U.S. Dollar Declines As Investors Await Fed Decision

31 Julho 2024 - 10:07AM

RTTF2

The U.S. dollar fell against its major counterparts in the New

York session on Wednesday, as ADP private sector employment

increased less than expected in July and investors awaited the

Federal Reserve's interest rate decision for clues about a cut in

September.

Data from payroll processor ADP showed that private sector

employment climbed by 122,000 jobs in July after jumping by an

upwardly revised 155,000 jobs in June.

Economists had expected private sector employment to increase by

150,000 jobs, matching the job growth originally reported for the

previous month.

The Federal Reserve will deliver its policy decision shortly,

with the markets widely expecting the central bank to keep rates on

hold.

Traders have priced in a 100 percent chance for a September rate

reduction, according to the CME FedWatch Tool.

The greenback declined to a 2-day low of 1.0849 against the euro

and 4-1/2-month lows of 149.62 against the yen and 0.8770 against

the franc, off its early highs of 1.0806, 153.88 and 0.8834,

respectively. The greenback is seen finding support around 1.10

against the euro, 147.00 against the yen and 0.86 against the

franc.

The greenback fell to 1-week lows of 1.3787 against the loonie

and 0.5948 against the kiwi, from its early highs of 1.3859 and

0.5888, respectively. The greenback is likely to challenge support

around 1.33 against the loonie and 0.63 against the kiwi.

The greenback eased to 0.6539 against the aussie, from an early

nearly 3-month high of 0.6479. The currency may locate support

around the 0.69 level.

Against the pound, the greenback reached as low as 1.2854. The

currency is poised to challenge support around the 1.31 level.

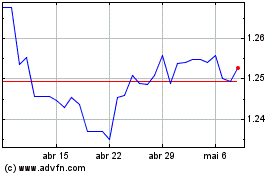

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Dez 2024 até Jan 2025

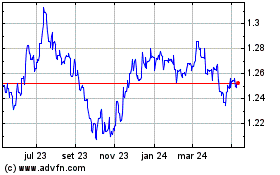

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Jan 2024 até Jan 2025