Euro Falls Amid Risk Aversion

28 Agosto 2024 - 1:05AM

RTTF2

The euro weakened against other major currencies in the Asian

session on Wednesday amid risk aversion, as markets in Australia,

New Zealand, Japan, South Korea, Hong Kong, Singapore, Taiwan and

China all declined. Traders remain cautious and await the release

of key U.S. inflation report later in the week, which could impact

expectations for how quickly the U.S. Fed will cuts interest

rates.

Weakness in mining and energy stocks amid tumbling commodity

prices, also weighed on the investor sentiment.

Crude oil prices fell after three successive days of strong

gains, consolidating ahead of supply data due out later today. West

Texas Intermediate Crude futures for October slumped $1.89 or 2.5

percent at $75.53 a barrel.

All eyes remain on AI darling Nvidia, which will release its

fiscal second quarter results after the close of U.S. trading later

in the day.

The highly anticipated earnings report will provide a key test

for the AI demand story.

Traders also look ahead to the release of Commerce Department's

report on personal income and spending for July on Friday, which

includes readings on inflation said to be preferred by the Federal

Reserve.

Economists currently expected the report to show the annual rate

of consumer price growth was unchanged at 2.5 percent.

The annual rate of core consumer price is expected to tick up to

2.7 percent in July from 2.6 percent in June.

With inflation nearly defeated and the job market cooling, the

inflation reading could impact expectations for how quickly the Fed

cuts rates.

In the Asian trading today, the euro fell to a 5-day low of

1.1135 against the U.S. dollar and a 2-day low of 160.85 against

the yen, from yesterday's closing quotes of 1.1184 and 160.99,

respectively. If the euro extends its downtrend, it is likely to

find support around 1.09 against the greenback and 158.00 against

the yen.

Against the pound and the Swiss franc, the euro slipped to

nearly a 4-week low of 0.8420 and nearly a 3-week low of 0.9402

from Tuesday's closing quotes of 0.8432 and 0.9411, respectively.

The euro may test support near 0.82 against the pound and 0.92

against the franc.

Against Australia, the New Zealand and the Canadian dollars, the

euro dropped to more than a 1-month low of 1.6408, nearly a

1-1/2-month low of 1.7856 and more than a 2-week low of 1.4996 from

Tuesday's closing quotes of 1.6464, 1.7883 and 1.5031,

respectively. On the downside, 1.59 against the aussie, 1.77

against the kiwi and 1.47 against the loonie are seen as the next

support levels for the euro.

Looking ahead, the European Central Bank is slated to release

monetary aggregates for July at 4:00 am ET in the European

session.

In the New York session, U.S. MBA weekly mortgage approvals data

and U.S. EIA weekly crude oil data are slated for release.

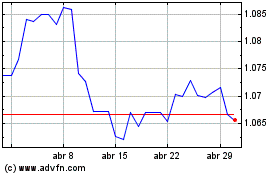

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Out 2024 até Nov 2024

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Nov 2023 até Nov 2024