UK House Prices Rise For Third Month: Nationwide

01 Agosto 2024 - 12:43AM

RTTF2

UK house prices increased for the third straight month in July,

suggesting stabilization in the housing market, data from

Nationwide Building Society showed on Thursday.

House prices posted a monthly growth of 0.3 percent after rising

0.2 percent in June. This was the third consecutive increase and

faster than forecast of 0.1 percent.

On a yearly basis, house price growth accelerated

more-than-expected to 2.1 percent from 1.5 percent in June. The

latest pace of growth was the fastest since December 2022.

Economists had expected prices to climb 1.8 percent.

Nationwide's Chief Economist Robert Gardner said the

affordability is still stretched for many prospective buyers.

"Investors expect Bank Rate to be lowered modestly in the years

ahead, which, if correct, will help to bring down borrowing costs,"

Gardner said.

"However, the impact is likely to be fairly modest as the swap

rates which underpin fixed-rate mortgage pricing already embody

expectations that interest rates will decline in the years ahead,

added Gardner.

The Bank of England is likely to lower its interest rate from a

16-year high today but it will be a very close call.

The Monetary Policy Committee is expected to trim the bank rate

by 25 basis points to 5.00 percent. This would be the first

reduction since the onset of the pandemic.

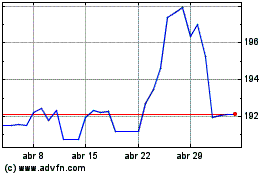

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Out 2024 até Nov 2024

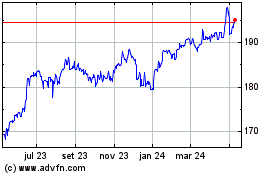

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Nov 2023 até Nov 2024