian trading now, the yen fell to 2-week lows of 163.33

against the euro and 191.07 against the pound, from yesterday's

closing quotes of 162.14 and 189.82, respectively. If the yen

extends its downtrend, it is likely to find support around 164.00

against the euro and 192.00 against the pound.

The yen dropped to nearly a 2-week low of 169.20 against the

Swiss franc, from yesterday's closing value of 167.98. On the

downside, the yen may test support near the 172.00 region.

Against the U.S. and the Canadian dollars, the yen slipped to

2-week lows of 150.25 and 110.89 from Monday's closing quotes of

149.14 and 110.20, respectively. The next possible support level

for the yen is seen around 152.00 against the greenback and 112.00

against the loonie.

The yen slipped to 5-day high of 91.09 against the NZ dollar

from an early 4-day high of 90.52. The yen may test support near

the 93.00 region.

Looking ahead, Switzerland foreign trade data for February and

Swiss SECO economic forecasts, Germany's ZEW economic confidence

survey results for March and Eurozone labor cost data for the

fourth quarter are due to be released in the European session.

In the New York session, Canada CPI data for February, U.S.

building permits and housing starts data for February are slated

for release.

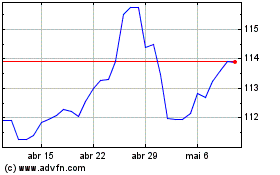

CAD vs Yen (FX:CADJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

CAD vs Yen (FX:CADJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024